Getting out of debt is easier when you have the right plan and the right professional support. There are two popular debt relief programs if you’re having trouble paying it off on your own: consolidation and settlement.

You can find which works best for you and your financial situation with new technology. Answer a few questions from Instant Debt Advisor℠, and you’ll know which is the best debt relief program in only three minutes. It’s a free service that won’t impact your credit – and you’re not obligated to sign up until you’re ready.

On the fence? This guide helps you compare options for all kinds of debt. That way you can make an informed decision.

Debt consolidation programs

Consolidation programs pay back everything you owe in full to avoid credit damage. The goal is to reduce or eliminate interest charges and fees. This allows you to get out of debt faster because you can focus on paying off the principal debt.

Debt consolidation programs go by different names, depending on the type of debt you want to pay off:

- A debt management program consolidates credit cards and other unsecured debts

- An Installment Agreement (IA) consolidates IRS tax debt if you owe back taxes

- Federal student loan repayment plans consolidate many types of federal student debt

Pros: People use debt consolidation programs because they’re committed to repaying everything they owe. It’s good for their credit and often offers a sense of accomplishment or satisfaction that you met your obligations.

Cons: Consolidation costs more than settlement because you repay the principal plus some interest charges. It also usually takes longer.

Debt settlement programs

Debt settlement programs aim to get you out of debt quickly for the least amount of money possible. You get out of debt for a portion of what you owe. Interest charges and fees aren’t a factor when you settle, because the goal is to only pay a percentage of the principal debt.

Debt settlement is also referred to as debt negotiation. If you have IRS tax debt, a settlement plan is known as an Offer in Compromise (OIC).

Pros: Settlement is all about fast and cheap. You use debt settlement when you want a fast exit. It provides the same kind of clean break that you get from bankruptcy. But it keeps you in charge of the negotiation instead of giving that control to the courts.

Cons: The benefit of only paying a percentage of what you owe comes at a price: credit damage. Each debt you settle creates a negative remark on your credit report. This penalty sticks around for seven years. It hurts your credit score and makes it harder to get loans and credit cards immediately after you settle. You can still get financing, but rates will be higher and terms won’t be as flexible. Once you settle, take steps to rebuild your credit.

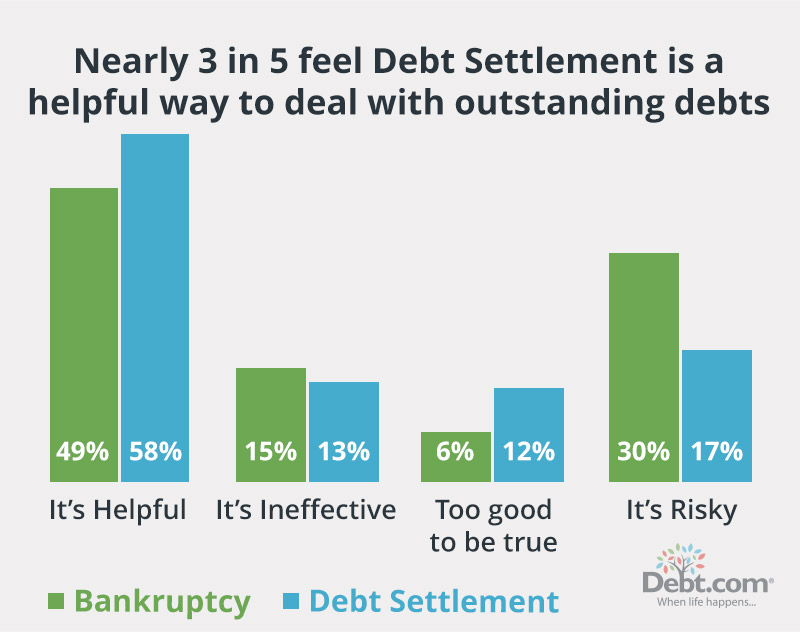

Overall, most people find debt settlement to be a better debt relief option than bankruptcy. Debt.com surveyed 1,000 Americans on how they view both debt settlement and Chapter 7 Bankruptcy. More felt debt settlement was an “effective way to deal with outstanding debts” than bankruptcy – and less viewed it as “risky.”

This free calculator will help you add up the costs. That way you can save the most money.

Debt Relief Comparison Calculator

Other options for relief

If you’re not sure you need professional help, there are other options you can use to find relief. Remember, debt relief refers to any solution that gives you a fast, easy, or cheaper way to get out of debt. There are plenty of do-it-yourself debt relief options to consider besides formal debt relief programs. You can work directly with a creditor or lender to find a solution you can afford.

Deferment

This option allows you to temporarily suspend debt payments. You get the lender’s approval to pause monthly payments without incurring penalties. It also doesn’t negatively affect your credit.

Interest charges still accrue during deferment, except in specific circumstances. For instance…

- If you have a subsidized federal student loan, you defer the payment until you leave school. The government pays interest charges while you attend school.

- Conversely, if your loans are unsubsidized then the payments are deferred but interest charges accrue. This means the amount you owe increases while you attend school.

Deferment is most common on student loans. However, it is possible to defer other types of debt. You just need lender approval. Call your servicer and ask if they offer debt deferment. This is a good option if you’ve had a temporary setback and can’t make your payments.

Forbearance

This solution is similar to deferment. The lender agrees to reduce or suspend monthly payments entirely. Forbearance periods are generally shorter than deferment periods. Forbearance is typically granted by a lender if you contact them when you first experience financial hardship. If you think you won’t be able to make your payments, request forbearance BEFORE you fall behind.

This type of debt relief is typical for student loans and mortgages. Unlike in deferment, interest charges almost always accrue, even with subsidized federal student loans. However, it’s usually easier to qualify for forbearance. This can also work for other types of debt, including credit cards.

Refinancing

While deferment and forbearance change your payment schedule for a period of time, refinancing permanently changes the loan. The goal is to lower the rate applied to your debt. It may also provide other benefits, such as lower monthly payments.

Lowering the rate allows you to save money over the length of your term.

- You can refinance mortgages auto loans, and private student loans. You qualify for a new interest rate based on your credit score. If you refinance a mortgage, you may pay closing costs again.

- There is no federal program to refinance student loans; you must go through a private lender.

- If you lower the rate on a credit card, it’s simply known as interest rate negotiation.

Refinancing is only the right choice when you can qualify for a lower rate. This means you need a better credit score than when you took out the loan. Also, keep in mind that other factors can affect your interest rate. For example, in a strong economy, the Federal Reserve raises rates. This makes refinancing less beneficial.

Loan modification

Like refinancing, modification permanently changes the terms of a loan agreement. While refinancing reduces the interest rate, a modification can change the principal amount or the length of the term. You can also switch from an adjustable to a fixed rate. In most cases, you modify it to fit your needs or to get lower payments.

Mortgages are the most common types of loan modification. If your home is worth less than the remaining mortgage balance, modification matches the principal to the property value. Modifications were common during the mortgage crisis in 2008. However, as of January 1, 2017, the federally subsidized modification program (HAMP) ended. That means modifications are less common now.

Consolidation loans

Debt consolidation loans allow you to consolidate debt on your own. You roll multiple debts into a single monthly payment at the lowest interest rate possible. You take out a new loan in an amount that’s large enough to pay off your existing debts. This leaves only the new account to repay.

Like refinancing, the success of consolidation often hinges on your credit score. You must qualify for a loan that provides a lower rate. It may also reduce your monthly payments.

There are two types:

- You consolidate most debts with a personal consolidation loan. That includes credit card debt, medical debt, auto loan debt, and IRS tax debt. Student debt requires special consolidation loans.

- You can use a Federal Direct Consolidation Loan to consolidate federal school loans. However, this doesn’t lower your rate. The purpose is to make sure all your federal loans are eligible for federal student loan repayment and forgiveness programs. If you want to lower the rates, you must use a private student debt consolidation loan.

Debt forgiveness

True loan forgiveness (also called debt forgiveness) erases debt without penalties. Once you meet certain eligibility requirements, the lender forgives your debt without added fees or credit penalties. They report the debt as paid in full to the credit bureaus.

As you can imagine, this is rare. The most common type of forgiveness applies to federal student loan debt. But you must be in the military or a public service profession, such as nursing or teaching, to qualify.

There is also tax debt forgiveness. However, you must prove you are not legally responsible for the debt. This happens in Innocent Spouse cases. You prove your spouse incurred tax debt without your knowledge.

Workout arrangements

A workout arrangement is a repayment plan that you set up with an individual creditor. This relief option only applies to credit cards. If you fall behind and want to avoid a charge-off, the creditor will freeze your account and set up a payment plan you can afford.

In some cases, the creditor will “re-age” your account. They tell the credit bureaus to remove late payments and bring your account current. This removes credit damage caused by missed payments.

Settlement agreements

This type of relief is similar to a debt settlement program because you settle the debt for less than you owe. However, a settlement program handles multiple debts at once through a settlement company. You negotiate settlement agreements on your own with individual creditors or collectors.

There are two ways to set up individual settlement agreements:

- You send a settlement offer to a collector and they accept it.

- You receive a settlement offer from a collector a negotiate a settlement.

Voluntary surrender

Voluntary surrender involves giving up property attached to a loan. This gets you out of the agreement. The term “voluntary surrender” specifically refers to giving up a vehicle to get out of an auto loan. It’s also called voluntary repossession.

There is also a voluntary surrender option that you can use to avoid foreclosure on your home. It’s called a deed-in-lieu of foreclosure. This was a common relief option for homeowners during the mortgage crisis in 2008. Many lenders offered “cash for keys” programs that allowed homeowners to avoid foreclosure and make a clean break.

Be aware that voluntary surrender doesn’t mean you avoid credit damage. You still didn’t meet your obligation to repay the loan, so it will hurt your credit.

You may also face deficiency judgments. Voluntary surrender allows the lender to sell the property to cover their losses. But if the sale doesn’t cover the full balance, the lender has the right to sue you for the difference.

Bankruptcy

When is it comes to debt relief, the final option is bankruptcy. Bankruptcy provides relief by discharging most (not always all) of your debt. Chapter 7 bankruptcy is usually the fastest option. it liquidates any available assets, so you can make a clean break quickly. Chapter 13 bankruptcy sets up a repayment plan to pay back at least a portion of what you owe before final discharge.

The best relief option for every type of debt

Credit card debt relief

There is a wide range of options available if you need relief from credit card debt. Most credit users usually opt for do-it-yourself solutions first. However, high balances can make it impossible to get out of debt on your own. Most people end up needing professional help. There are two services you can use:

- If most of your accounts are current and you don’t want to damage your credit, call a consumer credit counseling agency. These agencies run debt management programs, which are consolidation programs designed to eliminate unsecured debt.

- If you’re already behind and most of your debts are in collections, call a settlement company.

This video explains the nuances between debt management and debt settlement programs in plain-English…

Debt Relief Options

There are many debt relief options, two of which include debt management programs and debt settlement plans. A common misconception is that they are the same thing.

But they are actually two very different types of solutions.

Debt management programs

A debt management program, or DMP, is the relief option where you pay back your principal in full but your rates are reduced or even eliminated.

You only have one payment to make each month, instead of several. And your credit score stays intact and may even improve while on the program.

The key to a successful debt management program is that more money goes to eliminating the principal while high-interest charges end.

In comparison, with a debt settlement program, you don’t pay back everything you owe.

Debt settlement programs

A debt settlement specialist negotiates with your creditors with the goal of getting them to sign off on a settlement offer, where they agree to reduce your principal so you only pay a portion of the original amount.

Once they agree to the debt settlement, the creditor receives their money from what you set aside in a ‘program savings account’.

After you complete a debt settlement program, you will enjoy freedom from debt but it may take a few months to a few years to rebuild your credit rating, depending upon your unique situation.

To find out which option is better for you, fill out our form or better yet, call us now. We’ll match you with the best solution for your situation, for free. We’re A-plus rated by the Better Business Bureau and have helped thousands of people become financially stable.

So, don’t struggle any longer, give us a call. When life happens, we’re here for you.

It’s worth noting that solutions for credit card debt also apply to other unsecured debts. You can use the same solution to solve medical debt, unsecured personal loans, and payday loans.

If you try all these solutions and still can’t get out of debt, it’s time for bankruptcy. Unsecured debts are fairly easy to discharge through bankruptcy. So, if you have a lot of unsecured debts on your plate and need a clean break, bankruptcy may be the way to go.

Student loan debt relief

There is a wide range of methods for student loan relief. The best choice usually depends on the type of student debt you have – federal or private.

Relief options for federal student loans that don’t affect eligibility for other federal relief programs:

- Deferment

- Forbearance

- Deferment

- Federal Direct Consolidation loan

- Federal repayment plans

- Public Service Loan Forgiveness

Private student loan relief options:

- Student loan refinancing

- Private student loan settlement

It’s important to note that you can use private refinancing for federal student loans. However, it converts federal debt to private. You lose all eligibility for federal relief moving forward.

Also, discharging student loans through bankruptcy is not as easy as other types of debt. To discharge, you must prove that not discharging those debts will cause continued financial hardship. It’s possible to discharge these debts through bankruptcy. But you’ll need a good attorney to get the results you want.

Tax debt relief

Finding the right relief option for tax debt is critical. The IRS also has broad collection powers that don’t require court orders. They can garnish your wages, intercept your tax refund, place liens on your property, and levy bank accounts – all without suing you in civil court. If you have tax debt, you need to find a solution fast.

Tax debt relief strategies tend to have special names for each program:

- Deferment = Currently Not Collectible (CNC) status

- Consolidation / Repayment Plan = Installment Agreement (IA)

- Settlement = Offer in Compromise (OIC)

- Interest Rate Negotiation = Penalty Abatement

Penalty abatement usually goes hand-in-hand with other methods. IRS penalty rates can go as high as 25%, depending on which penalties you incur. That kind of high interest adds up quickly, making your debt grow just as fast. The key to getting out of tax debt is to reduce those penalties as much as possible. This requires the help of a certified tax expert or CPA.

Mortgage debt relief

Problems with mortgage debt don’t just affect your credit and finances, they can have a very real impact on your life, too. A foreclosure could mean that you’re forced to uproot your family and scramble to find housing. The good news is that there are plenty of paths available to homeowners who are struggling to keep up with their payments. You have two paths you can take. The first path is to prevent foreclosure entirely. The second path is to make a quick and graceful exit when you can’t avoid foreclosure.

Relief options that prevent foreclosure:

- Forbearance

- Refinancing

- Workout arrangement

- Loan modification

Relief options for a fast exit:

- Deed-in-lieu of foreclosure

- Deed-for-lease

- Short sale

Deed-for-lease is similar to deed-in-lieu of foreclosure. The difference is that you stay in the home as a leasing tenant. This is a good option if you have kids in school that need to finish a semester before you move. In both cases, you voluntarily surrender the property.

A short sale can also be a good option for a fast exit. You sell the home for less than the remaining balance owed on the mortgage. The mortgage lender takes a loss on the sale. If the lender approves a short sale before you do it, it’s called an approved short sale. But even if they approve the short sale, they still reserve the right to get a deficiency judgment.

It’s important to note that any voluntary surrender or short sale will cause the same credit damage as a foreclosure. Foreclosure creates a 7-year negative item on your credit report. However, short sales and cash-for-keys carry the same 7-year penalty.

Auto loan debt relief

Auto loans are usually not the debt that causes financial hardship. But if you’re struggling with other types of debt, you may have trouble keeping up with the payments. In this case, you can use:

- Forbearance

- Refinancing

- Auto loan consolidation

- Voluntary vehicle surrender

The first three of those choices won’t hurt your credit, but the last will. It’s equivalent to repossession.

Payday loan debt relief

If you’re in trouble with payday loans, then debt settlement is usually the best option. These debts carry rates of 300% or higher. Finance charges stack up quickly. You want to get out of debt for a percentage of what they say you owe.

That being said, if you have a few payday loans but most of your debt problems come from credit cards, you can include payday loans in a debt management program. This will consolidate the payday loans with your other unsecured debts. As a result, you can stop all those Direct Debit transfers that are draining your accounts and causing added fees.

On the other hand, if the bulk of your issues is with payday loans, use a debt settlement program.

Medical debt relief

Out-of-pocket medical expenses that don’t get paid turn into medical debt collections. You may not even be aware that you owe anything until you receive collection notices. This can happen when you have gaps in insurance and other coverage issues. These issues are why medical debt collections are now a leading cause of bankruptcy in the U.S.

If you have medical debts in collections, debt settlement is usually the best option. You can either settle with the collection agency or go back to the original service provider. In some cases, the service provider may be willing to help you set up a repayment plan. If so, they will cancel the collection account.

Medical bills can also be rolled into a debt management program, but only if you have credit card debt to consolidate as well. You can’t use a debt management program solely to consolidate medical debt. But credit counseling agencies may be willing to help with medical collections if you already plan to enroll in a program.

Still, bear in mind that medical collections don’t have interest charges. You lose one of the main benefits of a consolidation program because there is no rate to reduce. That’s why debt settlement is usually the best option. You just need to get out quickly for the least amount of money possible.

Directly comparing debt relief methods

After learning about all the different ways you can get rid of your debt, you can narrow down your choices. Take a look at these direct comparisons to help you decide:

Debt Consolidation vs Debt Settlement

You may see debt consolidation and debt settlement advertised as being the same. Learn the differences and avoid being fooled.

Debt Management vs Debt Settlement

It’s not always obvious that debt management and debt settlement are two very different methods of debt relief. Learn the differences before you choose.

Debt Consolidation vs Bankruptcy

Find out how debt consolidation affects your finances differently from bankruptcy and get help choosing the best debt relief solution for you.

Debt Settlement vs Bankruptcy

Not sure whether to use debt settlement or bankruptcy to get rid of your debt? Review how the two are similar and different, plus the pros and cons of each.

5 tips for finding a trustworthy debt relief company

1. Check the BBB

All debt relief companies should be rated by the Better Business Bureau. You want a company that’s rated by the BBB, preferably with an A or A+ rating that’s been maintained for several years.

When you visit a company’s BBB page to check their rating, don’t just check the letter grade. See how many complaints they have and how those complaints were handled. Keep in mind that any business is almost certain to have at least one or two bad customer experiences. But it’s how they handle those experiences that matter. You want to know if things go wrong, you want a company that will do everything they can do to make it right.

Also, check to make sure the company is not tied to any organization that’s the subject of a class-action lawsuit by a state Attorney General’s office. Class action lawsuits are a bad sign.

2. Ask the Internet

There are good ways and bad ways to use the Internet to check debt relief companies. Bad is simply going to the company’s website and trusting what they tell you. Good is going to independent third-party review sites to get the real scoop. Most companies will cherry-pick their best customer testimonials for their website. They won’t show you anything bad.

Instead, go to websites like:

Look for sites that specifically say that they are independent. Avoid review websites that take compensation to remove negative reviews. They basically positively review people that pay them and negatively review anyone that doesn’t. That’s hardly an accurate reflection of the service you can expect.

3. Make sure the company is accredited

Oftentimes, debt relief providers are accredited by a trade association or approved by a government agency. Both are good signs that a company is reputable.

Trade associations are business cooperatives within a certain industry. A business must maintain a high ethical standard to be a member of the association. Credit counseling agencies may belong to the National Foundation for Credit Counseling or the Association of Certified Debt Management Professionals. Debt settlement companies have the American Fair Credit Council. These associations mean that the company must live up to a minimum ethical standard. You can have peace of mind that the company will provide the service that they claim.

Government approval is also a good indicator of a reputable company. For instance, if you need mortgage debt relief, find a HUD-approved housing counseling agency. HUD approval means that the housing counselors get special training and must adhere to certain standards.

4. Be wary of companies that charge upfront fees

Almost any relief option you use will have a cost. Even if you get a loan to consolidate debt, you must pay fees to set it up; then you pay interest charges on the new loan. So, if you work with a debt relief company, it’s reasonable to expect that there will be some fees.

What you want to avoid are any upfront fees that don’t come with a money-back guarantee. If a company wants to charge exorbitant fees to set up a program without a guarantee, they can take your money and run.

A company should either not charge any fees upfront until they perform at least some part of their service OR they should offer a money-back guarantee. If you’re supposed to pay upfront and have faith that they’ll do what they say, walk away.

5. Get a good feel from your initial consultation

Most debt relief services offer free consultations. That way, they can evaluate your debt, credit, and finances to see if they can help you. But outside of finding out if you’re eligible, use these consultations to get a read on companies you contact.

Make sure that you feel comfortable and confident after the consultation. If they leave you with more questions than answers, or you have a sinking feeling that something is wrong, don’t move forward! Trust your gut and only work with someone that engenders trust.

And always keep in mind, that these consultations are free with no obligation. So, although the representative may push you to sign up immediately, there’s no requirement to do so. You can thank them for their time, hang up and take time to consider what you want to do. You should never feel rushed or pressured into making a decision.

Government debt relief programs

There are times that the federal government steps in to help consumers with a specific type of debt. These programs usually have a limited lifespan. Congress will set them up during a crisis and continue to renew them until consumers recover. Many of the programs you see outlined below started after the housing crisis of 2008 and the Great Recession of 2009.

Federal student loan repayment plans

The government offers eight different plans that make it easier or more efficient to repay federal student loan debt.

There are two plans for borrowers that want to get out of debt as quickly as possible:

The other seven repayment plans help borrowers that are having trouble making payments:

- Extended repayment plan

- Income-based repayment (IBR)

- Income-contingent repayment (ICR)

- Income-sensitive repayment

- Pay as you earn (PAYE)

- Revised pay as you earn (RePayE)

These programs consolidate eligible federal student loans into a single monthly payment. If you have federal loans that don’t qualify for these programs, use a Federal Direct Consolidation loan. This helps ensure all your federal loans are eligible for relief.

And if that seems like an overwhelming number of choices, then be patient. President Trump proposed that Congress should reduce the number of plans from eight to three, to make things easier. But for now, ask your federal student loan servicer for more information about which plans are right for you.

Public Service Loan Forgiveness (PSLF)

This program offers penalty-free student loan forgiveness to people who work in public service. This program started under President Bush, but it was overhauled by President Obama so that more people could qualify. That’s why some people think it’s called Obama Student Loan Forgiveness.

In order to use this program, you must enroll in a hardship-based repayment plan first – that’s an ICR, IBR, PayE or RePayE plan. Then you must make payments for 10 years while you work in an approved public service profession. Then the government forgives the remaining balances without penalties.

The Department of Education revised its rules for employment certification to roll back the Obama-era expansion. They have talked about making even bigger changes to the program, which could limit the amount of debt forgiven or who can qualify. If you think you may qualify, start working now!

Fresh Start Program (aka Fresh Start Initiative) for IRS tax relief

In 2013, the IRS created the Fresh Start Program. Its purpose was to make it easier for taxpayers that had fallen behind on their taxes. This provides immense relief since it stops things like tax liens and wage garnishment.

Here is what the law provides:

- Fresh Start increases the amount of debt required to trigger a Notice of Federal Tax Lien. Now if you owe less than $10,000, you don’t need to worry about liens.

- Fresh Start also made it easier to file an Installment Agreement if you owe less than $50,000. You can use the streamlined online application and skip the full financial statement usually required to set up an IA.

- Fresh Start also expanded and improved Offer in Compromise access. The IRS is more relaxed in evaluating taxpayers’ ability to repay back taxes. Now it’s easier to qualify for an OIC.

Mortgage Forgiveness Debt Relief Act of 2007 extended through 2025

The name of this program often confuses people. They think there’s a program where the government forgives mortgage debt. But that’s not what the program does. Instead, it ensures that debt canceled by a mortgage lender on the sale of a primary residence is non-taxable.

Basically, this law is designed to prevent people from being forced to pay taxes after a short sale. When part of your debt is canceled by a lender, you usually must pay income taxes on the canceled portion. The only way to avoid paying taxes is to file for tax exclusion.

Around the time of the mortgage crisis, Congress created the Mortgage Forgiveness Debt Relief Act of 2007. This act automatically qualifies homeowners for the income tax exclusion if they have canceled mortgage debt on their primary residence.

For example, let’s say you have a short sale on your home. You sell the home for $50,000 less than the remaining balance on your mortgage. In normal circumstances, that $50,000 would be treated as taxable income. But, as long as you fill out Form 1099-C and the amount forgiven is less than $2 million, you qualify for the exclusion.

The program has been extended multiple times. The latest was enacted in December 2020. It provides relief for debt forgiven from January 1, 2021 through December 31, 2025.

Is there a government program for credit card debt relief?

No. The government does not have any relief programs that forgive or repay consumer credit card debt. There are, however, several ways that the government regulates credit card relief programs:

- The FTC regulates debt relief companies to make sure they provide services as advertised.

- The government created the Advance Fee Ban to ensure consumers receive help before they pay fees.

- The FTC also oversees nonprofit consumer credit counseling agencies that provide debt management programs.

Nonprofit credit counseling agencies are granted 501c(3) status. But in order to qualify, they must provide impartial help. In other words, a consumer credit counselor must review all possible paths toward debt relief during a consultation. They can only recommend a solution if it’s the best choice to use in your unique financial situation. This allows you to get expert advice without being driven to a debt management program.

These agencies are funded by grant money to provide low-cost relief to consumers. That’s how credit counseling agencies keep debt management program fees low. However, the grants these agencies receive are not federal grants. They are private grants from credit card issuers.

How does debt relief affect your credit?

The effect of debt relief on your credit score depends on which option you use. Any solution that pays back everything you borrowed should have a neutral or positive impact on your credit. Reducing interest charges or eliminating fees does not result in credit damage. On the other hand, any solution that gets you out of debt for less than the full amount owed damages your credit score.

Refinancing will not damage your credit as long as you make all the payments as scheduled. The same is true of a consolidation or a modified loan. Negotiating a lower rate on a credit card will also not have any negative effect on your credit. Deferment and forbearance also do not hurt your credit, because the creditor agrees to change your payment schedule.

The impact of workout arrangements and credit card debt management programs is usually neutral or positive. These solutions help you avoid missed payments and build a positive credit history. Most credit users don’t see any damage to their credit using these solutions. However, these methods will close the accounts. This can have a slightly negative effect on your credit, but the damage is usually nominal.

Solutions like debt settlement, short sales, and voluntary surrender all damage your credit. You incur a seven-year negative remark on your credit report for each of these. Foreclosure and Chapter 13 bankruptcy also result in a seven-year credit penalty. Chapter 7 bankruptcy has a 10-year penalty.

Bad ideas for debt relief

You might think things like settlement and bankruptcy would be bad ideas for debt relief. But even though these solutions may damage your credit, they are still viable strategies for finding relief. When you declare bankruptcy, you make a clean break from debt, so you can move forward in a positive way.

On the other hand, there are several options that put people in a weaker financial position than when they started. These solutions increase your financial risk or hurt your assets. Even though they wipe out your debt, they put you behind. If possible, you want to avoid these solutions.

Tapping home equity

Home equity loans, Home Equity Lines of Credit (HELOCs) and cash-out refinancing use home equity to provide debt relief. You basically borrow against the equity in your home to pay off debt. This can seem like a good solution, especially if you have a lower credit score. It’s easier to get a low rate when a loan is secured using your home as collateral.

But these significantly increase your financial risk. If you default on any of these options, you risk foreclosure. You could lose your most valuable asset and the place you call home.

In general, you want to leave home equity alone. It’s often the largest asset you have for building net worth. When you borrow against equity, you turn an asset into a liability. (Literally, net worth is calculated by taking total assets minus total liabilities – i.e. your debts.) That will be a problem when you go to open a new loan because your assets-to-liabilities ratio won’t be where you need it to be. So, your solution to avoid hurting your ability to borrow can actually make it harder to borrow.

Using retirement funds

We do not recommend tapping your 401(k) or IRA to pay off debt. You lose the funds you take out, as well as the growth you would have enjoyed on those funds. You can set your retirement back by years or even decades.

In addition to draining your retirement funds, you can face early withdrawal penalties if you take out money before the age of 59½ on a 401(k) or traditional IRA. The penalties for early withdrawal are 10% of the money you withdraw. In addition, you may also be required to pay taxes on the money you withdraw, since it’s considered taxable income. These penalties and taxes do not apply to a Roth IRA.

Still, the amount of time and savings that you lose by making an early withdrawal can’t be understated. You could be forced to delay your retirement or work part-time through retirement if you drain the funds now.

Ready to shed the debt? Give Debt.com a call (844) 452-9059 for a free debt analysis. Our certified counselors are waiting to map out your debt-free journey.