If you’ve been searching for a path to debt relief, you’ve likely heard of debt consolidation and debt settlement. What’s the difference in how they affect your finances? Is one a better fit for your debt than the other? Find out how each one works before choosing a path toward debt relief.

How does Debt Consolidation work?

Let’s start with the definition of “consolidate.” According to Merriam-Webster, “to consolidate” means “to join together into one whole.” So, how does this apply to your debts? Debt consolidation works by combining all of your debts together to make them easier to pay off. This means you’re only dealing with one payment and one interest rate instead of multiple monthly bills and varying rates and fees. There are a few ways to do this:

- Debt Management Program (DMP)

- Balance transfer

- Debt consolidation loan

Debt Management Program (DMP)

Debt management programs or DMPs, are set up through credit counseling agencies to help you rearrange your budget and pay off everything you owe, in many cases with lower monthly payments. By working with credit counselors, you stop using credit and focus your finances toward making your payments.

See if a debt management program could help you »

Balance transfer

Consolidating your debts with a balance transfer credit card is a very common way of paying off your debts. A balance transfer card has a 0% APR for a limited amount of time. It allows you to transfer your balances from other credit cards, so you don’t have to get penalized by their high interest rates. As long as you pay off the balance transfers before the APR promotion is over, they won’t charge you interest on that balance. However, there are fees associated with transferring the balances themselves.

Learn how to transfer a credit card balance »

Debt Consolidation Loan

This is a type of personal loan to pay off all of your debt in a lump sum payment. Then the only interest rate you have to worry about is on the loan. No more individual interest rates and bills – you will only have one monthly payment.

Find out how consolidation loans work »

Pros and cons of Debt Consolidation

Depending on the type of debt consolidation you choose, there are different pros and cons. Overall, Debt Consolidation is usually better for your credit than most other debt relief options. This is because consolidation means you’re still paying back everything you owe.

How does Debt Settlement work?

Settlement works a little differently. While your debts may be rolled into one monthly payment if you enter into a Debt Settlement Program, it will affect your credit differently than consolidation. Additionally, you will pay less than what you really owe. While consolidation pays off your debts in a full lump sum payment, settlement means negotiating with your creditors to lower the amount you owe them. You can do this by negotiating a settlement agreement with your creditor on your own or working with a Debt Settlement company.

Almost 1 in 3 Americans have, or know someone who has, gone through a Debt Settlement Program. That’s only 15% fewer than those who’ve been through a Bankruptcy filing.

Pros and cons of Debt Settlement

Debt Settlement is one of the fastest and cheapest ways to get out of debt without filing for Chapter 7 bankruptcy. This can be great if you don’t mind the damage it will deal to your credit scores. When you start Debt Settlement, you will likely see your credit scores drop. After you settle your debt, it will usually remain on your credit report for up to 7 years.

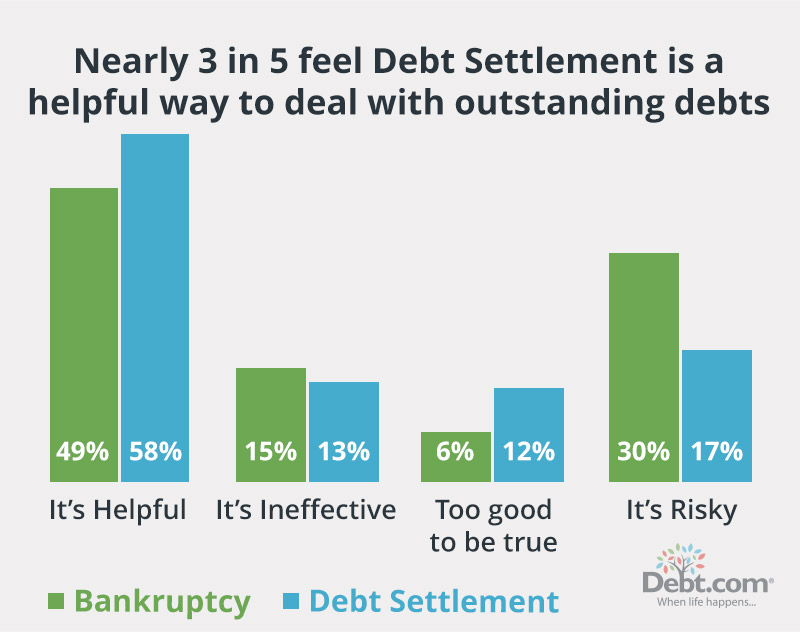

More Americans feel Debt Settlement is a “helpful way to deal with outstanding debts” compared to filing for Bankruptcy. More also call Bankruptcy “risky” than Debt Settlement.

Find out about the other pros and cons of Debt Settlement »

Debt Relief Comparison Calculator

Which one makes the most sense for your situation?

The answer to this question depends on your amount of debt and your ability to make the monthly payments. If you are going through a financial hardship that makes it impossible to pay off your high level of debt, then debt settlement may be the right option for you. If you think you can afford to pay off all of your debt and make the monthly payments, consolidation could be better for you. It really all depends on the specifics of your financial situation and if you want to save money.

There’s a super fast and easy way to find the best debt relief service for you. It’s a new tool called Instant Debt Advisor℠. It’s free to use, won’t impact your credit, and literally takes three minutes to use! Instant Debt Advisor℠ will ask you a series of questions then it will you the best debt solution for your situation.

Reach out today to get matched with the right debt relief service for you.

Want to know more about how debt consolidation applies to real life? Check out this question sent to our experts by a reader:

I trying to get out of debt and I keep hearing ads for debt consolidation. Isn’t that something that I can do on my own? Why do I need a company to help me? And what’s the catch? I’ve learned in my 50 years that everything has a downside.

— Peter in Florida

Howard Dvorkin CPA answers…

You’re right. There are several different debt ways to consolidate debt and you might not need a Debt Consolidation company to help you. There are a few ways you can attempt to consolidate on your own. But consolidation isn’t without its risks. In fact, if it’s used in the wrong situation, it can end up making your debt problems worse. So, you need to be aware of these risks so you can choose the best solution for you.

Of course, Peter, there are also “catches” to employing a Debt Consolidation firm.

When you enter into a Debt Management Program, also known as a DMP, you must stop using credit cards. All accounts that you include in the program will be frozen for the duration of your enrollment in the program. You can’t use those cards. You also won’t be able to apply for new credit cards.

Now, I don’t see this as a bad thing — I’ve written as much in my book Power Up — but some clients I’ve advised over the years are addicted to credit cards. They might have close to $100,000 in credit card debt, and they fully realize they desperately need help, but they just can’t let go of those cards.

I tell them they can get a debit card so they can still fly aboard an airline and rent a car, but let’s face it: Their lack of willpower with credit cards got them in this mess. The solution to any addiction is not more of what got you there.

In more than 20 years as a financial adviser, educator, and author, I’ve seen literally thousands of former credit card addicts emerge from their DMPs with not only zero debt but zero addiction. Some get new credit cards and use them responsibly. Some find no need for them any longer.

The big difference? The debt consolidation company provided free educational tools to assist them, and that made all the difference. Sometimes, Peter, going it alone is lonely.

Learn more about the three reasons you need expert debt consolidation assistance here »

Comparing the pros and cons of Debt Consolidation to Debt Settlement

Finally, Peter, if you’re paying attention to ads touting to help you get out of debt, you may also be considering Debt Settlement. Debt Settlement advertisements claim to get you out of debt “for pennies on the dollar.” This is, by and large, accurate – the average settlement pays back less than half of what the person originally owed.

But, you guessed it, there’s a catch. Every debt you settle incurs a seven-year penalty on your credit report. These can seriously drag down your credit score and make it tough to move forward once you eliminate your debt. So, even though you can get out of debt faster and cheaper, it will take you longer to recover financially.