Having bad credit can feel like it gets in the way of everything in your life. No matter how you try to move forward, your poor credit score keeps pulling you back. The best way to combat this negativity is to learn what a bad score means in the first place. Once you understand what bad credit really is, it will be much easier for you to improve it.

What is a bad credit score?

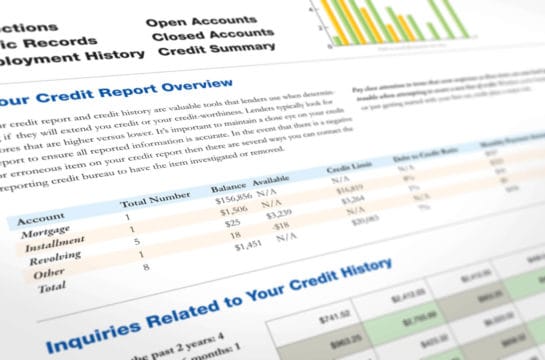

There’s a lot to unpack behind those three digits of your credit score. To make a bad credit score good again, you need to understand how a credit score is calculated. There are five main components that the three major credit bureaus use to determine your score:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New applications: 10%

- Types of credit: 10%

Learn more about how your credit score is determined »

If your credit score is low, there are many decisions that could have led you there. Perhaps you missed payments on your credit cards or a loan. Maybe you used too much of your credit limit and your utilization ratio slipped above 30%. Or it could be that you are new to credit and just haven’t had time to build up a score. No matter what’s bringing your score down, a bad credit score means that lenders see you as less trustworthy. If lenders don’t trust you to pay them back, this means you they will give you a higher interest rate or refuse to lend to you at all.

How do you know if your credit score has gotten this bad? Well, in general, any score below 650 is considered a poor score. If you’re below 600, then you are past poor and in the “bad credit” range. 300 is the absolute lowest score.

Types of Scores

The three major credit bureaus (Experian, TransUnion, and Equifax) each have a different credit report and score for you. However, there are many more different types of credit scores used by lenders to determine if you are creditworthy. FICO and Vantage are the most popular, both score types range from 300 to 850.

FICO Score

Your FICO Score 8 is the score most commonly used by lenders to determine your creditworthiness. There are other kinds of FICO scores, too, but 8 is the one you should focus on.

| FICO Range | Credit Score Designation |

|---|---|

| Above 800 | Excellent or exceptional |

| 740-799 | Very good |

| 670-739 | Good (this is the median credit score range) |

| 580-669 | Below average or fair |

| Below 579 | Poor or bad |

VantageScore®

VantageScore is very similar to FICO. The biggest difference is that FICO also makes industry-specific scores for things like auto loans and credit cards, while VantageScore only calculates your base score.

| VantageScore 3.0 Range | Credit Score Designation |

|---|---|

| 781-850 | Super prime |

| 661-780 | Prime |

| 601-660 | Near Prime |

| 501-600 | Subprime |

| 300-500 | Deep subprime |

How will a bad credit score affect my life?

Having a bad credit score can invade every aspect of your life. Here are just a few examples of the kind of havoc it can wreak:

Covering emergency expenses

If you’re in over your head financially, it’s likely that you don’t have an emergency fund to cover unexpected expenses. But with bad credit, you may also have difficulty using credit to cover emergencies. This means you may be forced to rely on high-cost, risky lending alternatives, like payday loans.

Getting any kind of credit

If your credit is really bad, creditors may not extend a line of credit to you at all. This can make it difficult to get credit when you need it or rebuild your poor credit score. In most cases, you’ll need to out down a cash deposit if you want to get a credit card.

Making big purchases

Trying to get a home or auto loan can be very difficult with a low credit score. Your personal plans to become a car or homeowner may be put on hold until you can raise your score.

Insurance costs

You may not relate your credit score to your insurance costs, but bad credit can actually mean paying higher insurance rates in some states.

Learn how your credit score can affect your car insurance »

Getting good interest rates

Your chances of getting a reasonable interest rate on a loan or credit card are very low when you have a poor credit score.

How can you fix a bad credit score?

The good news about having a bad credit score is that there are plenty of ways to fix it. Start by monitoring your credit, if you don’t already. Credit monitoring allows you to keep an eye on your credit scores from all three major credit bureaus, as well as other factors included on your full credit report.

Want help fixing your bad credit? You aren’t alone. We can help you find the best credit repair method for you.

There are also many apps that can help you monitor your credit and give you tips to improve it. Credit Karma, Credit Sesame, and Mint can all show you an updated credit score. Keep in mind that these applications don’t show your FICO score, which is the one most commonly used by lenders. They also don’t show you what lenders would see on your full credit report, so you can’t monitor your loans or credit history on these platforms.

Once you’ve set up a way to monitor your score, go through all of the components of your score to see where you are falling behind:

- Payments

- Since you have a low credit score, chances are that you haven’t been making payments on time. The best way to improve is to start paying off your debt and make sure you make all of your minimum payments by the due date. If you have any accounts that are behind, you need to make catchup payments to bring them current.

- Credit Utilization

- Any credit utilization ratio over 30% will harm your credit score. This doesn’t necessarily mean you have to spend less money, although that would help. To keep your utilization low, try paying your bill off multiple times per month.

- Credit Age

- If your credit age is bringing your score down, the best thing you can do is wait and not close any accounts you currently have. It may feel like the final step in paying off your debt to close an account, but it can actually hurt your score if you get rid of older accounts.

- New Applications

- Applying for too many lines of credit in a short period of time can also hurt your score. To fix this, simply refrain from applying for any more credit cards, loans, or other types of credit until your score is where you want it to be.

- Types of Credit

- With a bad score, you may not be able to do much about this component of your credit. Fortunately, the variety of accounts you have has a relatively low impact on the overall health of your credit. You may want to consider using something like a credit building loan to diversify your credit mix.

Another thing to be aware of when examining your credit is how long some negative items will stay on your credit report. There are many items, such as missed payments or tax liens, that will stay on your report for up to seven whole years.

TIP: You can try to dispute negative items on your credit report that may be holding you back.

Next, take a look at these methods for repairing your credit. Need some motivation? Find out how raising your credit score can improve your life:

Easy ways to starting improving your credit score

DIY Credit Repair

Credit repair is the process of identifying and disputing mistakes in your credit report. Correcting credit report mistakes is not guaranteed to raise your score, but it often does and it’s usually a good starting point. It can be very tricky, but it is possible to fix your credit on your own.

Find out if DIY credit repair really works »

Self Lender

Self Lender is a service that allows you to basically make a real loan to yourself. You can then build up your credit score and your saving by paying yourself back.

Read our review of Self Lender »

Credit Repair Programs

To prevent hurting your credit score further, Debt.com recommends working with a credit repair company to start fixing your credit. It works fast, and it minimizes your risk of accidentally lowering your score. Credit repair programs will handle all of your disputes for you and give you the best advice for your particular situation. Again, keep in mind that credit repair is not guaranteed to raise your score. But it’s often nice side effect of removing negative information that’s incorrect from your credit report.

Learn how credit repair can work for you »

What can you still do with a bad credit score?

You’ll be facing high interest rates and possibly some application fees, but there are still ways to get access to credit with a bad score.

Personal Loans

Especially if you have bad credit, it’s important to be careful with any kind of personal loan. Predatory lenders are common and interest rates can get very high.

Read more about how to get a personal loan with bad credit »

Credit Cards

The best credit card you can get with a bad credit score is none at all. If you need a card, stick with your debit card until you can reduce your debt and improve your score. Opening a new account may only make it worse. However, if you really need access to a line of credit, you can try a secured credit card.

You can get a secured credit card if you make an initial deposit. Essentially, your secured credit card allows you to borrow against that deposit. Since you’re borrowing against that asset, your credit score doesn’t really matter.

Understand your credit card options with a bad score »

Get Hired

Did you know that bad credit can affect your ability to get hired? Unfortunately, some companies run credit checks on their potential employees. While employers don’t check your credit score, they are legally allowed to review your credit report. So, your bad credit can still affect your career.

Learn how to prevent your bad credit from hurting your chances of employment »

Buy a Home

It may still be possible for you to buy a home with bad credit. Adjustable-rate mortgages and FHA financing are both options for scores below 620.

Find out how to become a homeowner with bad credit »

Buy a Vehicle

Purchasing your dream car may not be possible but you can still get something that will get you from Point A to Point B.

Find out how to purchase a car with bad credit »

Get Approved for an Apartment

Having a roof over your head is a necessity but poor credit may limit where you can live. You may have to skip the deluxe apartment in the sky for something a little more modest.

Learn strategies to get a landlord to approve your apartment rental »

What is a good credit score?

You know your credit score is bad. But what will it take for it to be good again? Looking at the five main components of your score again will guide you toward improvement.

Learn when your credit score will be considered “good” »

How long does it take to go from good credit to bad credit?

The answer to this question depends on the method you take to raise your score and what’s contributing to your bad score. If mistakes in your credit report are hurting your score, then you could see your score improve in the next 30 days if you use a credit repair service. On the other hand, if your credit score is low because of run of missed payments, then it will take time and making all your payments on time to improve it. This will take longer. In most cases though, a combination of credit repair and using techniques to build credit should start showing results in 6 months to a year.

Read more about how long credit repair takes »

How long does it take to clear a bad credit history?

Even if you raise your credit score, your credit report may reveal a troubled history. Many negative items will stay on your credit report for seven years or more. However, the “weight” of these negative items decreases over time. So, even before a penalty expires, it will have less and less of an impact on your score.

Compare how long different things will stay on your credit report »