For the third consecutive year, Debt.com has polled 500 divorcees on how their debt weighed in on their decision to break up. One-third say credit card debt and spending was “a factor in their divorce.”

But debt may not be the sole reason. Just under 7 in 10 of those respondents say they or their spouse hid credit card debt.

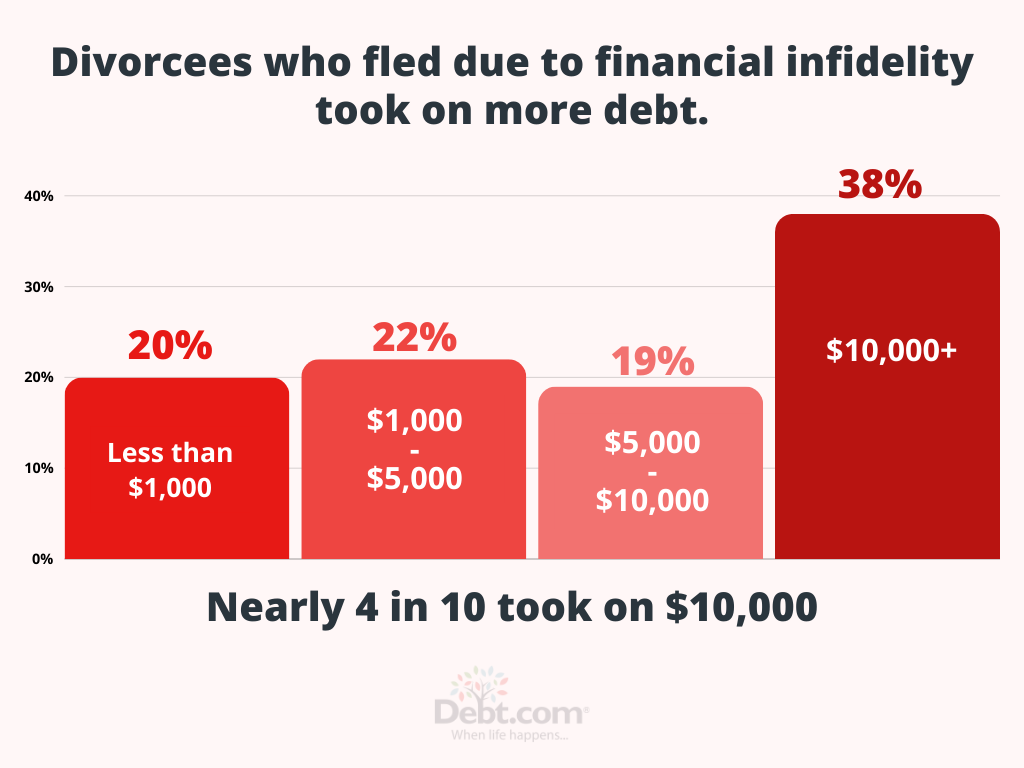

For many of them, getting away from the unagreed-upon debt led to even more.

Those who said “credit card debt was a reason for their divorce” took on significantly more debt following their divorce: 22% say they took on $15,000-$20,000 due to breaking up. Only 15% of all respondents said the same.

Key findings

- 1 in 3 (34%) say credit card and spending was a factor in their divorce. That includes 4 in 10 (41%) Millennials and 1 in 4 (26%) of Gen Xers – 31% are women and 40% are men.

- More than half (51%) said they took on debt following their divorce. That includes 33% men and 67% women.

- Nearly 1 in 4 (24%) say they took on between $15,000 and $20,000 worth of debt. Of those respondents, 1 in 3 (35%) are men and 3 in 5 (65%) are women.

- Over 1 in 4 (28%) respondents said their credit score decreased by more than 50 points as a result of their divorce. More women (64%) than men (36%) had damage to their credit.

- More than 1 in 3 (37%) now have sole responsibility for a debt they once shared with their partner. That includes 2 in 3 (66%) women and 1 in 3 (34%) men.

| Region | States (breakdown defined by the U.S. Census Bureau) |

| Middle Atlantic | New York, New Jersey, Pennsylvania, Delaware, Maryland |

| Pacific | California, Oregon, Washington, Alaska, Hawaii |

| South Atlantic | Florida, Georgia, North Carolina, South Carolina, Virginia, West Virginia, District of Columbia |

| East North Central | Illinois, Indiana, Michigan, Ohio, Wisconsin |

| West South Central | Arkansas, Louisiana, Oklahoma, Texas |

| Mountain | Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming |

| East South Central | Alabama, Kentucky, Mississippi, Tennessee |

| West North Central | Iowa, Kansas, Minnesota, Nebraska, North Dakota, South Dakota |

| New England | Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont |

Click here for full survey results

| Were debt or other financial difficulties the primary factors in your divorce | |

|---|---|

| Strongly agree | 12.02% |

| Agree | 20.23% |

| Neither agree nor disagree | 16.98% |

| Disagree | 22.90% |

| Strongly disagree | 27.86% |

| What financial difficulty(s) contributed to your divorce? | |

|---|---|

| Shopping | 12.98% |

| Going out to eat/drink too often | 22.71% |

| Disagreements on big purchases (i.e. cars, appliances, furniture, etc.) | 56.87% |

| Vacations | 7.44% |

| Was credit card debt and spending a factor in your divorce? | |

|---|---|

| Yes | 33.97% |

| No | 66.03% |

| Did you or your spouse hide credit card debt? | |

|---|---|

| Yes | 33.59% |

| No | 66.41% |

| Did you or your spouse hide spending? | |

|---|---|

| Yes | 53.82% |

| No | 46.18% |

| Did you take on debt following your divorce? | |

|---|---|

| Yes | 50.76% |

| No | 49.24% |

| How much additional debt did you incur as a result of your divorce? | |

|---|---|

| Less than $1,000 | 41.03% |

| $1,001-$5,000 | 18.51% |

| $5,001-$10,000 | 14.50% |

| $10,001-$15,000 | 11.07% |

| $15,001-$20,000 | 14.89% |

| Did you and your spouse share a debt that is now only your responsibility? | |

|---|---|

| Yes | 37.02% |

| No | 62.98% |

| How much did your credit score change as a result of your divorce? | |

|---|---|

| Decreased by 50 points or less | 11.45% |

| Decreased by more than 50 points | 27.86% |

| Increased 50 points or less | 4.20% |

| Increased by more than 50 points | 7.44% |

| My credit score was unaffected | 23.85% |

| I don’t know | 25.19% |

| Did you consider separation instead of divorce as a way to save money and avoid the cost of divorce and debt? | |

|---|---|

| Yes | 25.95% |

| No | 74.05% |

| Were debt or other financial difficulties the primary factors in your divorce? | Percentage of respondents |

|---|---|

| Strongly agree | 15.02% |

| Agree | 24.90% |

| Neither agree nor disagree | 18.63% |

| Disagree | 19.58% |

| Strongly disagree | 21.86% |

| What financial difficulty(s) contributed to your divorce? | Percentage of respondents |

|---|---|

| Shopping | 10.41% |

| Going out to eat/drink too often | 14.90% |

| Vacations | 4.08% |

| Credit card debt | 28.98% |

| Did you or your spouse hide credit card debt? | Percentage of respondents |

|---|---|

| Yes | 36.12% |

| No | 63.88% |

| Did you or your spouse hide spending? | Percentage of respondents |

|---|---|

| Yes | 53.99% |

| No | 46.01% |

| Did you take on debt following your divorce? | Percentage of respondents |

|---|---|

| Yes | 58.75% |

| No | 41.25% |

| How much additional debt did you incur as a result of your divorce? | Percentage of respondents |

|---|---|

| Less than $1,000 | 36.69% |

| $1,000-$5,000 | 22.05% |

| $5,001-$10,000 | 18.25% |

| $10,001-$15,000 | 11.41% |

| $15,001-$20,000 | 11.60% |

| Did you and your spouse share a debt that is now your responsibility? | Percentage of respondents |

|---|---|

| Yes | 42.78% |

| No | 57.22% |

| How much did your credit score change as a result of your divorce? | Percentage of respondents |

|---|---|

| Decreased by 50 points or less | 11.79% |

| Decreased by more than 50 points | 27.76% |

| Increased 50 points or less | 5.70% |

| Increased by more than 50 points | 9.13% |

| My credit score was unaffected | 13.50% |

| I don’t know | 32.13% |

| Who had a higher credit score prior to the divorce? | Percentage of respondents |

|---|---|

| Me | 54.94% |

| My spouse | 18.44% |

| Unknown | 26.62% |

| Who had a higher credit score following the divorce? | Percentage of respondents |

|---|---|

| Me | 40.68% |

| My spouse | 23.38% |

| Unknown | 35.93% |

| Did you consider separation instead of divorce as a way to save money and avoid the cost of divorce and debt? | Percentage of respondents |

|---|---|

| Yes | 29.47% |

| No | 70.53% |

For many survey respondents, their debts reached more than $5,000 – and their credit scores dropped by more than 50 points.

Debt.com and DivorceMag.com partnered to ask Americans how divorce impacts their finances. After surveying more than 500 divorcees, we’ve determined that debt and financial disagreements can certainly lead to unhappiness in marriage – but it’s not why most break their vows.

One-third of divorced couples say financial problems were not a contributing factor to their split. However, nearly two-thirds reported they took on debt after their divorce was finalized.

More than half of survey respondents said their debts reached more than $5,000. And nearly 15 percent said their debts amassed over $25,000.

Taking on more debt meant taking a hit to their credit score. More than 4 in 10 said their divorce sunk their credit by at least 50 points.

- Decreased 50 points or less: 13%

- Decreased more than 50 points: 32%

- Increased 50 points or less: 4%

- Increased more than 50 points: 6%

“It doesn’t matter how much you earn, couples will fight about money. It doesn’t matter how much you have, divorce will cost you money,” says Debt.com president Don Silvestri. “We already knew this from our seven years of helping Americans get out of debt. But those high numbers were a little surprising – and depressing.”

Most respondents said financial difficulties did not contribute to their divorce

2 in 3 said they took on debt following their divorce

Divorce caused more than half of respondents to take on over $5,000 worth of debt

3 in 10 said their credit score dropped by more than 50 points as a result of their divorce

4 in 10 shared a debt with their former spouse that’s now theirs alone

| Were debt or other financial difficulties the primary factors in your divorce? | Percentage of respondents |

|---|---|

| Strongly agree | 12.28% |

| Agree | 20.86% |

| Neither agree nor disagree | 14.62% |

| Disagree | 24.95% |

| Strongly disagree | 27.29% |

| Did any financial problems during the pandemic contribute to your divorce? | Percentage of respondents |

|---|---|

| Strongly agree | 3.70% |

| Agree | 10.33% |

| Neither agree nor disagree | 10.92% |

| Disagree | 23.00% |

| Strongly disagree | 52.05% |

| Did you take on debt following your divorce? | Percentage of respondents |

|---|---|

| Yes | 62.96% |

| No | 37.04% |

| How much additional debt did you incur as a result of your divorce? | Percentage of respondents |

|---|---|

| Less than $1,000 | 29.24% |

| $1,000-$5,000 | 17.35% |

| $5,001-$10,000 | 15.79% |

| $10,001-$15,000 point drop | 12.09% |

| $15,001-$20,000 | 7.02% |

| $20,001-$25,000 | 4.09% |

| More than $25,000 | 14.42% |

| Did you and your spouse share a debt that is now your responsibility? | Percentage of respondents |

|---|---|

| Yes | 40.94% |

| No | 59.06% |

| How much did your credit score change as a result of your divorce? | Percentage of respondents |

|---|---|

| Decreased 50 points or less | 12.87% |

| Decreased more than 50 points | 31.77% |

| Increased 50 points or less | 3.90% |

| Increased more than 50 points | 5.65% |

| My credit score was unaffected by my divorce | 19.69% |

| I don’t know | 26.12% |

| Did you consider separation instead of divorce as a way to avoid incurring debt? | Percentage of respondents |

|---|---|

| Yes | 20.47% |

| No | 79.53% |

| Household Income | Percentage of respondents |

|---|---|

| $0-$9,999 | 6.29% |

| $10,000-$24,999 point drop | 10.02% |

| $25,000-$49,999 point drop | 22.24% |

| $50,000-$74,999 | 22.24% |

| $50,000-$74,999 | 18.65% |

| $75,000-$99,999 | 13.24% |

| $100,000-$124,999 | 7.61% |

| $125,000-$149,999 | 4.46% |

| $150,000-$174,999 | 2.12% |

| $175,000-$199,999 | 1.39% |

| $200,000+ | 4.02% |

| Prefer not to answer | 9.95% |

Methodology: Debt.com and DivorceMag.com surveyed more than 500 divorced Americans and asked nine questions related to how divorce impacted their finances. People responded from all 50 states and Washington, DC and were aged 18 and above. Responses were collected through SurveyMonkey. The survey was conducted from Jan. 28, 2022 to March 30, 2022. Percentages were rounded up to the nearest whole number and might not total 100 percent.

Most survey respondents told us that debt and financial difficulties were not a factor in their divorce.

| Response | Percentage of Respondents |

|---|---|

| Strongly Disagree | 26.01% |

| Somewhat Disagree | 12.12% |

| Disagree | 22.98% |

| Somewhat Agree | 24.24% |

| Agree | 6.44% |

| Strongly Agree | 8.21% |

All respondents to our survey told us they took on debt following their divorce – and the majority (40%) said it was more than $5,000.

| Response | Percentage of Respondents |

|---|---|

| More than $5,000 | 39.90% |

| Less than $1,000 | 29.42% |

| Between $1,000 and $5,000 | 30.68% |

When asked if they took on sole responsibility for a shared debt following divorce, respondents were near-split. Most respondents (57%) didn’t – but close to half (43%) did.

| Response | Percentage of Respondents |

|---|---|

| No | 56.57% |

| Yes | 43.43% |

Most respondents (38%) said their credit score dropped more than 50 points.

| Response | Percentage of Respondents |

|---|---|

| Decreased more than 50 points | 37.75% |

| I don’t know | 29.67% |

| My credit score was unaffected by my divorce | 16.54% |

| Decreased 50 points or less | 10.35% |

| Increased more than 50 points | 4.04% |

| Increased 50 points or less | 1.64% |

Most divorced respondents told us they “never considered separation” rather than filing for divorce.

| Response | Percentage of Respondents |

|---|---|

| No | 88.01% |

| Yes | 11.99% |

Methodology: Debt.com and Moneywise.com surveyed 2,700 Americans through online platform SurveyMonkey between Nov. 1, 2019 and Dec. 29, 2019 – but only sourced data from about 800 Americans who have been through a divorce. Moneywise.com is a personal finance website affiliated with Wise Publishing headquartered in Toronto Canada.

Methodology: Debt.com surveyed 526 adults and asked 11 questions about their divorce. People responded from all 50 states and Washington, DC, and were aged 18 and above. Responses were collected through SurveyMonkey. The survey was conducted on January 31, 2024.