During the holidays, Americans give gifts to others — while gifting themselves with debt.

The national average holiday debt last year increased to $1,230 from 2017’s $1,054 — and 68 percent of those surveyed used credit cards, a Magnify Money survey found.[1] But using a credit card for your holiday shopping can help you during your sprees if you play your cards right, literally.

People resorting to credit cards almost exclusively during the holidays can result in extra debt that you can avoid. Here are a few credit card tips that will help you stay out of debt this holiday season…

Avoid store credit cards

Store credit cards make money for the store because they finance your purchases at significant interest rates. To encourage the greatest number of customers to make the most purchases, these store cards have fairly low qualifications.

Shoppers will typically qualify with average or even slightly below-average credit scores. So naturally, any card designed for those with mediocre credit will have high interest rates and less competitive terms.

They’ve got higher interest rates than regular credit cards and the rewards aren’t better. Unless you’re planning on shopping at the store frequently, you won’t actually save as much money as they tend to offer.

Finally, consider this: The check-out line is the last place you should be making important financial decisions. Shoppers should take the time to research the store’s credit card options at home — before going out to the store.

Read about: Things to Know Before Getting a Retail Credit Card

Treat yourself (with rewards)

Instead of buying a gift for yourself this holiday season like you were already planning on doing, maybe try to just earn some rewards while you’re shopping for others instead.

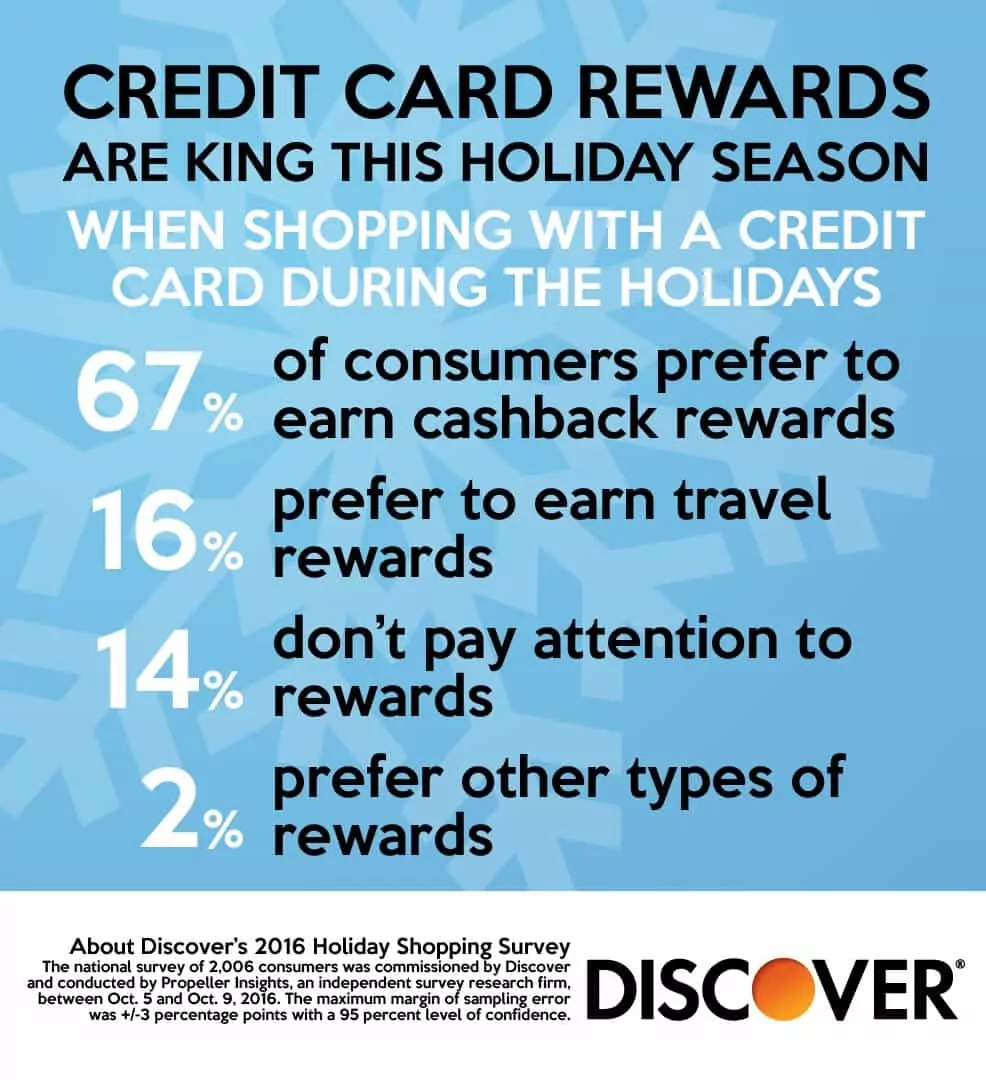

It turns out that 38 percent of Americans will charge their holiday purchases to a credit card, and almost half of those said it’s to earn rewards, according to a survey from Discover.[2]

Two-thirds of the survey say they are using credit cards to earn cash back during their holiday shopping. Sixteen percent are looking for travel rewards.

Perks and convenience seem to be part of the shopping plan. Almost half of the survey respondents say they plan to do most of their holiday shopping online this year.

Read more: Are Rewards Cards Rigged?

Stick to your budget

One of the reasons Americans’ debt increases every year is they don’t stick to a budget. Your budget, even if you break it, can hold you accountable when you walk into the store.

Nearly half of Americans felt pressured to spend more than they were comfortable with last year, a survey from Bankrate found.[3] Experts said that the reason for this was likely people striving to exceed others’ gift expectations.

“If you’re overspending to try and maintain a certain quality to a friendship or family relationship, then that’s not sustainable,” Mark Hamrick, a senior economic analyst at Bankrate, says. “Ultimately, if someone’s world is grounded in something that’s counter to the true spirit of the holidays, then there probably needs to be a reckoning for everybody.”

Since most Americans use credit cards for holiday shopping, budgeting will help you minimize your debt while preventing surprise expenses from being thrown at you. If you do your homework and create a list outlining what you’re buying and for who, you’re less likely to overspend than those who wing it.

If you stick to your budget, make your credit card payments before interest piles on. Over half of Americans that Bankrate surveyed said that their holiday debt would take over five months to pay off. To avoid having that month-long burden just because of the holidays, double-think before you impulse buy.

Learn: How to Make a Holiday Budget

Find the best offers

There are dozens of tools and alerts that let you compare prices from retailers during the holiday season. Take advantage of Black Friday deals instead of waiting until the last minute — this will be easier if you budget.

Skim through retailers’ policies. Most have price-matching policies for both online and in-store — which will save you even more money.

Getting a head start before Black Friday will also allow you time to do some research on the product you’re buying — especially if you’re buying yourself something you’ll use for years, like a phone or TV. If you find a product that’s narrowly below its competitors’ average prices, look into its reviews. Then, see if the $50 you save for a product you’ll hang on to for a while is worth the few dollars.

Or, just save big using Debt.com’s cheap, lazy gift guide for the holidays.

Talk to a debt relief specialist to find the best way to pay off credit card debt.

Kristen Grau contributed to this report.

Source:

2. https://investorrelations.discover.com/ – ‘Tis the Season to Earn When It Comes to Credit Card Rewards

3. https://www.bankrate.com – Gift-giving guilt: Nearly half of Americans have felt pressured to overspend during the holidays