Everything Auto

Learn how to buy, lease, refinance, and manage auto loan debt effectively.

As debt goes, auto loans tend to be much less of a hassle than other debts like credit cards and student loans. But you still want to put as much thought and consideration into a car or truck purchase as possible, especially if you’ll be financing the purchase. That way, you can ensure every vehicle you buy will fit your budget and auto loan debt won’t become a problem down the road.

The guides below can help you understand every aspect of the car buying process. You can learn how to get the best auto loan for your needs and budget. You’ll also get helpful information to compare leasing versus buying, and details on how to refinance the right way.

Car Buying Guides

How to Buy a Car

Read more

Buying a Used Car

Read more

The Best Time to Buy

Read more

Saving Up for a Car

Read More

Buying with Bad Credit

Read more

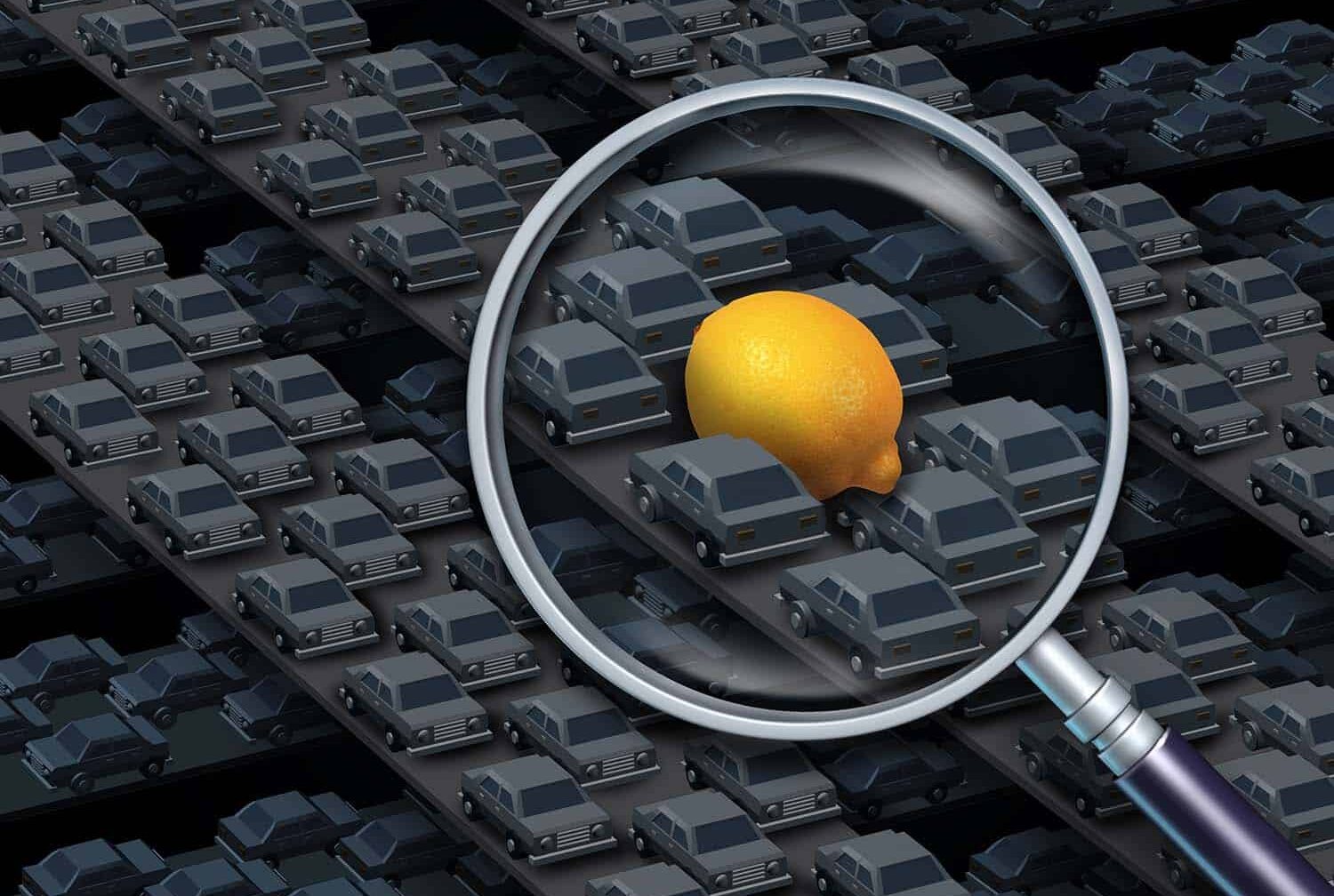

Lemon Laws

Read more

Auto Loan Guides

Auto Loans

Read more

Auto Loan Refinancing

Read more

Leasing Guides

Leasing vs Buying

Read more

Lease Buyout

Read More