The results of Debt.com’s latest survey of 1,000 Americans have surprised our in-house team of personal finance experts and certified debt management professionals: Most are aware of the powerful solution called Debt Settlement.

When asked if they’d ever heard the term before, nearly 9 in 10 (89%) answered “yes.” Nearly 3 in 5 (58%) say “it’s a helpful way to deal with outstanding debts.”

Debt.com’s president Don Silvestri is happy to see how many Americans have done their homework on reputable ways to get out of debt.

“Debt Settlement done right is a powerful tool,” Silvestri said. “Frankly, I’m surprised how many Americans understand these pros and cons.”

Key findings

- Half (49%) of respondents know Debt Settlement can cut their debt by 30-50%. That includes more than half (52%) of Millennials and 50% of Gen Zers.

- 8 in 10 (79%) think Bankruptcy will do more damage to their credit than Debt Settlement (21%). That percentage jumps up to 87% when focusing on Baby Boomers and 85% of Gen Xers.

- More than 4 in 10 (46%) know their credit will take a hit from a Debt Settlement Program, but will rebuild in 6-24 months.

- Meanwhile, more than 4 in 10 (44%) know that credit scores have no impact on your ability to pursue Debt Settlement.

- More than 1 in 3 (37%) know Debt Settlement costs 20% of the amount forgiven.

- 1 in 5 (20%) know the hit to your credit score in Debt Settlement is “minimal,” because your settlement is “paid as agreed” with your creditor.

Nearly all respondents know the term Bankruptcy, which isn’t surprising. In the United States, Bankruptcy has been a legal way to absolve responsibility of debt since the 1800s. Debt Settlement has only been available since the late 1980s and early 1990s, when the federal government deregulated the banking industry.

Given Debt Settlement’s relatively short history compared to Bankruptcy, it’s surprising nearly 9 in 10 (89%) have heard of it.

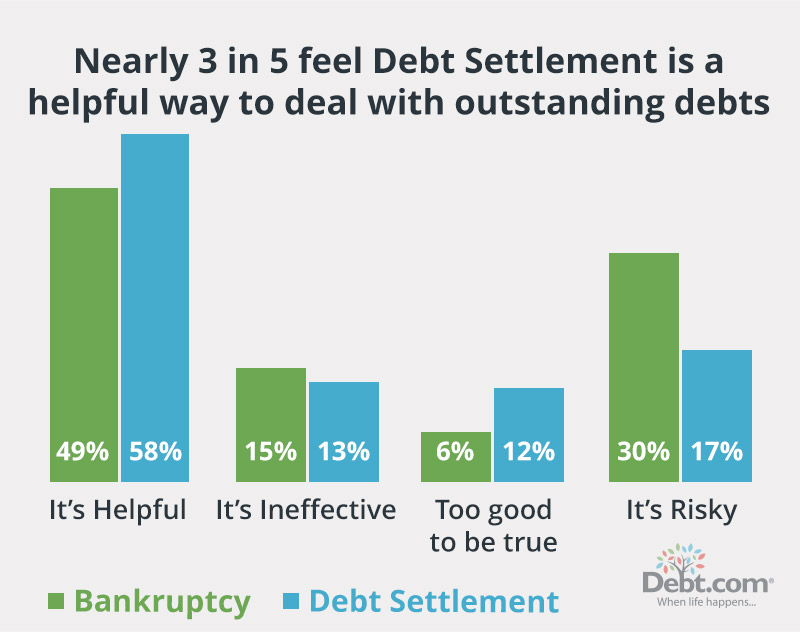

When looking at what respondents have heard about the two debt relief options, the outlook is overall more positive for Debt Settlement. Nearly 3 in 5 (58%) say it’s a helpful way to deal with debt – 8% fewer respondents feel Bankruptcy is helpful. Also, more than twice as many call Bankruptcy (30%) “risky” compared to Debt Settlement (17%).

Debt Settlement can help consumers reduce their debts by up to 30-50%. When we asked more than 1,000 Americans across the country “how much the average person can cut their debt by?” half (49%) correctly answered. Reinforcing the popularity of the debt relief option.

Nearly 8 in 10 respondents know unsecured debts like credit cards are best for a Debt Settlement Program. However, when asked “which debts do you think are eligible?” 4 in 10 selected mortgages, which are a secured debt and won’t qualify for Debt Settlement.

The other 43% of those who said payday loans answered correctly. Meanwhile, 2 in 3 said medical debts, which is true – but not entirely. Medical bills will only qualify for Debt Settlement after they’ve gone into collections.

When asked “have you, or anyone you know ever gone through Debt Settlement or Bankruptcy?” more than 4 in 10 answered Bankruptcy, while 3 in 10 said Debt Settlement. A deeper look at the data found surprising results: The demographic most likely to have, or know someone has, used Debt Settlement is Millennials (ages 30-44).

It’s interesting to see that 42% of the generation is so familiar with it because being born in the late 1980s and early 1990s, Millennials and the Debt Settlement industry grew up together. That makes them the first generation to have debt relief options other than Bankruptcy or Credit Counseling.

Just because more respondents know of Bankruptcy doesn’t mean they necessarily know how it works. When asked “how much do you think Chapter 7 Bankruptcy costs?” an alarming 15% think it’s a free service.

It’s not even true for the 1 in 3 who said Bankruptcy will cost them $500. Depending on the complexity of the case, it can cost between $750 and $4,500 to hire an attorney and for the filing fees.

Your credit score won’t disqualify you from a Debt Settlement Program. More than 4 in 10 (44%) answered correctly when asked, “what credit score do you think is needed to qualify for Debt Settlement?” Unlike a Consolidation Loan, Debt Settlement is a debt relief service where you can get out of debt quickly to then rebuild your credit quickly.

A deeper dive into the data shows where most people in the U.S. use Debt Settlement. More than 1 in 3 of respondents who have, or know someone who has, gone through a program are in the Middle Atlantic region of the country.

Census breaks down Middle Atlantic states as, New York, New Jersey, Pennsylvania, Delaware, and Maryland. The reason why more live in that is unclear. Nonetheless, far more live in that area.

| Region | States (breakdown defined by the U.S. Census Bureau) |

| Middle Atlantic | New York, New Jersey, Pennsylvania, Delaware, Maryland |

| Pacific | California, Oregon, Washington, Alaska, Hawaii |

| South Atlantic | Florida, Georgia, North Carolina, South Carolina, Virginia, West Virginia, District of Columbia |

| East North Central | Illinois, Indiana, Michigan, Ohio, Wisconsin |

| West South Central | Arkansas, Louisiana, Oklahoma, Texas |

| Mountain | Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming |

| East South Central | Alabama, Kentucky, Mississippi, Tennessee |

| West North Central | Iowa, Kansas, Minnesota, Nebraska, North Dakota, South Dakota |

| New England | Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont |

Click here for full survey results

| Have you ever heard the term “Debt Settlement”? | |

|---|---|

| Yes | 88.63% |

| No | 11.37% |

| What have you heard about it? | |

|---|---|

| It’s a helpful way to deal with outstanding debts. | 57.70% |

| It’s ineffective and will not help most people with debt problems. | 13.01% |

| It’s too good to be true. It’s not a real way to get out of debt, it’s a gimmick. | 11.82% |

| It’s risky – there are many pitfalls, and it might not work. | 17.48% |

| Have you ever heard the term “Debt Resolution”? | |

|---|---|

| Yes | 74.04% |

| No | 25.96% |

| What you heard about it? | |

|---|---|

| It’s a helpful way to deal with outstanding debts. | 62.33% |

| It’s ineffective and will not help most people with debt problems. | 13.96% |

| It’s too good to be true. It’s not a real way to get out of debt, it’s a gimmick. | 11.91% |

| It’s risky – there are many pitfalls, and it might not work. | 11.79% |

| Have you ever heard the term “Bankruptcy”? | |

|---|---|

| Yes | 96.74% |

| No | 3.26% |

| What have you heard about it? | |

|---|---|

| It’s a helpful way to deal with outstanding debts. | 49.18% |

| It’s ineffective and will not help most people with debt problems. | 14.74% |

| It’s too good to be true. It’s not a real way to get out of debt, it’s a gimmick. | 6.32% |

| It’s risky – there are many pitfalls, and it might not work. | 29.76% |

| Have you, or anyone you know, ever gone through Debt Settlement, Debt Resolution, or Bankruptcy? | |

|---|---|

| Debt settlement | 30.30% |

| Debt resolution | 19.79% |

| Bankruptcy | 44.52% |

| N/A | 37.10% |

| How much do you think filing Chapter 7 Bankruptcy costs? | |

|---|---|

| Nothing, it’s a free service | 15.43% |

| Up to $500 | 33.95% |

| $1,000 or more | 50.62% |

| With a Debt Settlement Program, how much do you think the average person can cut their debt by? | |

|---|---|

| 60-80% | 26.51% |

| 30-50% | 49.43% |

| 15-25% | 24.06% |

| How much does the average Debt Settlement Program fee cost? | |

|---|---|

| 50% of the amount forgiven | 25.94% |

| 30% of the amount forgiven | 37.55% |

| 20% of the amount forgiven | 36.51% |

| In Debt Settlement, which debts do you think are eligible for the program? | |

|---|---|

| Car loans | 47.45% |

| Credit cards | 78.87% |

| Medical debts | 65.28% |

| Mortgages | 39.72% |

| Payday loans | 42.92% |

| Privately held (non-government) student loans | 27.36% |

| How does Debt Settlement affect your credit score? | |

|---|---|

| Minimal, because your settlement will be “paid as agreed” with your creditor. | 19.43% |

| Your credit will take a hit, but you can begin rebuilding your credit score in 6-24 months. | 45.75% |

| Your credit will take a hit between 100 and 150 points and will remain low for 7 years. | 26.98% |

| Damages your credit – you’ll never get a loan again. | 7.83% |

| What credit score range do you think is needed to qualify for Debt Settlement? | |

|---|---|

| Fair | 20.94% |

| Good | 35.28% |

| It doesn’t matter | 43.77% |

| Which option do you think is more damaging to your credit: Bankruptcy or Debt Settlement? | |

|---|---|

| Bankruptcy | 79.06% |

| Debt Settlement | 20.94% |

| On a scale from 1 to 5, how concerned are you about your personal debt? | |

|---|---|

| 1 | 30.0% |

| 2 | 8.96% |

| 3 | 14.15% |

| 4 | 20.0% |

| 5 | 26.89% |

| How do you feel other Americans are dealing with their debt? | |

|---|---|

| Doing fine | 19.06% |

| Same as me | 37.26% |

| Much worse | 43.68% |

Survey Methodology: Debt.com: Do-It-Yourself Guidance plus Professional Debt Help surveyed 1,144 people asking 16 questions related to debt relief services. People responded from all 50 states and Washington, DC, were aged 18 and older, and the population split is weighted against the US census with a Margin of Error +/-7%. The survey was conducted on Jan. 4, 2024.