If you’re considering either option, it’s important to learn the truth about how they work and how they are different. They have different effects on the amount you owe, your credit score, credit reports, and financial future.

Debt Settlement vs. Bankruptcy

How do debt settlement and bankruptcy compare? Here are just a few of the main points that define the two:

- Both could get you out of debt relatively quickly, although with both a debt settlement program and Chapter 13 bankruptcy you will still make monthly payments for a period of time.

- Both could drop your credit score, but bankruptcy could make it worse than a settlement.

- Both may mean paying less than you owe, but bankruptcy can result in a smaller amount.

- You can settle your debt on your own but can’t file bankruptcy without the courts.

| Debt Settlement | Chapter 7 Bankruptcy | Chapter 13 Bankruptcy | |

|---|---|---|---|

| How long it takes | 12 months-4 years | 4-6 months | 3-5 years |

| Credit score impact | Can drop around 60-100+ points | Can drop up 100-200+ points | Can drop up 100-200+ points |

| How long it stays on your credit report | 7 years | 10 years | 7 years |

Debt Settlement

Debt settlement is a common option for consumers seeking debt relief, especially when it comes to credit card debt. It’s all about paying less than what you owe. Either on your own or with the help of a debt settlement company, you can get settlement agreements with your various creditors that allow you to create a payment plan to repay a smaller percentage of what you owe.

Learn about what settlement is and how it works »

DIY Debt Settlement

Arranging a settlement agreement yourself can be a good option if you only have one or two accounts to settle, especially if those accounts have already been sold to a third-party collector. You will need to talk to the collectors/creditors to arrange a settlement agreement directly with them. Make sure to get everything in writing so you have a clear record of every interaction.

See what it takes to DIY debt settlement »

Debt Settlement Program

Going through a debt settlement company can be a good option for those who are behind on multiple accounts, but the accounts are still with the original creditor. Debt settlement companies handle all the settlement agreements for you, so you don’t have to interact with the lenders/creditors yourself anymore. When you sign up for a debt settlement program, you

Find out if a debt settlement program is right for you »

Pros and cons of debt settlement

There are many positive aspects of settlement. First, it’s usually the fastest way to get out of debt without filing Chapter 7 bankruptcy. It’s also usually the cheapest option. On average, people who choose debt settlement pay only 48% of what they owe.

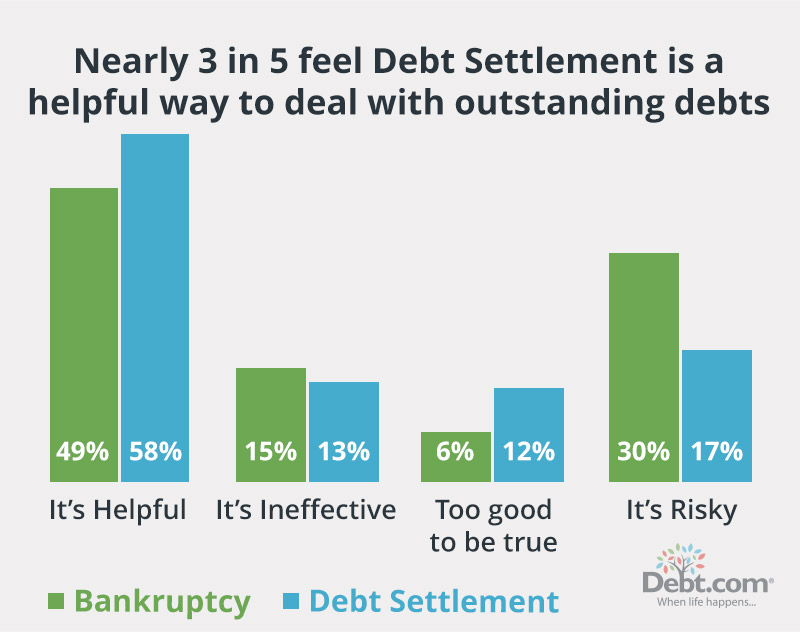

Debt.com polled more than 1,000 Americans on how they felt about debt relief services. Nearly 3 in 5 (58%) say debt settlement is “a helpful way to deal with outstanding debts” – less than half (49%) said the same about bankruptcy.

So far, settlement probably sounds great. Before you choose to settle, make sure you know the cons to this method of debt relief. Yes, debt settlement is faster and cheaper. But it can also leave a negative mark on your credit score that could stay there for 7 years. It’s likely that your credit score will drop. If that’s a concern, keep in mind, your debt load will drag down your credit. The quicker you’re out of debt, the quicker you can rebuild your credit.

Weigh the pros and cons of debt settlement before you commit »

Let a certified debt relief specialist help you weigh the pros and cons of debt settlement based on your needs, credit, and budget.

Bankruptcy

People often think of bankruptcy as a terrible, last-ditch effort to save their finances. However, if your credit score is already low or you just want a clean break, bankruptcy can be a reasonable option. To go through bankruptcy, you have to go through the courts to arrange how much you have to pay. In some instances, all of your debt could be discharged, but this isn’t very common.

Get an overview of bankruptcy and how it works »

Chapter 7 Bankruptcy

This type of bankruptcy is one of the fastest and cheapest ways to get out of debt. It’s commonly called liquidation bankruptcy because it involves selling available assets that don’t qualify for an exemption for a lump sum payment for settling your debts. If you don’t have assets or your assets qualify for the exemption, you can get out of debt for close to nothing. Chapter 7 bankruptcy only takes 4-6 months, but it will stay on your credit report for 10 years. If you are struggling to save for your long-term goals and you’ve stopped paying your minimum payments on your debts, this may be a reasonable option.

Decide if Chapter 7 bankruptcy is right for you »

Chapter 13 Bankruptcy

This type of bankruptcy stays on your credit report for 7 years after the discharge date. It’s actually quite similar to a debt settlement program because it sets up a monthly plan to pay back a percentage of your debts. The biggest difference is that Chapter 13 bankruptcy terms are decided by the courts, not negotiated between you and your lender or creditor. Depending on this payment plan, it could take up to 5 years to complete the court-ordered repayment plan. This is commonly called wage-earner bankruptcy, and it can be a good option if your creditors don’t want to work with you on debt settlement.

Read about Chapter 13 bankruptcy »

Pros and cons of bankruptcy

Though it has a bad connotation, bankruptcy does have some pros worth discussing. Chapter 7 bankruptcy is one of the fastest ways to get out of debt – even faster than debt settlement. Chapter 13 and Chapter 7 are clean breaks from your debt, but that doesn’t come without a cost. Bankruptcy comes with fees, and if you don’t qualify for Chapter 7, you must file for Chapter 13 bankruptcy and spend the next 3-5 years making monthly payments on your debt.

On average, Chapter 7 bankruptcy costs $1,000-$3,500 and Chapter 13 can cost between $2,500 and $6,000.

Many Americans aren’t aware of those costs. Debt.com’s survey found more than 1 in 10 (15%) respondents thought it was free to file for Chapter 7 bankruptcy and 1 in 3 (34%) thought it only costs $500.

Compare the pros and cons of the different types of bankruptcy »

Raising your credit score after debt settlement vs bankruptcy

Both of these debt relief options can lower your credit score, so it’s essential to know how to repair your credit after the fact.

Post-bankruptcy, you will likely see more damage to your credit score if you had a high score before you filed. If you already had a low score, you may not see as much of a drop.

Read more about what happens to your credit after bankruptcy »

After you settle your debt either through a program or through an individual settlement agreement, your score could drop, but likely not as much as it would during bankruptcy. No matter which option you choose, credit repair is often a good next step for your financial health.