Credit card debt in the U.S. recently hit a record high: $1.13 trillion. Debt.com’s latest in-house research shows how the average American is faring during a high inflationary period.

In a survey of 1,000 adults, 1 in 3 (35%) say they’ve “maxed out their credit cards in recent years while inflation and interest rates have increased.” Of those respondents, 8 in 10 (85%) say “price increases from inflation made them use their credit cards to make ends meet.”

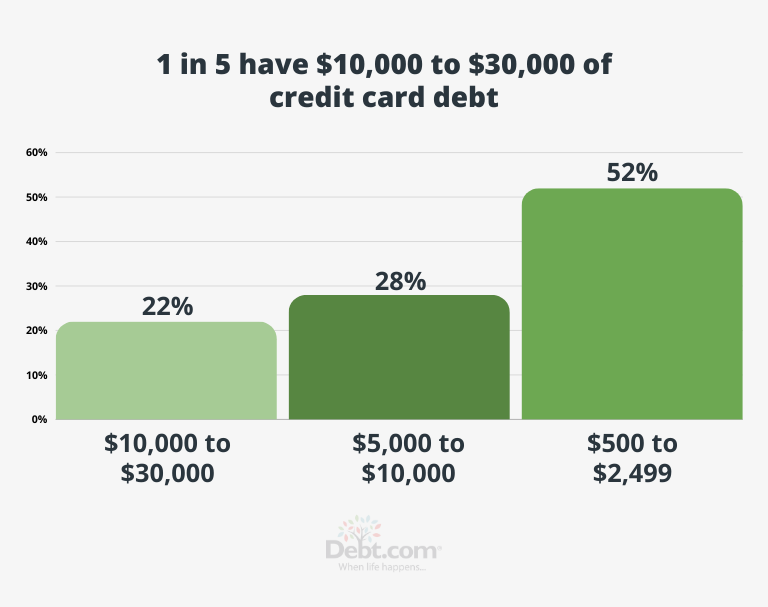

One in five (22%) have at least $10,000 to $20,000 worth of credit card debt. Of those, just over 5% have more than $30,000.

Key findings

- More than 4 in 10 (45%) of all survey respondents say “price increases from inflation caused them to use credit cards to make ends meet.” That includes 2 out of every 3 (67%) Millennials and half (53%) Gen Xers.

- 35% report having maxed out their credit cards in recent years. That’s made up of 17% Gen Z, 49% Millennials, 23% Gen Xers, and 11% of Baby Boomers.

- Over half (55%) of all respondents need credit cards to pay for a financial emergency. Nearly 3 out of 4 (73%) are Millennials. Over half (55%) are women.

- More than half (51%) say inflation has “caused them to carry a larger monthly credit card balance.” Of those respondents, 3 people out of 10 (32%) have at least $10,000 to $20,000 of credit card debt. That includes 3 in 10 (31%) Millennials.

- Nearly 3 in 5 (58%) of all respondents have never considered Do-It-Yourself or professional credit card debt solutions like debt management and settlement programs – most of whom (48%) are Baby Boomers.

- More respondents (41%) with at least $10,000 to $20,000 of credit card debt are Millennials.

| Region | States (breakdown defined by the U.S. Census Bureau) |

| Middle Atlantic | New York, New Jersey, Pennsylvania, Delaware, Maryland |

| Pacific | California, Oregon, Washington, Alaska, Hawaii |

| South Atlantic | Florida, Georgia, North Carolina, South Carolina, Virginia, West Virginia, District of Columbia |

| East North Central | Illinois, Indiana, Michigan, Ohio, Wisconsin |

| West South Central | Arkansas, Louisiana, Oklahoma, Texas |

| Mountain | Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming |

| East South Central | Alabama, Kentucky, Mississippi, Tennessee |

| West North Central | Iowa, Kansas, Minnesota, Nebraska, North Dakota, South Dakota |

| New England | Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont |

For full survey results, click here

| At what age did you get your first credit card? | |

|---|---|

| 18-24 | 55.71% |

| 25-34 | 24.37% |

| 35-44 | 12.48% |

| 45-54 | 4.45% |

| 55-64 | 1.26% |

| 65+ | 1.74% |

| Who introduced you to your first credit card? | |

|---|---|

| Parent(s) | 32.21% |

| Unsolicited offer | 21.28% |

| Retail store offer | 25.82% |

| School (College credit card) | 12.19% |

| Financial emergency | 8.51% |

| Select which financial emergency you’ve needed to charge on a credit card in recent years. | |

|---|---|

| Medical emergency | 65.12% |

| Mechanic (Auto repair) | 44.19% |

| Appliance repair or replacement | 52.33% |

| Funeral expenses | 24.42% |

| Job loss / loss of income | 27.91% |

| What is your total credit card debt? | |

|---|---|

| More than $30,000 | 5.16% |

| $20,000 to $29,999 | 5.56% |

| $10,000 to $19,999 | 10.91% |

| $5,000 to $9,999 | 11.81% |

| $2,500 to $4,999 | 14.29% |

| $500 to $2,499 | 52.28% |

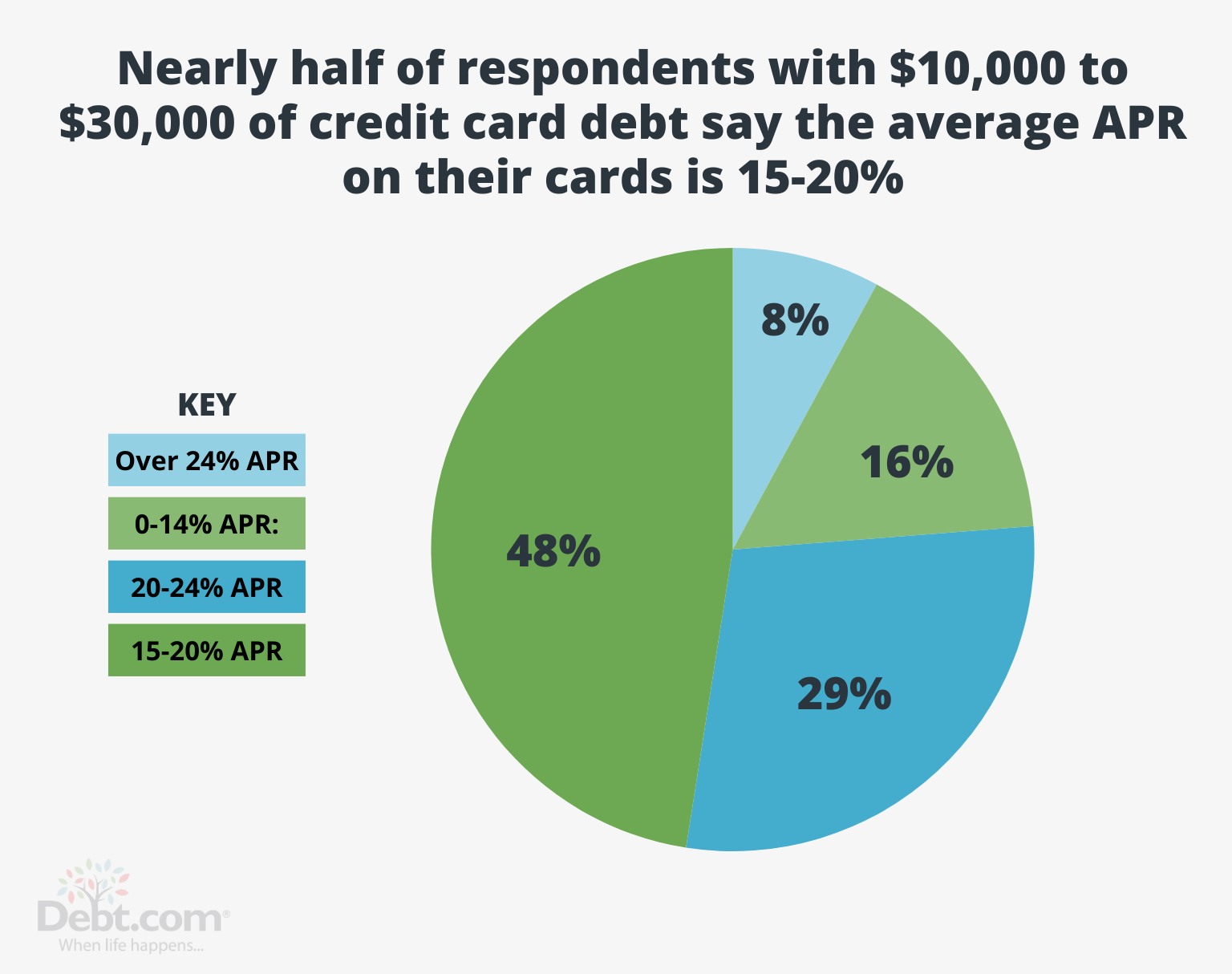

| Do you know what your average credit card APR is? | |

|---|---|

| 0-14% | 29.07 |

| 15-20% | 35.71% |

| 20-24% | 25.79% |

| Over 24% | 9.42% |

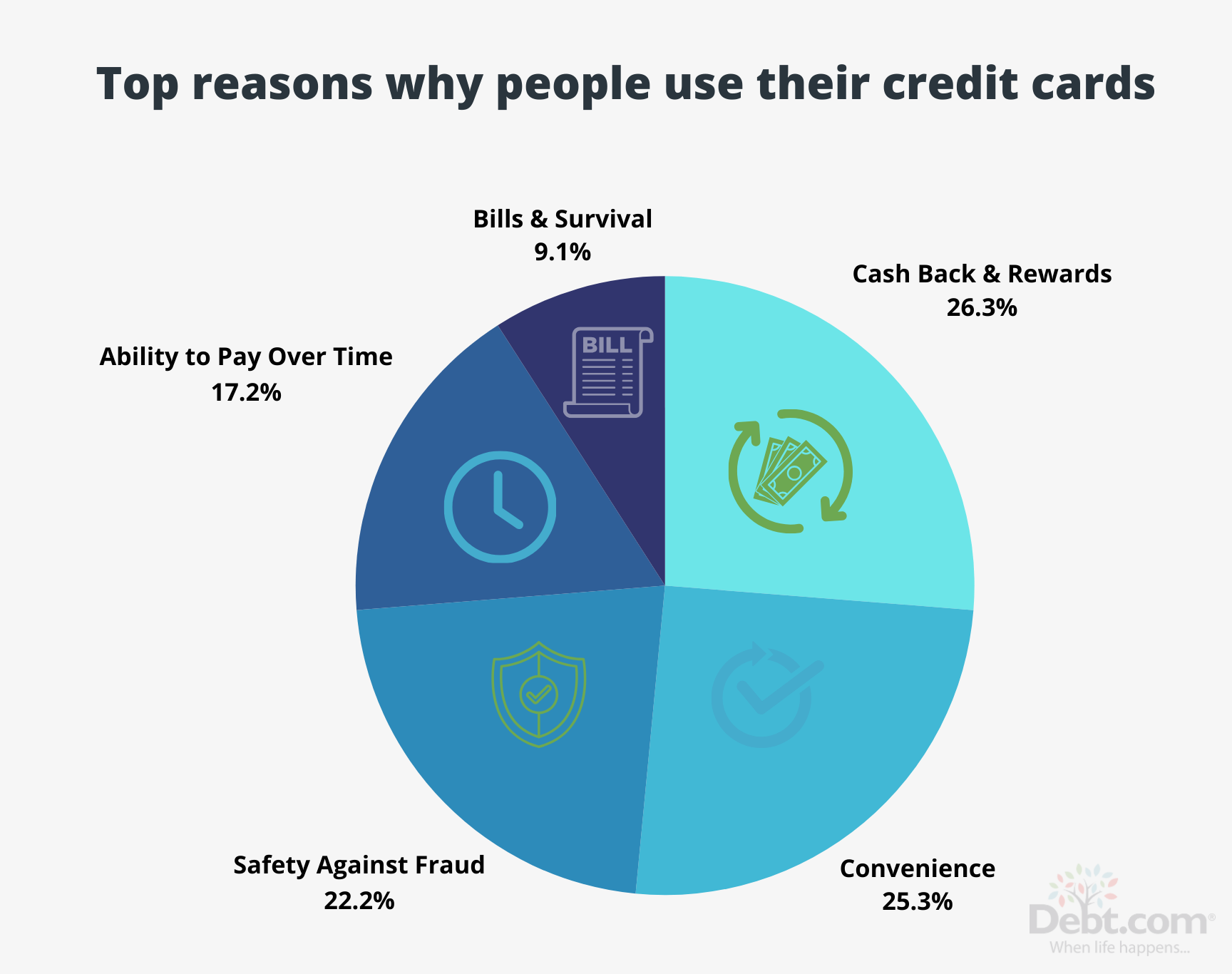

| Why do you use credit cards? | Strongly Disagree | Disagree | Neither Agree Nor Disagree | Agree | Strongly Agree |

|---|---|---|---|---|---|

| They’re convenient. | 4.17% | 4.27% | 18.25% | 41.67% | 31.65% |

| I earn cashback and rewards. | 5.75% | 6.35% | 13.00% | 36.90% | 38.00% |

| It’s easy to dispute fraud. | 5.85% | 6.75% | 23.12% | 38.00% | 26.29% |

| They allow me time to make purchases I can’t afford. | 19.64% | 11.31% | 18.95% | 32.54% | 17.56% |

| I can’t pay my bills without credit them. | 35.42% | 21.13% | 15.97% | 16.67% | 10.81% |

| Have you maxed out your credit cards in recent years while inflation and interest rates have increased? | |

|---|---|

| Yes | 34.72% |

| No | 65.28% |

| Have price increases from inflation made you use your credit cards to make ends meet? | |

|---|---|

| Yes | 45.34% |

| No | 54.66% |

| Has inflation caused you to carry a larger monthly credit card balance? | |

|---|---|

| Yes | 51.39% |

| No | 48.61% |

| Would you need to rely on your credit card(s) if faced with a financial emergency? | |

|---|---|

| Yes | 55.46% |

| No | 44.54% |

| Do you know your credit score? | |

|---|---|

| Yes | 80.74% |

| No | 19.26% |

| What credit score range do you fit in? | |

|---|---|

| Excellent: 800 to 850 | 40.32% |

| Very good: 740 to 799 | 29.59% |

| Good: 670 to 739 | 17.63% |

| Fair: 580 to 669 | 10.36% |

| Poor: 300 to 579 | 2.10% |

| Have you considered using any of the following solutions to help with your credit card debt? | |

|---|---|

| Yes, DIY plans like “debt snowball” and “debt avalanche” methods | 11.17% |

| Yes, a credit card balance transfer | 18.84% |

| Yes, a consolidation loan | 13.96% |

| Yes, credit counseling | 12.56% |

| Yes, debt settlement | 9.97% |

| No | 58.42% |

| What is your total credit card debt? | Percentage of respondents |

|---|---|

| More than $30,000 | 5.60% |

| $20,000 to $29,999 | 6.07% |

| $10,000 to $19,999 | 9.58% |

| $5,000 to $9,999 | 11.86% |

| $2,500 to $4,999 | 11.39% |

| $500 to $2,499 | 30.27% |

| N/A | 25.24% |

| Do you know what your average credit card APR is? | Percentage of respondents |

|---|---|

| 0-14% | 16.86% |

| 15-20% | 22.10% |

| 21-24% | 24.19% |

| Over 24% | 9.24% |

| I don’t know | 27.62% |

| Have you maxed out your credit cards over the past two years while inflation and interest rates have increased? | Yes | No |

|---|---|---|

| Percentage of respondents | 31.05% | 68.95% |

| Have price increases from inflation made you use your credit cards to make ends meet? | Yes | No |

|---|---|---|

| Percentage of respondents | 44.57% | 55.43% |

| Has inflation caused you to carry a larger monthly credit card balance? | Yes | No |

|---|---|---|

| Percentage of respondents | 48.67% | 51.33% |

| Other than inflation and price hikes, have any of these reasons added to having to take on more debt? | Percentage of respondents |

|---|---|

| Reduced income | 27.52% |

| Loss of job | 13.90% |

| Death of a family member | 7.43% |

| Divorce or separation | 6.38% |

| Medical issues | 17.43% |

| N/A | 53.52% |

| Have you considered any of the following solutions to help with your credit card debt? | Percentage of respondents |

| Yes, DIY plans like “debt snowball” or “debt avalanche” methods | 14.18% |

| Yes, a credit card balance transfer | 18.97% |

| Yes, a consolidation loan | 15.90% |

| Yes, credit counseling | 6.99% |

| Yes, debt settlement | 5.94% |

| No | 58.14% |

We’re using fewer credit cards, we’re charging less on them, and many Americans say that’s permanent.

During the pandemic, many studies and polls showed that Americans were spending less money and worrying more about their debts. A recent Debt.com/Her Money survey even suggested some of these changes might linger long after COVID-19 is just a bad memory.

In a nationwide survey with 1,000 respondents, 42 percent believe Americans have “learned how much credit cards cost in interest and fees and will permanently cut back.” Even further, compared to 2019 – the last time Debt.com ran this poll – 8 percent more said they “never or rarely hit their credit card limits.”

As expected, fewer Americans currently use credit cards at hotels and restaurants than two years ago. How much? Twenty percent less used their credit cards at hotels and 16 percent less charged restaurant meals on plastic.

What may come as a surprise: Last year, an estimated 95 percent of the population was ordered to shelter at home. But only 11 percent fewer Americans said most their credit card spending is on airfare compared to 2019.

Below are the most interesting findings from the survey…

The vast majority of respondents use credit cards

The majority believe Americans will cut back on credit card spending when the pandemic ends

One in five carry a balance between $0 and $100

More than half never – or rarely – hit the limit on their credit cards

Most respondents said they have three to five credit cards

| Do you use credit cards? | Percentage of respondents |

| No | 10.26% |

| Yes | 89.74% |

| When you’re shopping for a credit card, what features do you look for? | Percentage of respondents |

| Best rewards | 16.47% |

| More cash back | 18.96% |

| Lower interest rate | 64.57% |

| How many credit cards do you have? | Percentage of respondents |

| More than 12 | 2.32% |

| Nine to 12 | 4.03% |

| Six to eight | 12.30% |

| Two | 22.68% |

| One | 23.69% |

| Three to five | 34.98% |

| How many credit cards do you actively use? | Percentage of respondents |

| More than 12 | 0.20% |

| Nine to 12 | 0.50% |

| Six to eight | 2.83% |

| Three to five | 25.93% |

| Two | 26.84% |

| One | 43.69% |

| Have Americans learned to use credit card sparingly since the pandemic? | Percentage of respondents |

| I don’t know | 25.08% |

| As soon as the pandemic ends, we’ll run up bills at restaurants and retailers | 33.40% |

| I believe we’ve learned how much interest and fees cost. We’ll permanently cut back | 41.52% |

| What do you use your credit cards for? | Percentage of respondents |

| Other travel costs | 22.13% |

| Home repairs | 24.65% |

| Airfare | 26.46% |

| Medical expenses | 30.08% |

| Hotels | 31.29% |

| Gifts | 33.90% |

| Bills/covering budget gaps | 36.92% |

| Restaurants | 45.67% |

| Gas | 49.90% |

| Emergencies | 51.31% |

| Shopping | 60.76% |

| What is your total current credit card debt? | Percentage of respondents |

| More than $20,000 | 10.53% |

| $101 to $500 | 10.83% |

| More than $10,000 | 10.93% |

| $5,001 to $10,000 | 12.84% |

| $2,501 to $5,000 | 16.05% |

| $501 to $2,500 | 17.85% |

| $0 to $100 | 20.96% |

| What do think the average interest rates on your credit cards are? | Percentage of respondents |

| 0 to 5 percent | 8.03% |

| 6 to 9 percent | 10.84% |

| 10 to 12 percent | 12.45% |

| 13 to 15 percent | 17.17% |

| More than 20 percent | 21.49% |

| 16 to 20 percent | 30.02% |

| Do you ever hit the limit on your credit cards? | Percentage of respondents |

| I have hit a limit in the past six months | 6.26% |

| I have hit a limit in the past three months | 7.68% |

| I hit my credit limit monthly | 8.79% |

| I have hit a limit in the past year | 19.49% |

| I never or rarely hit my credit limits | 57.78% |

| Have you ever used a balance transfer offer to consolidate debt? | Percentage of respondents |

| Yes | 37.07% |

| No | 62.93% |

| On the card you transferred the balance from, did you continue to use that card for purchases? | Percentage of respondents |

| Yes | 42.12% |

| No | 57.88% |

| Did you pay off the balance transfer before the teaser rate expired? | Percentage of respondents |

| No | 38.90% |

| Yes | 61.10% |

| When was the last time you signed up for a new credit card? | Percentage of respondents |

| Yesterday | 1.91% |

| Last month | 8.79% |

| In the past 13 to 18 months | 11.23% |

| In the past seven to 12 months | 13.56% |

| In the past two to six months | 15.25% |

| It’s been over five years | 22.35% |

| It’s been over two years | 26.91% |

| Which credit card company has the best customer service? | Percentage of respondents |

| Wells Fargo | 1.91% |

| Citibank | 4.13% |

| Bank of America | 4.56% |

| American Express | 9.64% |

| Chase | 11.97% |

| Discover | 14.72% |

| Capital One | 23.73% |

| Not applicable | 29.34% |

| Which credit card company has the worst customer service? | Percentage of respondents |

| Citibank | 3.50% |

| Discover | 3.61% |

| American Express | 4.56% |

| Chase | 5.52% |

| Capital One | 6.79% |

| Wells Fargo | 11.25% |

| Bank of America | 13.16% |

| Not applicable | 51.59% |

| Have you ever used a credit monitoring service? | Percentage of respondents |

| Yes | 39.26% |

| No | 60.74% |

| Do you believe that the information in your credit report is accurate? | Percentage of respondents |

| No | 21.27% |

| Yes | 78.73% |

| When was the last time you reviewed your credit report? | Percentage of respondents |

| Never | 5.93% |

| In the past five years | 6.24% |

| In the past two years | 10.48% |

| In the past year | 18.10% |

| In the past six months | 59.26% |

| Do you know that you can receive a free annual credit report guaranteed by federal law? | Percentage of respondents |

| No | 15.56% |

| Yes | 84.44% |

Methodology: Debt.com surveyed 1,003 people and asked 19 questions about their credit card spending. People responded from all 50 states and Washington, DC and were aged 18 and above. Responses were collected through SurveyMonkey. The survey was conducted from Jan. 17, 2021 to March 22, 2021.

For Debt.com’s second annual Credit Card Survey, there was good news and bad news – but the bad news really sticks out.

When comparing 2019’s results to 2018’s, Americans are doing better in several areas. For starters, 10 percent more are wisely searching for the lowest interest rate when shopping for a new credit card. Last year, 58 percent did that. This year, it’s up to 68 percent.

However, the greatest swing in responses came from a crucial question: How often do you hit your credit limit? With the Great Recession in the rearview mirror, you’d think fewer Americans would be bumping up against the most they can borrow. Sadly, that’s not the case.

In 2018, 64 percent of respondents never or rarely hit their credit limit. In 2019, it’s down to less than half – 49 percent. Below are the other results, based on responses from nearly 1,400 U.S. adults.

How many Americans use credit cards?

| Do you use credit cards? | |

|---|---|

| Yes | 84.56% |

| No | 15.44% |

What features do consumers look for when they shop for a credit card?

On a positive note, most consumers look for low interest rates when shopping for credit cards. The lower the interest rate the easier it is to pay off credit card debt. That’s because you can focus on the principal, not the interest charges for borrowing money.

| When you’re shopping for a credit card, what features do you look for? | |

|---|---|

| Lowest interest rate | 68.37% |

| Most cash back | 14.33% |

| Best rewards | 17.30% |

How many credit cards does the average American have?

Most Americans have more credit cards that financial experts recommend. The rule of thumb is to have only 2-3. However, Debt.com’s survey findings reveal most have more than that.

| How many credit cards do you have? | |

|---|---|

| 1 | 15.35% |

| 2 | 20.74% |

| 3-5 | 41.58% |

| 6-8 | 15.35% |

| 9-12 | 3.81% |

| More than 12 | 3.16% |

Do most people actively use all the cards they have?

Just because Americans have more credit cards than experts recommend, that doesn’t mean they use them. Our survey results show that most just keep them instead of actively charging up a balance.

| How many credit cards do you actively use? | |

|---|---|

| 1 | 31.94% |

| 2 | 32.50% |

| 3-5 | 31.56% |

| 6-8 | 3.35% |

| 9-12 | 0.19% |

| More than 12 | 0.47% |

Why do people use credit cards?

There is more than one reason why people use credit cards. Unfortunately, most survey respondents use them for the wrong type of spending – daily expenses and emergencies. It’s dangerous to do because emergencies always get more expensive and trap people in debt.

| What do you use your credit cards for? Check all that apply. | |

|---|---|

| Hotels | 51.64% |

| Airfare | 37.70% |

| Other travel costs | 33.77% |

| Restaurants | 61.18% |

| Home repairs | 29.65% |

| Medical expenses | 33.86% |

| Emergencies | 59.21% |

| Bills / covering budget gaps | 42.66% |

| Gifts | 42.75% |

| Shopping | 69.50% |

| Gas | 58.84% |

How much credit card debt does the average American have?

The average credit card debt per U.S. household is $5,700, according to financial data site ValuePenguin.[1] And when it drilled down on households that carry balances from month to month, that averages shoots up to $9,300.

But if you look only at households that carry credit card balances, that average jumps $9,300. Now our survey results show that nearly three-fifths (59%) of people have balances less than $5,000, and 44% owe $2,500 or less.

| What is your total current credit card debt? | |

|---|---|

| $0-$100 | 11.32% |

| $101-$500 | 11.23% |

| $501-$2,500 | 21.51% |

| $2,501-$5,000 | 15.38% |

| $5,001-$10,000 | 18.02% |

| More than $10,000 | 13.21% |

| More than $20,000 | 9.34% |

What is the average interest rate on your credit cards?

The national average credit card interest rate usually fluctuates between 16%-18% APR, according to CreditCards.com.[2] But if you use reward credit cards, your rates may often be more than 20% APR.

At the same time, if you have low interest rate credit cards, your average credit card rates could very well be in the 13%-15% range. A big shock is how many survey respondents who say their average rate is even lower.

| What do you think is the average interest rates on your credit cards? | |

|---|---|

| 0-5% | 6.33% |

| 6%-9% | 8.79% |

| 10%-12% | 13.42% |

| 13%-15% | 20.32% |

| 16%-20% | 26.47% |

| More than 20% | 24.67% |

How often do consumers go over their credit limit?

Maxing out your cards will hurt your credit score. A good rule of thumb is to keep your credit limit lower than 30%. It’s also bad to carry balances month to month. Unfortunately, the amount of respondents who never or rarely hit their credit limit has gone down by 15 percentage points since last year’s survey.

| Do you ever hit the credit limit on your credit cards? | |

|---|---|

| I never or rarely hit my credit limits | 49.01% |

| I have hit a limit in the past year | 16.84% |

| I have hit a limit in the past 6 months | 8.23% |

| I have hit a limit in the past 3 months | 14.29% |

| I hit my credit limit monthly | 11.64% |

Do people know about balance transfers?

Balance transfer credit cards can be used to consolidate credit card balances into one new one with a lower APR. Some even offer 0% APR introductory periods, which gives consumers the ability to pay off debt without interest.

| Have you ever used a balance transfer offer to consolidate debt? | |

|---|---|

| Yes | 38.45% |

| No | 61.55% |

Do people continue to use the cards that transferred the balance away from?

Most people stay away from using a credit card that they transferred their balance away from. Yet still, only by a small percent difference.

| On the card that you transferred the balance from, did you continue to use that card for purchases? | |

|---|---|

| Yes | 41.23% |

| No | 58.77% |

Do consumers use balance transfers the right way?

The bad news is that only a third of respondents have used a balance transfer for their credit card debt. However, the good news is they’re using them correctly. Roughly three out of five (61%) pay their balance off before the offer expired.

| Did you pay off the balance transfer before the teaser rate expired? | |

|---|---|

| Yes | 61.04% |

| No | 38.96% |

How often do Americans sign up for credit cards?

Constantly applying for new credit cards can raise red flags to banks and credit card companies. It can look as though your a risk to lend money to. On the other hand, keeping the same cards for too long without looking for better offers could leave you missing on some great new rewards and credit card offers.

The majority of our survey respondents seem to be in a good spot when it comes to how long they wait to sign up for new cards.

| When was the last time you signed up for a new credit card? | |

|---|---|

| Yesterday | 1.13% |

| Last month | 7% |

| In the past 2-6 months | 13.12% |

| In the past 7-12 months | 13.45% |

| In the past 13-18 months | 15.06% |

| It’s been over 2 years | 25.68% |

| It’s been over 5 years | 24.56% |

Which credit card company do Americans favor for customer service?

Customer service is important when dealing with any business, but especially when it can make the difference when disputing inaccurate charges or negotiating new credit lines or fees. Here are the credit card companies that our survey respondents felt were the best:

| Which credit card company has the best customer service? | |

|---|---|

| Capital One | 25.41% |

| Chase | 12.91% |

| Discover | 17.21% |

| Citibank | 4.95% |

| American Express | 7.55% |

| Bank of America | 5.11% |

| Wells Fargo | 3.17% |

| N/A | 31.98% |

Which credit card companies do Americans feel have the worst customer service?

We also asked in our survey which credit card companies consumers felt had the worst customer service. Here’s what they had to say:

| Which credit card company has the worst customer service? | |

|---|---|

| Capital One | 7.03% |

| Chase | 5.31% |

| Discover | 2.37% |

| Citibank | 3.76% |

| American Express | 3.10% |

| Bank of America | 9.31% |

| Wells Fargo | 10.29% |

| N/A | 58.82% |

Do people use credit monitoring services?

Nowadays there are so many different credit monitoring services to choose from. Some are free, like Credit Karma. Others are paid services, like LifeLock. We’re happy to see that more respondents are using these services than last year’s poll.

| Have you ever used a credit monitoring service? | |

|---|---|

| Yes | 59.66% |

| No | 40.34% |

Do consumers trust that their credit reports are accurate?

One out of every four credit reports have errors in them, according to a 2013 study conducted by the Federal Trade Commission.[3]

The congressional research also revealed that 1 in 5 Americans have inaccurate information in one of their credit reports that can drag down their credit score. Although it’s vital to regularly check your credit, most respondents believe the three credit bureaus correctly report their information.

| Do you believe that the information in your credit report is accurate? | |

|---|---|

| Yes | 53.59% |

| No | 12.99% |

| Not sure | 33.42% |

How often do consumers review their credit report?

Americans are able to review their credit for free once yearly through annualcreditreport.com.[4] It seems to be helping most of our poll respondents – they regularly check.

| When was the last time you reviewed your credit report? | |

|---|---|

| In the past six months | 54.07% |

| In the past year | 17.91% |

| In the past 2 years | 10.76% |

| In the past 5 years | 11.18% |

| Never | 6.08% |

Do consumers know that free credit reports are guaranteed by federal law?

Just because the government mandates programs doesn’t mean all Americans are aware of them. However, the majority of Debt.com’s survey respondents are aware that they legally can get their credit report yearly for free.

| Do you know that you can receive a free annual credit report guaranteed by federal law? | |

|---|---|

| Yes | 83.07% |

| No | 16.93% |

Methodology

Debt.com polled 1,408 U.S. adults online using SurveyMonkey. The survey was open from May 24, 2019 through July 15, 2019.

Debt.com’s 2018 credit card survey

Credit cards are extremely convenient, but they also have the potential to create serious debt problems for consumers when they’re not used correctly. According to the Federal Reserve Bank of New York, revolving debt topped $1 trillion at the end of last year, and most of that debt comes from credit cards. Experts warn that this could spell trouble for consumers if the economy takes a turn. But at least for now credit card delinquency rates are falling.

So, to find out what’s really true when it comes to consumers and credit cards, Debt.com and Money Talks News partnered up to conduct a nationwide survey of over 4,500 U.S. adults to ask about their perspectives on credit cards and credit card debt. Out of the responses, two risky bad credit habits stood out:

Full credit card survey results

Below you can find the full results to all the questions from Debt.com’s 2018 Credit Card Survey.

How many Americans use credit cards?

Following the Great Recession, some experts predicted that credit card use would become less popular, especially among Millennials. However, according to our findings, most Americans still believe in the power of their plastic.

| Do you use credit cards? | |

|---|---|

| Yes | 84.86% |

| No | 15.14% |

What features do consumers look for when they shop for a credit card?

The good news is that when consumers shop for a new credit card, most focus on the right thing: low interest rates. A low rate makes it easier to pay of credit card debt because more of each payment goes to elimiante principal, rather than accured interest charges.

| What is the main feature you look for when you shop for a new credit card? | % |

|---|---|

| Lowest interest rate | 58.11% |

| Most cash back | 20.28% |

| Best rewards | 21.61% |

How many credit cards does the average American have?

Most experts recommend that you really only need 2-3 credit cards because any more than that creates too much potential for debt problems. However, Debt.com’s findings show that the marjority of people may have more accounts than they really need.

| How many credit cards do you have? | |

|---|---|

| 1 | 13.46% |

| 2 | 22.97% |

| 3-5 | 43.95% |

| 6-8 | 13.15% |

| 9-12 | 3.99% |

| More than 12 | 2.48% |

Do most people actively use all the cards they have?

While many Americans have more cards than most experts would recommend, that doesn’t mean that they’re actively using all those cards. In reality, only a few cards are actively used, even when a person has a wallet full of plastic.

| How many credit cards do you actively use? | |

|---|---|

| 1 | 33.01% |

| 2 | 34.93% |

| 3-5 | 28.32% |

| 6-8 | 2.71% |

| 9-12 | 0.74% |

| More than 12 | 0.28% |

Why do people use credit cards?

Credit cards don’t just serve one purpose, and as a result, credit card use has become an integral part of our daily lives. In some cases, they may be used strategically. But unfortunately, they often get used to cover daily expenses and emergencies. This type of use can be dangerous because unexpected expenses always inevitably arise.

| What do you use your credit cards for? Check all that apply. | |

|---|---|

| Hotels | 57.69% |

| Airfare | 47.98% |

| Other travel costs | 45.30% |

| Restaurants | 65.00% |

| Home repairs | 40.97% |

| Medical expenses | 40.61% |

| Emergencies | 58.43% |

| Bills / covering budget gaps | 38.83% |

| Gifts | 52.18% |

| Shopping | 76.67% |

How much credit card debt does the average American have?

According to our friends at ValuePenguin, the average credit card debt per household is $5,700. But if you only at households that carry credit card balances, that average jumps $9,300. But according to Debt.com’s results, nearly two thirds (66%) of people we polled had balances of less than $5,000 and almost 40% had a balances of $1,000 or less.

| What is your total current credit card debt? | |

|---|---|

| $0-$100 | 21.95% |

| $101-$500 | 8.89% |

| $501-$1,000 | 8.79% |

| $1,001-$3,000 | 15.62% |

| $3,001-$5,000 | 10.25% |

| $5,001-$10,000 | 13.35% |

| $10,001-$15,000 | 7.46% |

| $15,001-$20,000 | 4.30% |

| $20,001-$25,000 | 2.92% |

| $25,001-$30,000 | 1.36% |

| $30,001-$35,000 | 1.28% |

| $35,001-$40,000 | 1.02% |

| $40,001-$45,000 | 0.44% |

| $45,001-$50,000 | 0.63% |

| $50,001-$100,000 | 0.31% |

What is the average interest rate on your credit cards?

According to CreditCards.com, the national average credit card interest rate usually fluctuates between 16-18% APR. But if you use reward credit cards, your rates may often be over 20% APR. At the same time, if you have low interest rate credit cards, then your average creidt card rates could easily be in the 13-15% range. What’s suprising is the number of respondents that reported their average rate was even lower than that. Either these respondents have extremely good credit and negotiating skills for getting lower rates, or this may show that many people underestimate how much credit really costs them.

| What do you think is the average interest rates on your credit cards? | |

|---|---|

| 0-5% | 7.37% |

| 6-9% | 10.58% |

| 10-12% | 16.98% |

| 13-15% | 21.60% |

| 16-20% | 26.52% |

| Over 20% | 16.95% |

How often do consumers go over their credit limit?

Hitting your credit limit is bad for your debt and your credit score. In general, utilizing anymore than 30% of an available credit limit is bad for your score. Ideally, you really don’t want to carry balances over month to month. But we were pleased to see that almost a third of survey respondents never or rarely get close to their credit limits.

| Do you ever hit the credit limit on your credit cards? | |

|---|---|

| I never or rarely hit my credit limits | 64.20% |

| I have hit a limit in the past year | 12.57% |

| I have hit a limit in the past 6 months | 4.98% |

| I have hit a limit in the past 3 months | 9.95% |

| I hit my credit limits every month | 8.30% |

Do people know about balance transfers?

Balance transfer credit cards allow a consumer to consolidate existing credit card balances on a new card with lower APR. Often, these credit cards offer 0% APR introductory periods where you can pay off debt interest-free.

| Have you ever used a balance transfer to consolidate debt? | |

|---|---|

| Yes | 35.20% |

| No | 64.80% |

Do consumers use balance transfers the right way?

While only more than a third of respondents have used a balance transfer, the good news is that the majority use them correctly. That means paying off the balance in full before the end of the 0% APR teaser rate.

| Did you pay off the balance transfer before the teaser rate expired? | |

|---|---|

| Yes | 67.66% |

| No | 32.34% |

How often do Americans sign up for credit cards?

When it comes to using credit strategically, there’s a sweet spot when it comes to shopping for credit. You don’t want to constantly shop for new cards because it creates a risk for too much debt. On the other hand, you don’t want to use your cards for decades without shopping around. You could miss out on new reward programs and features. But at least with our respondents, shopping for new credit is a rarity.

| When was the last time you signed up for a new credit card? | |

|---|---|

| Yesterday | 0.74% |

| Last month | 6.40% |

| In the past 2-6 months | 11.08% |

| In the past 7-12 months | 11.72% |

| In the past 13-18 months | 11.92% |

| It’s been over 2 years | 23.05% |

| It’s been over 5 years | 35.07% |

Do people use credit monitoring services?

Credit monitoring services allow consumers to track changes in their credit score and review their credit reports more regularly. There are paid services, like LifeLock, and free services, like Credit Karma. But do people really use these services to strategically build credit?

| Have you ever used a credit monitoring service? | |

|---|---|

| Yes | 46.48% |

| No | 53.52% |

Do consumers trust that their credit reports are accurate?

A 2013 FTC study found that one in four credit reports contain an error and one in five have an error that would hurt a consumer’s credit score. That’s why it’s so important to review your credit often. Unfortunately, most people seem to trust the bureaus to get it right.

| Do you believe that the information in your credit report is accurate? | |

|---|---|

| Yes | 57.46% |

| No | 10.69% |

| Not sure | 31.85% |

How often do consumers review their credit report?

With free annual credit reports through annualcreditreport.com, consumers can review their credit without any strings attached once per year. And the majority of the people we polled stay on top of their credit.

| When was the last time you reviewed your credit report? | |

|---|---|

| In the past six months | 50.26% |

| In the past year | 20.41% |

| In the past 2 years | 11.43% |

| In the past 5 years | 12.14% |

| Never | 5.76% |

Do consumers know that free credit reports are guaranteed by federal law?

Often the biggest problem with government mandated programs is that consumers don’t know they exist. It’s the reason that the Government Accountability Office says that over half of student loan borrowers may be overpaying. But when it comes to knowing about free credit reports, most consumers are in the know.

| Do you know that you can receive a free annual credit report guaranteed by federal law? | |

|---|---|

| Yes | 85.99% |

| No | 14.03% |

Methodology

Debt.com partnered with Money Talks News to poll 4,462 U.S. adults online using SurveyMonkey. The survey was open from June 19, 2018 to July 9, 2018.

Source:

Methodology: Debt.com surveyed 1,000 credit card holders about how high inflation has impacted on their debt. People responded from all 50 states and Washington, DC, and were aged 18 and above. Responses were collected through SurveyMonkey. The survey was conducted on February 27, 2024.