Back-to-school shopping season is here again, and consumers expect to spend an average of nearly $674 this year. That’s according to the National Retail Federation’s annual survey, and up $44 from last year.

It’s part of a zig-zag trend the NRF has noticed: Parents try to squeeze an extra year out of more durable (and expensive) stuff like backpacks and computers, but end up forking out more the following year. One thing’s for sure, though — that zig-zag never trends down.

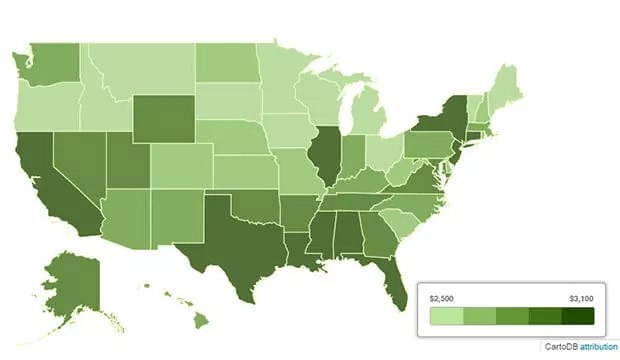

That makes it extra important to take advantage of the savings available on a sales tax holiday. Many states don’t charge any sales tax for a weekend or longer on certain school supplies. Dates and rules vary, so we’ve summed it all up in an interactive map sourced from state revenue departments. You can check that out below.

Five lucky states have no sales tax year-round: Alaska, Delaware, Montana, New Hampshire, and Oregon. Louisiana is an interesting case, too — they drop sales tax on nearly any “tangible personal property,” not just school supplies. But they only lower it from 5 percent to 3 percent, instead of zero like most states.