Debt Settlement is a powerful debt relief tool that can provide a fresh financial start without declaring bankruptcy. It’s ideal for people in dire financial straits who owe several thousands of dollars. Settlement is often one of the most affordable ways to pay off debt, allowing people to get rid of their balances for a fraction of what they owe and save as much as 80% of their total charges. It’s also one of the fastest debt relief methods, eliminating debt in one or two years.

Learn about the many benefits of Debt Settlement, how the process works, and how to determine if settling debt is the best way to deal with your money problems.

Or find out in less than three minutes here. That link takes you to Instant Debt Advisor℠. Answer a few questions and find out if settlement is the best solution for your debt. It’s free and won’t hurt your credit. This guide will be here when you get done.

What is Debt Settlement?

Debt Settlement is when a lender or creditor agrees to accept less than the full amount of debt owed and consider the debt paid off. It may sound too good to be true, but settlement is a legal and legitimate method of debt relief, that reliably saves people a substantial amount of money.

• The average Debt Settlement client reduced their total debt by $9,500 (after fees)

• 3 out of 4 clients settled at least one account within the first six months

Debt Settlement is more commonly known than decades ago. Debt.com’s 2024 Debt Settlement survey found nearly 9 in 10 Americans know what Debt Settlement is – only 8% less than those who know of Bankruptcy.

Once a settlement agreement has been reached, collection calls and fees will stop. A person could still be on the hook for interest and fees that may have accrued up until this point depending on the arrangement with their lender, but reaching an agreement immediately puts the brakes on the balance growing any further.

Why would a lender agree to accept less money than they’re owed?

It’s not out of the kindness of their hearts. If a person files for bankruptcy, the lender might not get any of their money back. Therefore, it’s actually in the lender’s best interest to be flexible and let a person pay less than the full amount owed.

Naturally, a lender will want their customers to pay back as much of the debt as possible, but with the right help, a person could negotiate a lower settlement amount.

Is Debt Settlement legit?

In the early 2000s, there were a lot of shady Debt Settlement companies – predatory, dishonest, take-your-money-and-run kinds of companies. To make matters even more challenging, there was painfully little protection for consumers and few, if any, consequences for those bad players. It was the Wild West of debt removal and a lot of good people were misled.

But things are different now.

Today, Debt Settlement is a respectable industry with loads of rules, regulations, and government scrutiny (see the Debt Settlement Consumer Protection Act of 2010). New legislation has made it so that Debt Settlement companies operate in a way that has the consumer’s best interests at heart. By law, the settlement companies don’t get paid unless they successfully save you money.

There are accreditations and councils that didn’t exist before, like the Consumer Debt Relief Initiative (CDRF) and American Fair Credit Council. Settlement companies must meet rigorous standards to claim any affiliation with these organizations – standards that are clearly stated and easy to find. Further, accredited members of these organizations must be audited by a 3rd party agency, like BSI, to ensure the standards are met or exceeded.

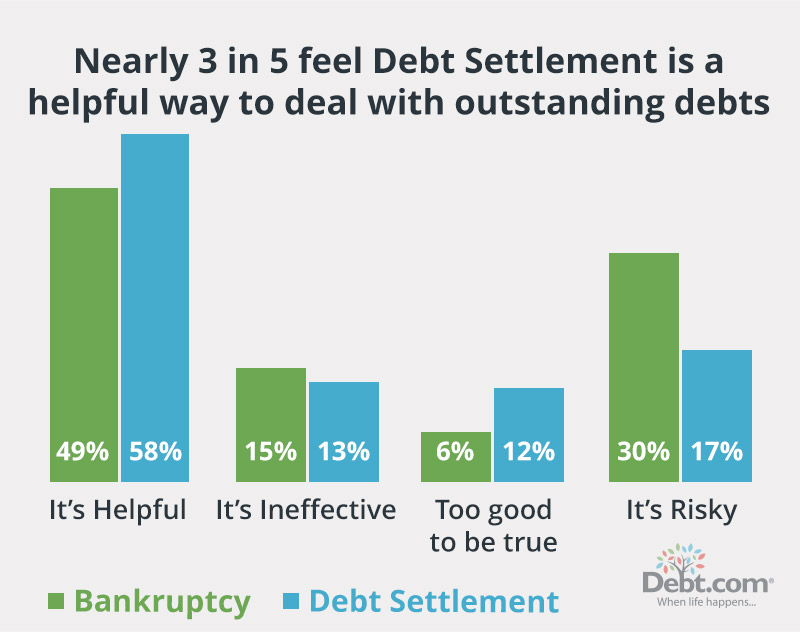

A Debt.com survey of more than 1,000 Americans shows more respondents feel Debt Settlement is a “helpful way to deal with outstanding debts” than Bankruptcy. Almost twice as many respondents called Bankruptcy “risky” compared to Debt Settlement.

For the first time, there’s a set standard of how a reputable Debt Settlement company should be conducting business and transparency about how Debt Settlement works and how companies are supposed to operate. This, combined with the dearth of industry reforms, makes it much easier for consumers to tell if a Sebt Settlement company is legit – and to avoid those who aren’t.

In the unlikely instance that a person does encounter an unreputable player, it’s also much easier for consumers to take action against them. The Consumer Financial Protection Bureau (CFPB) provides a clear pathway for consumers to report bad debt businesses and, perhaps more importantly, has the ability to penalize any violations.

Types of debt eligible for Settlement

The most common forms of debt handled through settlement are credit card debt and medical debt, which have great track records of successfully being settled. Other common types of debt that can be resolved with Settlement include:

- Personal loans

- Payday loans

- Some utility services

- Deficiency balances on repossessed vehicles

Most Americans know unsecured credit cards and payday loans are eligible for Debt Settlement, according to our 2024 Debt Settlement survey. However, 4 in 10 wrongly think secured debts like a mortgage will qualify.

Specialized types of debt, like student loans and tax debt, technically are eligible for Settlement but require meeting very specific criteria and can be difficult to settle.

Federal student loans

Federal student loans must be in a state of default (at least 270 days late on payments) before Settlement becomes an option. Even then, these loans are backed by the government so federal loan servicers have more options to recoup their money than other types of lenders, like garnishing wages or seizing your tax refund. There’s little incentive for federal student loan issuers to negotiate with borrowers.

Private student loans

The odds are slightly better for settling private student loan debt. You’ll still need to have defaulted on these loans before the loan servicers will begin to consider negotiating, but without the backing of the federal government, private student holders have fewer options if you can’t pay back your loans – but that’s not to say they don’t have ways of getting their money.

Private student loan holders can sue borrowers over unpaid loans. Depending on the state where you live, losing your case could give them the ability to garnish your wages or take money directly from your bank. However, if you’re able to prove that the debt is unenforceable, like the statute of limitations on your student loans expired, you could make a case to settle or even dismiss your private student loans.

Tax debt

Settling tax debt t has its unique term, Offer In Compromise (OIC), and process. You’ll need to fill out an application and work directly with the IRS to go this route. Depending on the amount of tax debt in question, the settlement process can take as little as four months.

Learn about the IRS’ Fresh Start program for tax debt

Types of debt that can’t be settled

Not all types of debt are eligible for Debt Settlement. Secured debts – loans tied to assets such as a house, car, or some other form of collateral – cannot be settled. If a person defaulted on their mortgage or car loan, the lender would simply repossess the property.

However, there is a pretty important loophole when it comes to settling mortgage or auto debt. When an asset is repossessed, that item is sold so that the lender can recoup their money. If the amount the asset sells for isn’t enough to repay what the person owes, they would be on the hook for that difference and still owe the lender what’s known as the deficiency balance.

Now, this is something that Debt Settlement can do something about. After the asset for a secured loan has been auctioned off, any remaining financial obligation is eligible for negotiation.

How does Debt Settlement work?

The Debt Settlement process is straightforward. The process typically takes between 12 and 48 months. (However keep in mind that some debts can only be negotiated after a certain amount of time has passed since the last payment due, which could be 90, 120, or 150 days.)

It starts with contacting the lender, creditor, collections agency, or even a law firm; notifying them that you’re unable to pay your balance but willing to repay a portion of it if they’ll consider the debt “settled” and paid off. If you want to settle multiple balances, each company will need to be contacted individually.

Next, it’s time for negotiation. You’ll make an offer as to how much you’re willing to pay per dollar owed, i.e. 50 cents on every dollar. Sometimes lenders will want to be paid in a lump sum and will refuse to settle unless you have the money on hand at the time of the negotiation. Today more lenders are willing to accept monthly payments in something known as term settlements, which allows a person to reach a settlement agreement without having a large amount of cash to pay upfront.

The exact Debt Settlement process can vary depending on all sorts of factors like the status of the debt (has it been sent to collections or is it still with the original lender?), who initiates contact (you or a professional?), and the state you live in (some states have more stringent rules than others). The biggest differences in this process come down to how you pursue Debt Settlement.

Method 1: Enrolling in a Debt Settlement program

Working with a professional, either a Debt Settlement company or a Debt Settlement attorney, saves you the hassle and headache of negotiating on your own. They will set you up in a settlement program and serve as a go-between for you and your lenders.

Here’s how Debt Settlement using professional services will go:

- In a free consultation, a certified debt resolution specialist reviews your debts and budget. They will often make recommendations on which debts would be best to include in the program.

- Once they confirm you’re a good fit for the program it’s time to generate the money to make settlement offers. Since most people usually don’t have a large lump sum of cash just sitting around the settlement company will usually set up an escrow account. They’ll work with you to find a monthly amount you can afford to set aside towards the settlement payment.

- You send them that amount each month and they hold the money in escrow until you have enough funds to approach companies with settlement offers.

- They call each of your creditors to negotiate. Once they reach an agreement that satisfies both sides, you sign a formal settlement offer and the money is paid out of the escrow account.

- The company also takes fees from the money saved in escrow, which is a percentage of the original balance you owe or a percentage of the amount you save.

- Accounts may be noted on your credit report as “paid as agreed”, “settled in full”, or “settled.” It will also be indicated that the balance owed is now $0. However, some debts, payday loans, and some medical debts may not be reported on credit reports at all.

Learn more about what to expect from a settlement program »

Method 2: Negotiating settlements on your own

An individual can represent themself and make a settlement offer. The overall process is the same, but you will be responsible for every element: determining which debts to include, setting aside money, negotiating the settlement, and any other concessions like payment status on the credit report.

Results may vary for self-initiated settlement. You’ll usually have the easiest time negotiating once a balance has gone to collections (though it is possible to negotiate with a lender or creditor before a balance reaches that stage).

Should you negotiate a settlement on your own? »

Method 3: Responding to Debt Settlement offers

Settlement offers usually only come when a debt has been sold to a third-party collection agency or debt buyer. These entities buy debt written off by credit card companies and service providers for pennies on the dollar. As a result, even recouping a small percentage of the original balance you owed is a financial gain for them and they may make offers to settle your debt by phone or by mail.

If you receive a settlement offer:

- Always insist that the collector send you the offer in writing.

- Make sure the debt is yours and that the collector has a legal right to collect BEFORE you acknowledge any obligation to pay. Ask the collector to send paperwork that verifies the debt.

- Only correspond with the collector by mail so that there’s a paper trail.

- Always try to negotiate the collector down from their initial offer.

- If your debt is held by a collection agency, see if they will agree to pay for delete which may remove the collection account from your credit report in exchange for payment. If your debt is still with the original creditor, ask about re-aging.

Debt Settlement template letters »

Professional vs. DIY Debt Settlement

The most notable benefit of negotiating a settlement yourself is the cost savings. Working with a professional Debt Settlement company or attorney will require payment, usually charged as a percentage of the dollar amount, they were able to reduce from your bill.

But communicating with lenders can be intimidating, time-consuming, and stressful for the average person (especially if they’re trying to negotiate more than one balance). The professionals, on the other hand, are experts in the process. They are also likely to have existing relationships with creditors and lenders. Both of which will increase the odds of successfully negotiating the lowest settlement possible. You’ll save more, but you’ll pay for it.

Pros and cons of Debt Settlement

While the prospect of only paying a fraction of your debt is obviously appealing, Debt Settlement has some drawbacks that might prevent it from being suitable for all situations.

A Debt Settlement company will charge a fee for their services – but you’ll likely save much more than they charge

Settlement companies typically charge 15-25% of the amount enrolled or 30-45% of the amount saved. Take, for example, a person with a debt of $25,000. If the settlement company was able to arrange for their client to only pay $15,000, the company’s payment would be based on the $10,000 difference between the two figures. Using the average industry rates, this would cost their client around $1,500 to $2,500. Don’t worry, you likely wouldn’t have to pay this in a lump sum. These service fees are generally rolled into the monthly settlement payment.

Debt Settlement often results in the highest cost savings compared to the other debt relief methods (consolidation loan, debt management plan, bankruptcy).

You’ll need to avoid scammers – but they’re easy to spot

Debt Settlement sometimes gets a bad rep due to some unscrupulous companies that make false promises, overcharge or engage in illegal practices. Fortunately, with just a basic idea of how Debt Settlement works, it’s fairly easy to determine if a settlement company is legit (or if it’s a scam).

Learn more about how to spot and avoid settlement scams »

Your credit will take a hit – but the sting is only temporary

Debt settlement’s effect on credit score can be close to bankruptcy. Both of these debt relief measures can cause credit scores to decrease. Additionally, any late or missed payments before a Debt Settlement offer is accepted will stay on your credit report for 7-10 years from the original delinquency date

The actual act of settling isn’t the only thing that impacts your credit score. In the instance that a person purposefully doesn’t make payments so that their balances become outstanding enough to be written off, the months leading up to a settlement agreement will also cause negative remarks.

But don’t panic.

As is the case of anything negative that affects your credit, the impact fades over time. Unlike bankruptcy, which can leave a permanent blemish on your credit history, the temporary dip caused by Debt Settlement can usually be reversed in a few short years.

Understand the credit impact of Debt Settlement »

Your lenders may refuse to settle – but you have other options.

There is no legal obligation on their end to agree to negotiate with you so there’s a possibility that your lender may refuse to settle. The good news is that if you’re working with a Debt Settlement company, you wouldn’t have to pay them any fees (legally, they cannot charge unless they’ve facilitated a successful settlement negotiation).

However, you could be responsible for any interest charges and other fees you’ve accrued while in negotiation. Before getting started, it’s best to talk to a Debt Settlement expert who’s knowledgeable about state-specific Debt Settlement rules.

Any debt that’s forgiven could be taxed…

Successful Debt Settlement will likely have tax implications. In most cases, more than $600 of forgiven debt is considered taxable income by the IRS. If this applies to you, you should receive a 1099-C form, Cancellation of Debt, from your creditor and you’ll need to report this canceled debt the same year it occurs. (Note: even if you aren’t sent this form, you are still responsible for reporting the canceled debt.)

| Pros of Settlement | Cons of Settlement |

|---|---|

| Debt Settlement is usually the fastest way to get out of significant debt without filing for Chapter 7 bankruptcy. | Each debt you settle may result in a negative item in your credit report that will stick around for seven years. |

| Settlement is also usually the cheapest option since the average person pays just 48% of what they owe. | In most cases, Debt Settlement will result in at least some credit score damage. |

| You can avoid the fees and hassle of filing for bankruptcy. | The settlement industry is filled with unscrupulous companies, so it’s possible to get scammed. |

Is Debt Settlement right for me?

Debt Settlement could be the ideal solution for someone with…

- At least $5,000 in debt. Creditors likely won’t view debts less than this amount as worthwhile or worth negotiating. Plus, there are more options for resolving smaller balances than there are for larger ones.

- A steady source of income: Whether you choose to work with a professional or self-negotiate, you’ll need income to contribute towards the settlement payout (lump sum or term-based repayment). This does not require stable employment, however. Income can come from other sources such as social security or child support. All that matters is that its money a person receives on a regular basis.

- No immediate big purchases: Since Debt Settlement usually has negative effects on a person’s credit score, it’s best not to plan on making large purchases until a year or two after the settlement has been completed. Once the debt has been settled and enough time has passed to rebuild a person’s credit score applying for a mortgage, financing a car, or anything requiring a credit check, like renting a new apartment should be fine.

- Debt at least 60 days overdue: Any balances less than 60 days overdue are unlikely old enough for a creditor to consider a balance a lost cause – that a person will default on their payments and the debt will need to be written off.

- Low credit score: Not a deal breaker but a person who already has a low credit score will have a lot less to lose credit-wise. Plus, someone with a high credit score has more potential options for paying off debt, such as balance transfers (if they’re dealing with credit card debt) or debt consolidation loans.

Debt Settlement is becoming more common. Three in ten Americans either gone through a Debt Settlement Program, or know someone who has.

Repairing your credit after Debt Settlement

Debt Settlement may show on your credit report for seven years. Although this negatively affects creditworthiness and credit score, the impact will lessen each year. Utilize these strategic credit-boosting strategies can put your credit on an upward trajectory in as little as 6 to 24 months:

- Dispute derogatory comments with the credit bureaus

- Get an installment loan

- Open a secured credit card

- Keep your debt-to-income ratio low

- Keep your debt utilization ratio to 30% or less

Alternatives to Debt Settlement

What can you do if your creditors won’t settle? Here are a few alternatives to consider:

Credit counseling

This is not a debt relief solution, in and of itself. Nonprofit credit counseling provides a free, unbiased debt evaluation to help you find the best option for relief. A good credit counseling agency won’t drive you to a single solution but recommend the best solution based on your needs and budget. If you’re not sure what to do when your settlement offer is rejected, talking to a credit counselor is a great place to start.

Debt consolidation loan

If you just need a bit of breathing room in order to get your debt under control, debt consolidation could be a great alternative. Consolidation can help with all the same types of debt that settlement can.

The key difference is that consolidation itself is a credit product, a personal loan, that is directly distributed to creditors, lenders, or collection agencies. Instead of paying those other companies, a person pays the consolidation loan which typically carries a lower interest rate for 12-48 months.

Debt management program (DMP)

Debt management involves working with nonprofit credit counselors, who act as a liaison between you and the creditors to whom you owe money.

Rather than reducing the amount of debt you’ll end up repaying, a debt management program arranges favorable conditions that make it easier to pay back your debt. They’ll get creditors to remove late fees and other charges, and to pause or eliminate interest as well, allowing a person to focus on paying down the principal balance and getting out of debt more quickly.

A DMP could be a great option for someone with subpar credit who wouldn’t qualify for a balance transfer or a consolidation loan; wants to keep their credit score intact; and has the patience to stick with the program, which typically takes three-five years.

Bankruptcy

If you’re truly overwhelmed with debt bankruptcy is the next best thing. With Chapter 7 bankruptcy, your assets can go untouched and you can get out of debt for almost nothing. However, those who aren’t approved must then file for Chapter 13 bankruptcy. In this situation, the courts, rather than you or a Debt Settlement company, negotiate with creditors and lenders to determine an appropriate (court-ordered) repayment plan.

Chapter 13 is the closest alternative to Debt Settlement and both approaches allow you to get out of debt fairly quickly and pay far less than the actual amount owed. However, the biggest difference between the two is that bankruptcy can be more difficult to pursue. It requires hiring an attorney and meeting very specific criteria to qualify, which can make bankruptcy a lot pricier than Debt Settlement.

It’s important to know the costs of filing for Bankruptcy. Our Debt Settlement survey shows 15% think filing for Bankruptcy is free.

As you’re working to get out of debt, it’s important to weigh the pros and cons of various types of debt relief you may decide to use. This table can help you understand how Debt Settlement compares to other solutions.

| Balance Transfer | Consolidation Loan | Debt Management Program | Debt Settlement | Bankruptcy | |

|---|---|---|---|---|---|

| APR | 0% APR for 6-18 months, based on your credit score | Low fixed interest rates, currently averaging 13% | Negotiated to between 0-11%, on average | n/a | n/a |

| Monthly payment | As high as possible to eliminate your debt during 0% APR period | May be lower than your total payments now | Total credit card payments reduced up to 30-50% | May require monthly set aside; amount based on your budget | Chapter 13 we create a court-ordered repayment plan |

| Credit required to use | Excellent | Good | Any | Any | n/a |

| Debt amount | Less than $5,000 | Up to $25,000 | $5,000-$100,000+ | $5,000-$100,000+ | Any |

| Credit score effect | Positive | Positive | Neutral or positive | Negative, but subject to negotiation | Negative, up to 10 years for Chapter 7 |

| Fees | Balance transfer fees up to 3% of each balance transferred | Loan origination fees, typically up to 1% of amount borrowed | Regulated by state, up to $69 per month | Typically, a percentage of the original amount settled | $335 for filing fee for Chapter 7, $310 for Chapter 13; attorney fees |

| Time to become debt free | 6-18 payments | 24-48 payments | 36-60 payments | 12-48 payments | 6-12 months for Chapter 7, 3-5 years for Chapter 13 |

Debt Settlement FAQ

Yes! Just like any debt solution, this is not a silver bullet; it won’t fix every debt situation for every consumer. But when it’s used in the right circumstances, it can be extremely effective. Just be aware that not all settlement companies are good. Some of them are scams. They charge huge fees up front, take your money, and disappear.

Always make sure to work with a settlement service that doesn’t charge fees upfront. Companies that offer a money-back guarantee can be good, too. Then check the company’s rating with the Better Business Bureau and read third-party reviews. As long as a company is above board and they say you’re a good candidate, a settlement program can work.

It’s possible to DIY debt settlement, but not always advisable. Plus, a professional debt settlement program will roll all of your monthly payments into one. If you settle on your own, you work with credit card companies directly and still have multiple monthly bills.

It’s up to you which path you take. But we always recommend working with a trustworthy debt settlement company.

This varies based on your credit profile. If you have perfect credit, then a settlement can affect you significantly; it’s likely you’ll lose your excellent credit rating. However, if you have a low score and already have lots of credit damage, then the actual point decrease on your score may be less.

Just keep in mind two things:

The settlement remains on your credit report seven years from when the account first became delinquent.

The “weight” of negative items on your score decreases as time goes by

This means you can build credit long before the penalty for settlement expires. It also lets you know when you should review your credit. You want to make sure the negative item disappears at the designated time.

This is an important question. The IRS counts forgiven debt as income. Essentially, the IRS expects you to pay taxes on the discharged balance. If you owe a creditor $20,000 and settle for $8,000, then you must pay taxes on the $12,000 you didn’t pay. The creditor or collector who settled the debt will send you Form 1099-C, which you must file with your annual income taxes for that year.

The good news is that you can request get the IRS to waive this tax liability. You basically need to show that you settled the debt during a period of financial hardship. If you can show you couldn’t afford to pay the debt, then you also effectively show you can’t afford to pay the taxes on it either.

Making a single settlement offer and setting up an agreement can take as little as a month. If you enroll in a debt settlement program, then it generally takes about 24 to 48 months to complete the program. A 24-month settlement program is often a much shorter timespan to get out of debt than other solutions, such as debt management programs.

When you work with a Debt Settlement company, you will pay fees. The fee amount varies by company. Usually, it’s a percentage of what you pay each month. However, you still save in the end because of how much debt you get out of paying.

This depends on your goals. If you have an excellent credit score and don’t want to hurt it, then settlement is extremely bad. But if your score has already taken hits from late payments and collections and bad credit is not a concern, then settlement can be good. Settling your debt can give you a fast exit where you control the discharge. It helps you avoid bankruptcy, where the court controls the discharge agreement (Chapter 13) or liquidate your assets (Chapter 7) to settle your debts.

Again, this depends on your financial situation and goals.

When Debt Consolidation is Better

Most of your debts are still current with the original creditors

You want to avoid credit damage.

You have a good credit score.

You have the ability to make monthly payments.

When Debt Settlement is Better

Most of your debts are in charge-off or default status.

The debts you want to settle are in collections.

You’re not concerned about credit damage.

You don’t have the credit score or income to qualify for consolidation.