Americans are hurting both medically and financially. That’s the result of Debt.com’s annual medical debt survey.

The latest poll of 1,000 U.S. adults reveals an alarming increase in the number struggling to pay medical bills and putting off seeing the doctor because of it. Here are three of the biggest takeaways from the research:

- This year, 67% reported that “inflation made it harder to pay medical bills.” That’s a significant jump from 57% the year before.

- Nearly a third (32%) said their medical bills were in collections this year. Last year, it was only 28%.

- Most concerning of all: 34% admitted they have been “avoiding medical care because of debt” – up from 28% in 2022.

“Inflation may be subsiding, but the damage it wrought will stay with us for a long time,” says Debt.com president Don Silvestri. “Medical debt was a growing problem before inflation, even before the pandemic. Now it’s becoming a crisis.”

More say inflation is making it harder to pay their medical bills

More have had medical bills sent to collections

More avoid medical care because of their debt

Simple doctors visits are the primary source of medical debt for most respondents

More than 3 in 10 owe over $1,000 in medical debt

| Do you have outstanding medical bills or medical debt? | Percentage of respondents |

|---|---|

| Yes | 49.50% |

| No | 50.50% |

| Have your medical bills been sent to collections? | Percentage of respondents |

|---|---|

| Yes | 31.54% |

| No | 56.39% |

| Unsure | 12.08% |

| How much do you owe? | Percentage of respondents |

|---|---|

| Less than $500 | 55.69% |

| $500 to $1,000 | 11.68% |

| $1,001 to $5,000 | 15.37% |

| $5,001 to $10,000 | 6.29% |

| $10,001 to $50,000 | 4.59% |

| $50,001 to $100,000 | 2.20% |

| $100,001 to $150,000 | 2.59% |

| More than $150,000 | 1.60% |

| Have you been avoiding medical care because of your debt? | Yes | No |

|---|---|---|

| Percentage of respondents | 33.63% | 66.37% |

| What type of health insurance do you have? | Percentage of respondents |

|---|---|

| Employer-provided | 45.41% |

| Medicare or Medicaid | 38.62% |

| Self-purchased through an exchange | 8.78% |

| None | 7.19% |

| What is the primary source of your medical debt? | Percentage of respondents |

|---|---|

| Diagnostic tests | 15.47% |

| Hospitalization | 16.87% |

| Emergency room | 16.67% |

| Outpatient services | 10.18% |

| Doctor visits | 21.06% |

| Dental care | 10.98% |

| Prescription drugs | 7.49% |

| Nursing home/long-term care | 1.30% |

| Has inflation made it harder to pay your medical bills? | Yes | No |

|---|---|---|

| Percentage of respondents | 66.97% | 33.03% |

| How did your insurance company respond to your medical bills? | Percentage of respondents who budget |

|---|---|

| Told me I received out-of-network care | 22.26% |

| Denied my claim | 14.47% |

| Other – N/A | 63.27% |

| Have you tried negotiating to lower the cost of your bills? | Percentage of respondents who budget |

|---|---|

| Yes, I tried to negotiate on my own | 29.64% |

| Yes, I used a medical bills advocate | 11.08% |

| No | 59.28% |

| Were you successful in this negotiation? | Yes | No |

|---|---|---|

| Percentage of respondents | 31.24% | 68.76% |

| Are you currently on a payment plan? | Yes | No |

|---|---|---|

| Percentage of respondents | 35.53% | 64.47% |

For the third year in a row, Debt.com polled over 500 Americans about their medical debt. Respondents owe significantly less this year but are struggling to pay off even the smallest bills.

Nearly 6 in 10 agreed that “inflation has made it harder to pay my medical bills.” Now, over a quarter say that they’re skipping medical care because of their debt.

“We tend to think of inflation as annoying instead of dangerous,” Debt.com President Don Silvestri says. “But inflation means more than higher food and gas prices. It pervades everything we spend money on – including our physical health.”

Americans owe less than they did last year – 80 percent owed over $500, in 2022 only 40 percent owe as much. In fact, most respondents (59 percent) owe less than $500. This may sound like good news, but there’s a sad reason behind it.

Respondents are struggling twice as much to pay for basic medical care and are taking on debt for things like doctor’s visits and prescription medication.

Over a quarter of Americans are now skipping out on care because of their medical debt.

Below are more key findings from Debt.com’s research…

Over 4 in 10 have outstanding medical bills

More than a quarter have had their medical bills sent to collections

Americans are avoiding medical care because of their debt

Inflation has made it harder for most Americans to pay off their medical debt

Most adults are not on a payment plan

| Do you have outstanding medical bills or medical debt? | Percentage of respondents |

|---|---|

| Yes | 44.46% |

| No | 55.54% |

| Have your medical bills been sent to collections | Percentage of respondents |

|---|---|

| Yes | 28.41% |

| No | 61.44% |

| Unsure | 10.15% |

| How much do you owe? | Percentage of respondents |

|---|---|

| Less than $500 | 59.23% |

| $500 to $1,000 | 33.21% |

| $1,001 to $5,000 | 15.68% |

| $5,001 to $10,000 | 5.35% |

| $10,001 to $50,000 | 2.95% |

| $50,001 to $100,000 | 2.03% |

| $100,001 to $150,000 | 0.92% |

| More than $150,000 | 1.11% |

| Have you been avoiding medical care because of your debt? | Percentage of respondents |

|---|---|

| Yes | 27.68% |

| No | 72.32% |

| What type of health insurance do you have? | Percentage of respondents |

|---|---|

| Employer-provided | 45.94% |

| Medicare or Medicaid | 36.90% |

| Self-purchased through an exchange | 10.89% |

| None | 6.27% |

| What is the primary source of your medical debt? | Percentage of respondents |

|---|---|

| Diagnostic tests | 15.68% |

| Hospitalization | 14.02% |

| Emergency room | 15.68% |

| Outpatient services | 11.07% |

| Doctor visits | 21.22% |

| Dental care | 11.25% |

| Prescription drugs | 9.23% |

| Nursing home/long-term care | 1.85% |

| Has inflation made it harder to pay your medical bills? | Percentage of respondents |

|---|---|

| Yes | 57.38% |

| No | 42.62% |

| How did your insurance company respond to your medical bills? | Percentage of respondents |

|---|---|

| Told me I received out-of-network care | 21.22% |

| Denied my claim | 10.70% |

| Other – N/A | 68.08% |

| Have you tried negotiating to lower the cost of your bills? | Percentage of respondents |

|---|---|

| Yes, I tried to negotiate on my own | 26.38% |

| Yes, I used a medical bills advocate | 8.12% |

| No | 65.50% |

| Were you successful in this negotiation? | Percentage of respondents |

|---|---|

| Yes | 26.20% |

| No | 73.80% |

| Are you currently on a payment plan? | Percentage of respondents |

|---|---|

| Yes | 29.15% |

| No | 70.85% |

The finances of many Americans are so fragile, even a few thousand dollars in medical expenses can drive them from the doctor to the debt collector.

During the peak of the pandemic last year, Debt.com conducted its first-ever medical debt survey. Only 15 months apart, the results changed significantly.

In 2020, just under half (46 percent) of Americans said they had medical debt. This year? It’s up to an even 50 percent.

The number of Americans who had medical debt in collections dropped a full 10 percent over the past year – from 56 percent in 2020 to 46 percent this year.

The pandemic may have reshaped the world but one fact remains: Americans struggle to pay medical bills.

“Long after this awful pandemic finally ends, medical debt will still be here,” says Don Silvestri, president of Debt.com. “There’s no easy vaccine for medical debt. It will take help from federal and state lawmakers, and more education for consumers.”

Below are the biggest year-over-year changes Debt.com found quizzing Americans on their medical debt…

Do you have outstanding medical bills or medical debt?

Have your medical bills been sent to collections?

Were you successful negotiating your debt?

How much do you owe in medical debt?

What is the primary source of your medical bills?

| Do you have outstanding medical bills or medical debt? | Yes | No |

|---|---|---|

| Percentage of respondents | 50.09% | 49.91% |

| Have your medical bills been sent to collections? | Yes | No | Unsure |

|---|---|---|---|

| Percentage of respondents | 45.86% | 39.47% | 14.67% |

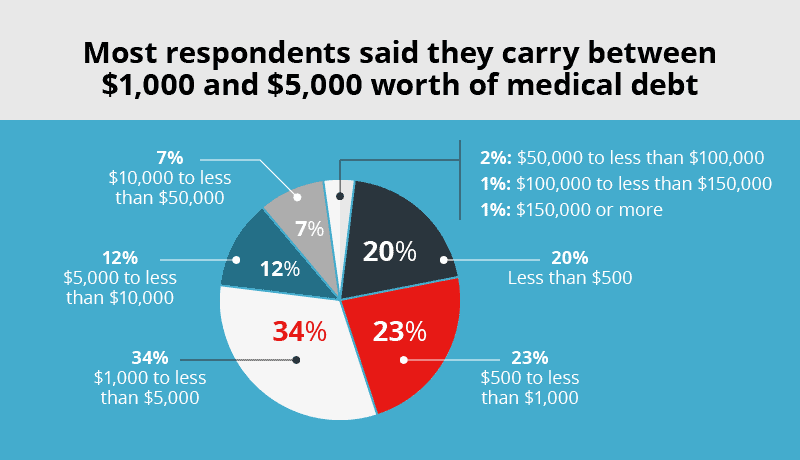

| How much do you owe? | Percentage of respondents |

|---|---|

| Less than $500 | 20% |

| $500 to less than $1,000 | 23.26% |

| $1,000 to less than $5,000 | 33.72% |

| $5,000 to less than $10,000 | 12.02% |

| $10,000 to less than $50,000 | 6.9% |

| $50,000 to less than $100,000 | 1.94% |

| $100,000 to less than $150,000 | 1% |

| $150,000 or more | 1.16% |

| What type of health insurance do you have? | Percentage of respondents |

|---|---|

| Employer-provided | 37.65% |

| Medicare or Medicaid | 45.88% |

| Self-purchased through an exchange | 11.76% |

| None | 4.71% |

| What is the primary source of your medical debt? | Percentage of respondents |

|---|---|

| Diagnostic tests | 23.77% |

| Hospitalization | 18.33% |

| Emergency room | 18.56% |

| Outpatient services | 15.16% |

| Doctor visits | 13.11% |

| Dental care | 6.15% |

| Prescription drugs | 4.10% |

| Nursing home/long-term care | 0.82% |

| How did your insurance company respond to your medical bills? | Told me I received out-of-network care | Denied my claim | Other |

|---|---|---|---|

| Percentage of respondents | 14.54% | 13.22% | 72.24% |

| Have you tried negotiating to lower the cost of your bills? | No | Yes, I tried to negotiate on my own | Yes, I used a medical bills advocate |

|---|---|---|---|

| Percentage of respondents | 60.43% | 35.32% | 4.25% |

| Were you successful in this negotiation? | Yes | No |

|---|---|---|

| Percentage of respondents | 34.04% | 65.96% |

| Are you currently on a payment plan? | Yes | No |

|---|---|---|

| Percentage of respondents | 34.63% | 65.37% |

Methodology: Debt.com surveyed 541 people and asked nine questions related to their medical debt. People responded from all 50 states and Washington, DC and were aged 18 and above. Responses were collected through SurveyMonkey. The survey was conducted from Sept. 7, 2021 to Sept. 28, 2021.

| Do you have outstanding medical bills or medical debt? | Yes | No |

|---|---|---|

| Percentage of respondents | 45.87% | 54.13% |

| Have your medical bills been sent to collections? | Yes | No | Unsure |

|---|---|---|---|

| Percentage of respondents | 56.16% | 30.78% | 13.06% |

| How much do you owe? | Percentage of respondents |

|---|---|

| Less than $500 | 13.77% |

| $500 to less than $1,000 | 18.55% |

| $1,000 to less than $5,000 | 31.93% |

| $5,000 to less than $10,000 | 14.91% |

| $10,000 to less than $50,000 | 15.30% |

| $50,000 to less than $100,000 | 3.06% |

| $100,000 to less than $150,000 | 0.96% |

| $150,000 or more | 1.53% |

| What type of health insurance do you have? | Percentage of respondents |

|---|---|

| Employer-provided | 43.13% |

| Medicare or Medicaid | 36.17% |

| Self-purchased through an exchange | 8.90% |

| None | 11.80% |

| What is the primary source of your medical debt? | Percentage of respondents |

|---|---|

| Hospitalization | 24.80% |

| Diagnostic tests | 21.68% |

| Emergency room | 18.95% |

| Doctor visits | 14.84% |

| Outpatient services | 10.94% |

| Dental care | 4.30% |

| Prescription drugs | 3.71% |

| Nursing home/long-term care | 0.78% |

| How did your insurance company respond to your medical bills? | Told me I received out-of-network care | Denied my claim |

|---|---|---|

| Percentage of respondents | 55.80% | 44.20% |

| Have you tried negotiating to lower the cost of your bills? | No | Yes, I tried to negotiate on my own | Yes, I used a medical bills advocate |

|---|---|---|---|

| Percentage of respondents | 60.52% | 34.55% | 4.94% |

| Were you successful in this negotiation? | Yes | No |

|---|---|---|

| Percentage of respondents | 27.47% | 72.53% |

Methodology: Debt.com surveyed 542 adults and asked 11 questions related to their medical debt. People responded from all 50 states and Washington, DC, and were aged 18 and above. Responses were collected through SurveyMonkey. The survey was conducted on September 2, 2022.

Methodology: Debt.com surveyed 1,000 adults and asked 11 questions related to their medical debt. People responded from all 50 states and Washington, DC, and were aged 18 and above. Responses were collected through SurveyMonkey. The survey was conducted on Aug. 30, 2023

FREE DEBT ANALYSIS

Contact us at (844) 845-4219

What can we help you with?