Debt.com and HerMoney asked more than 1,000 adults if COVID-19 has made them more financially responsible. The answer was a resounding yes – even for those who have lost no income.

The pandemic has had such a major impact on Americans’ finances and psyche that even those who didn’t lose part of their income are now rethinking how to approach spending and saving.

More than two thirds of respondents to a new Debt.com/HerMoney.com poll say they’re spending much less than during the pandemic – and includes those who haven’t suffered any income loss.

For this survey, Debt.com partnered with HerMoney.com, a digital media company focused on improving the relationships women have with money. The most dramatic result came from the most basic question: “Has the pandemic changed how you think about money?” For those who lost money in 2020 – from a quarter of their income to all of it – just over 70 percent responded that the pandemic had indeed changed their thinking in “profound ways.”

But the most dramatic result was from respondents who haven’t lost money: an astounding 50 percent also say the financial ramifications of COVID-19 has changed how they think about money in “profound ways.”

Why would the pandemic change so many minds even among those who have lost nothing, compared to those who have lost something or even everything?

HerMoney.com founder Jean Chatzky thinks she knows why: “Sometimes the fear of losing something is more overwhelming than the actual loss when it happens. So those who are worried they might be next are the ones who are preparing now for the worst.”

The other results were equally compelling…

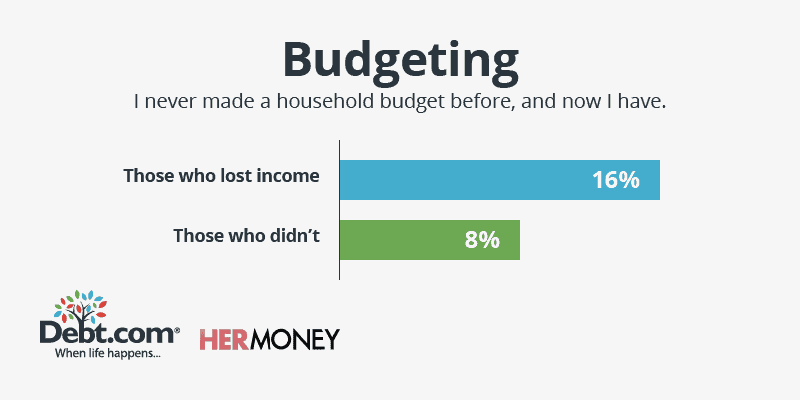

More Americans are budgeting since the COVID-19 outbreak

Sticking to a budget is now more important

Nearly half said they’ve cut spending by a fourth

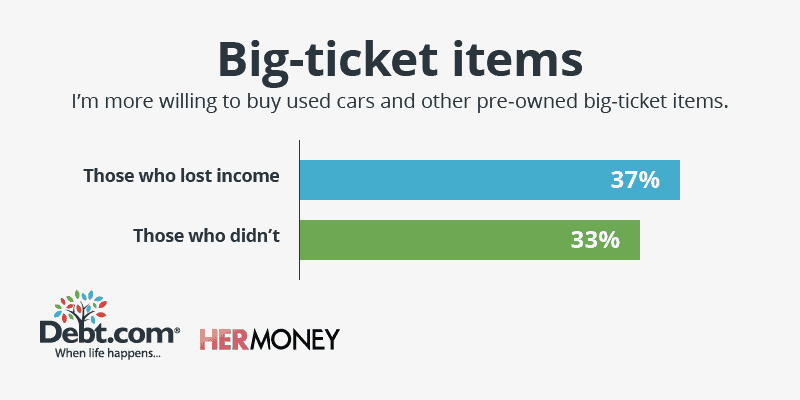

Three out of ten say they’re now interested in buying pre-owned big-ticket items

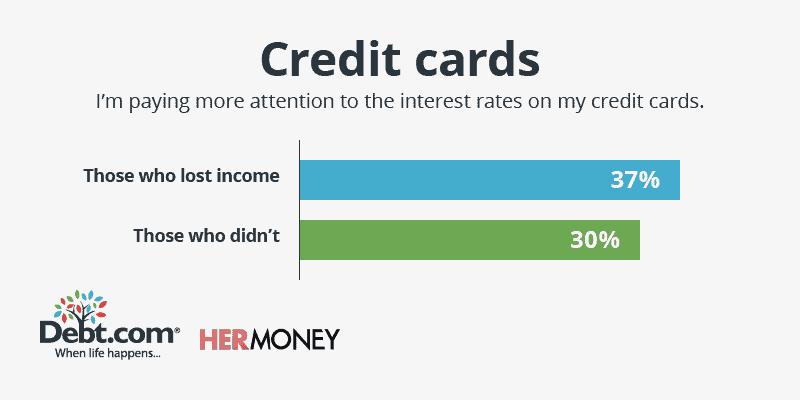

More of those who lost money now pay attention to interest rates on their credit cards

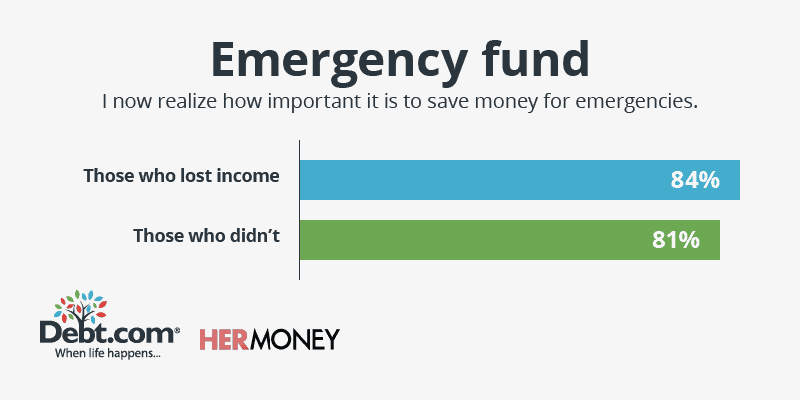

More Americans understand the importance of an emergency fund

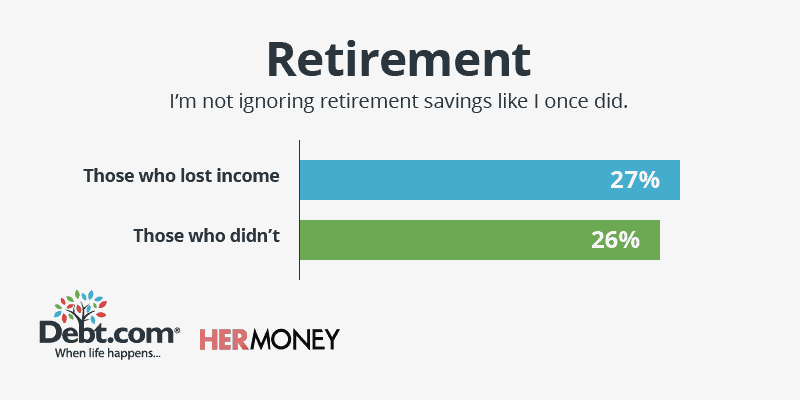

More than a quarter of all respondents are paying more attention to retirement savings

Slightly less than half feel their financial situation will improve under the Biden administration

| Have you lost income during the pandemic? | Percentage of respondents |

|---|---|

| Yes, we’ve lost all our household income | 2.82% |

| Yes, at least half of my household income | 8.18% |

| Yes, at least a quarter of my household income | 23.40% |

| No, I did not lose any household income | 65.60% |

| Has the pandemic changed how you spend money? | Percentage of respondents |

|---|---|

| Yes, I’ve cut at least half of my spending | 13.21% |

| These days, I only buy bare necessities | 18.69% |

| No, I still spend the same | 19.67% |

| Yes, I’ve cut spending by at least 25 percent | 48.43% |

| Has the pandemic changed how you handle money? | Percentage of respondents |

|---|---|

| Yes, I’ve never made a budget but do now | 11.02% |

| No, I never had a budget and still don’t see a need for one | 11.12% |

| I don’t currently have a budget but now see why it’s important | 20.94% |

| No, I had a budget and still use one | 27.66% |

| I’ve never stuck to my budget in the past, but do now | 29.26% |

| Has the pandemic changed how you think about money? | Percentage of respondents |

|---|---|

| No, my attitude about money is the same | 42.52% |

| Yes, in profound ways | 57.48% |

| If the pandemic has changed how you think about money, which of the following apply? | Percentage of respondents |

|---|---|

| I’m not ignoring my retirement savings anymore | 14.88% |

| I’m paying more attention my credit card interest rates | 18.77% |

| I’m more willing to buy used cars and other pre-owned big-ticket items | 19.94% |

| I now realize how important it is to save for emergencies | 46.42% |

| Do you think your financial situation will improve under President Biden? | Percentage of respondents |

|---|---|

| No | 23.14% |

| I think it will stay the same | 31.96% |

| Yes | 44.90% |

| Have you lost income as a result of the pandemic due to: | Percentage of respondents |

|---|---|

| Job furlough | 26.16% |

| Taking a pay cut | 32.27% |

| Job loss | 41.57% |

| Has the pandemic changed how you spend money? | Percentage of respondents |

|---|---|

| No, I still spend the same | 5.44% |

| Yes, I’ve cut at least half of my spending | 21.49% |

| These days, I only buy bare necessities | 27.79% |

| Yes, I’ve cut my spending by at least 25 percent | 45.27% |

| Has the pandemic changed how you handle money? | Percentage of respondents |

|---|---|

| No, never had a budget, still don’t see the need for one | 6.40% |

| Yes, I’ve never made a budget but do now | 16.57% |

| No, I had a budget and still use one | 18.02% |

| I don’t currently have a budget but now see why it’s important | 21.22% |

| I’ve never stuck to my budget in the past, but do now | 37.79% |

| Has the pandemic changed how you think about money? | Percentage of respondents |

|---|---|

| No, my attitude about money is the same | 29.39% |

| Yes, in profound ways | 70.61% |

| If the pandemic has changed how you think about money, which of the following apply? | Percentage of respondents |

|---|---|

| I’m not ignoring my retirement savings anymore | 26.92% |

| I’m paying more attention my credit card interest rates | 37.41% |

| I’m more willing to buy used cars and other pre-owned big-ticket items | 38.11% |

| I now realize how important it is to save for emergencies | 83.92% |

| Do you think your financial situation will improve under President Biden? | Percentage of respondents |

|---|---|

| No | 21.84% |

| I think it will stay the same | 24.71% |

| Yes | 53.45% |

| Has the pandemic changed how you spend money? | Percentage of respondents |

|---|---|

| Yes, I’ve cut at least half of my spending | 8.92% |

| These days, I only buy bare necessities | 13.97% |

| No, I still spend the same | 27.04% |

| Yes, I’ve cut spending by at least 25 percent | 50.07% |

| Has the pandemic changed how you handle money? | Percentage of respondents |

|---|---|

| Yes, I’ve never made a budget but do now | 8.10% |

| No, I never had a budget and still don’t see a need for one | 13.61% |

| I don’t currently have a budget but now see why it’s important | 20.80% |

| I’ve never stuck to my budget in the past, but do now | 24.77% |

| No, I had a budget and still use one | 32.72% |

| Has the pandemic changed how you think about money? | Percentage of respondents |

|---|---|

| No, my attitude about money is the same | 49.33% |

| Yes, in profound ways | 50.67% |

| If the pandemic has changed how you think about money, which of the following apply? | Percentage of respondents |

|---|---|

| I’m not ignoring my retirement savings anymore | 25.73% |

| I’m paying more attention my credit card interest rates | 30.25% |

| I’m more willing to buy used cars and other pre-owned big-ticket items | 33.18% |

| I now realize how important it is to save for emergencies | 80.36% |

| Do you think your financial situation will improve under President Biden? | Percentage of respondents |

|---|---|

| No | 23.81% |

| I think it will stay the same | 35.71% |

| Yes | 40.48% |

Methodology: Debt.com surveyed 1,064 people and asked 12 questions about how the COVID-19 pandemic has impacted their earnings and spending. People responded from all 50 states and Washington, DC and were aged 18 and above. Responses were collected through SurveyMonkey. The survey was conducted from Nov. 12, 2020 to Dec. 5, 2020.