There’s more than one way to get out of credit card debt. Finding the best way depends on how much you owe, your credit score, and how long you’ve been a good customer.

You can find out what the best way is for you in only three minutes! Check out Instant Debt Advisor℠. It’ll ask you a series of questions to narrow down what kind of debt solution you need for your credit card debt – not what works for anyone else. It’s free, won’t impact your credit, and you’re in the driver seat of your debt-free journey.

This comprehensive guide to getting rid of credit card debt covers everything. So you can check your work with Instant Debt Advisor℠ to confirm you’ll get rid of your credit card debt once and for all.

What’s the best way to pay off credit card debt?

There are several different options for getting rid of credit card debt (more on that below)—some of which you might want to avoid. Each has its own strengths and weaknesses and will involve some sort of a trade-off. Getting out of debt quickly and with minimal out-of-pocket costs will mean more damage to your credit score. Some of the in-between methods require having a good credit score, while others require you to be at financial rock bottom.

Figuring out which approach to use boils down to these main factors:

- The amount of debt you have

- Your timeline (how quickly you want to get out of debt)

- How much damage to your credit you’re willing to take

Learn the different ways to pay off Credit Card Debt »

5 types of credit card debt relief options

Debt relief refers to any solution that allows you to pay off debt more efficiently when traditional monthly payments aren’t working. From DIY credit card debt solutions to hiring professionals to negotiate with credit card issuers on your behalf, there’s a range of options to choose from that can vary in terms of involvement, how much is paid back, and damage to your credit score.

1. Do-it-yourself approach

There are several ways that you can try your hand at getting out of debt without professional assistance. Most of them involve taking out new financing, such as a debt consolidation loan or balance transfer credit card. The other options include negotiating with credit card issuers individually to work out a repayment solution such as a workout agreement (which is like a DIY debt management plan), deferment, forbearance, or even settlement.

To attempt any of the non-financing DIY methods, you’ll need to know how to negotiate with credit card issuers.

Ask for deferment: Credit card deferment allows you to skip payments without penalties. Interest charges and other fees may be waived as well. To qualify, you’ll need to prove you’re in financial hardship. Explain your situation and give a set time of when you will be able to resume repayments. Make sure the time frame is realistic to increase the odds that they’ll agree.

Ask for forbearance: Credit card forbearance may allow you to reduce your payments for a time with a temporary, modified payment plan, instead of pausing them outright. It will likely be referred to as a debt repayment plan by your credit card issuer. Be transparent about your financial struggles and explain what you are able to reasonably afford.

Ask for a workout agreement: A workout agreement or workout arrangement is a repayment plan that you set up with a creditor. The creditor will typically freeze your account, but in exchange, they reduce or eliminate your interest charges and help you by setting up an affordable payment plan.

It’s typically a last resort DIY option for accounts in default. This basically means your creditor will freeze your account, so you won’t be able to make new charges. In exchange, you’ll have your payments, interest, and penalties reduced or eliminated.

To use this option, your account needs to be with the original creditor. This method is best used when you’re several payments behind but your account has yet to be closed. This option is similar to a debt management program, except you set up a plan with each individual creditor. If you have more than one arrangement that you want to set up, this method can be time-consuming.

Settle on your own. Yes, you can make settlement offers to creditors on your own without the help of a settlement company. Basically, you negotiate with the creditor or collector to accept a percentage of what you owe instead of the total amount. If they agree, the remaining balance is discharged.

It may sound like an ideal scenario, but it can be tricky to achieve as an individual. Plus, there’s one major caveat. You’ll likely need to make a lump-sum payment to settle your debt. So unless you have a considerable chunk of change at your disposal, a settlement might not be feasible.

A settlement offer can occur in one of two ways. You reach out to the creditor first with your settlement offer. In this instance, you would write your offer in a formal letter. The other method of individual settlement is when the creditor or collector reaches out to you. They may call or send you a letter offering to discharge your balance for partial payment on your debt.

In this case, you can decide to accept the offer or make a counteroffer. During this negotiation, you can also try to negotiate a pay-for-delete if it’s a collection account or a re-aging if the account is still with the original creditor. However, be aware that these methods are not guaranteed. If a creditor or collector tries to get you to settle for a higher percentage in exchange for fixing your credit, make sure to get that agreement in writing first!

2. Balance Transfer

A balance transfer credit card allows you to transfer balances from your existing accounts to a new card that offers low or no APR on balance transfers. These cards often offer a 0% APR introductory rate when you first open the account, typically for 6-18 months. The extended time to pay off the transferred balance interest-free typically comes with a fee. Balance transfers are typically 3-5% of the total balance or a small base amount like $5 or $10.

This option works best if you have excellent credit and if you’ll be able to pay off the entirety of the balance before the end of the promotional 0% APR. If you don’t pay the balance in that timeframe, you’ll be right back where you started with a high-interest-rate credit card and a large amount of debt. This means you’ll need a reliable cash flow. If you’re short on cash (or it’s tied up paying debts elsewhere) this probably isn’t the best option for you.

If you still have a good credit score, there are two ways to find relief from credit card debt that involve new financing. You essentially take on a new debt that helps pay off your existing debts more efficiently. The key goal is to reduce or eliminate the APR applied to your total credit card balance.

3. Debt Consolidation

A debt consolidation loan is a personal loan that you take out with the intent of consolidating debt. This leaves only the loan to repay which can be beneficial as loans typically have much lower interest rates than credit cards. The better your credit score, the better your loan repayment terms. Additionally, there’s the benefit of fixed payments whereas most credit card APRs are variable and can fluctuate.

The debt consolidation strategy is recommended for those who owe $35,000 or less. Some lenders may have restrictions, such as requiring you to close your credit cards to secure the loan so be prepared to lose those lines of credit. Your credit score may take a significant hit, but it can save you a lot of money in the long run.

4. Credit counseling / Debt management plan

If you’ve exhausted all the do-it-yourself options and you are still having trouble paying off your debt, you may need to call in professionals. Professional help can often be the fastest, easiest, and most cost-effective means of eliminating credit card debt.

One of those options is not-for-profit credit counseling agencies which are government-regulated and operate solely to aid consumers. They can enroll you in a unique credit card debt solution known as a debt management program or (DMP). This program is a form of assisted debt consolidation but doesn’t require taking out a new loan.

Here’s how it works:

- A consumer credit counseling agency helps you set up a repayment plan that fits your budget.

- Then they negotiate with your creditors to reduce or eliminate interest charges and stop penalty fees.

- Once your creditors agree to receive payments through the program, your program starts.

- You make one payment to the credit counseling agency each month.

- Then they distribute the money to your creditors as agreed.

Unlike other types of consolidation, with a debt management program, you pay back everything you owe (because of this, many credit users who complete the program actually see improvements to their credit scores). The benefits of this strategy are that credit counselors work with credit card issuers and lenders to reduce or eliminate interest charges and fees. You can get out of debt faster with lower monthly payments and reduced damage to your credit score. You still owe your original creditors but are simply paying your creditors back in a more efficient and cost-effective way.

5. Debt settlement program

Debt settlement programs get you out of debt for only a percentage of the total that’s owed. It’s usually the quickest and cheapest option to eliminate debt and the closest to a credit card debt forgiveness program but it can do significant damage to your credit score.

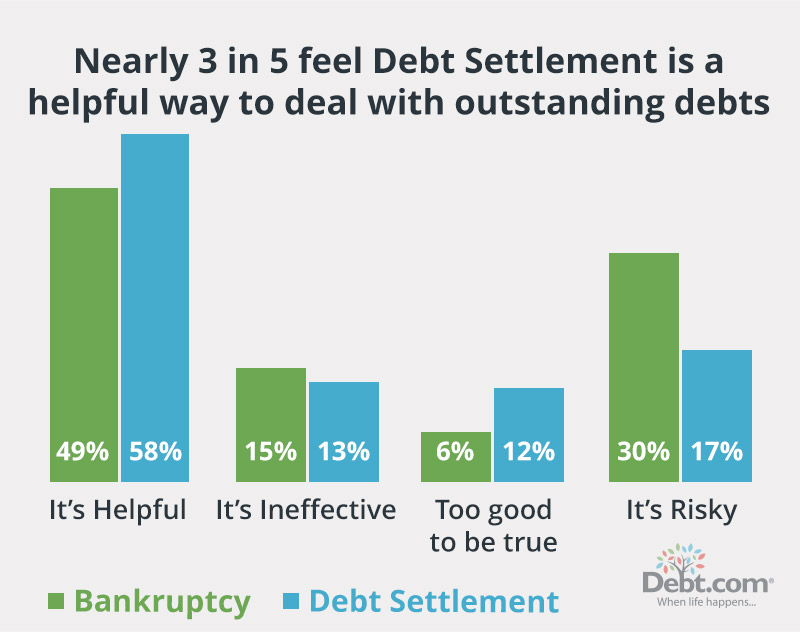

But so can other debt relief options. Of the available get-out-of-debt resources, a legitimate debt settlement program is one of the most helpful. Debt.com surveyed more than 1,000 Americans on how they felt about debt settlement and bankruptcy. More respondents found the former to be “helpful” and the latter to be “risky.”

This chart shows how they felt about each:

Here’s how professional debt settlement works:

- First, you and the debt settlement company will determine how much money you can contribute towards the lump sum settlement amount. That money will be set aside in a separate escrow account.

- Once you have enough funds, the settlement company reaches out to your creditors to negotiate settlements.

- They get each creditor to agree to accept a percentage of what you owe in exchange for discharging the remaining balance.

- Once your creditors agree to the settlement amount, the funds are taken out of your set aside account.

- From there, the creditor closes the account and discharges the remaining balance, and reports the settlement to the credit bureaus.

Working with a professional debt settlement company can greatly improve your odds of success (these companies likely already have relationships with your creditors), but there’s still the issue of needing a lump sum to actually settle the debt.

By law, settlement companies can only charge fees once they successfully reach a settlement in your favor. Most companies will charge you a percentage of the amount they save you.

Bad ideas for credit card debt relief

Not all credit card debt relief solutions are created equal! These bad ideas for debt relief put your finances on shaky ground and could make for a bumpy financial ride long-term.

1. Cashing out retirement savings and investments

You don’t just drain the funds you take out, you also lose out on the yield you would have received, putting you two steps back on saving for retirement.

In addition, retirement funds like a 401(k) and traditional IRA have early withdrawal penalties. If you take money out before you turn 59 ½ you’ll face a 10% charge on the funds. What’s more, you must pay taxes on the money withdrawn, since it counts as income.

These penalties and extra taxes don’t happen with a Roth IRA, but you’ll still be losing out on savings growth.

Is Using Your 401k or IRA to Pay Off Credit Card Debt a Bad Idea? »

2. Borrowing against your home

Credit card debt is unsecured, meaning there’s no collateral that secures the debt. Any option that taps home equity to get money, such as a home equity loan or cash-out refinance, is considered secured debt. If you borrow against your home equity to pay off credit card debt, you effectively convert unsecured debt to secured. If you default on the new debt, you could lose your home.

In general, you want to protect your home’s equity as much as possible. Borrowing against it is extremely risky, and it’s usually not worth that added risk to pay off your credit cards. Even if you default on a credit card and it goes to collections, they can’t take your home. In fact, they must sue you in civil court to force any kind of repayment. But once you take out an equity loan, your home is at risk of foreclosure if you fall behind with the payments.

Is Refinancing My Home to Pay Off Debts a Good Idea? »

3. Borrowing against a life insurance policy

If you have a life insurance policy that has cash value, then you can usually borrow against it. But just because you can doesn’t mean that you should. If you take money out, you effectively take out a loan against your insurance policy. You make a new debt with a whole new set of problems.

If you don’t pay the money back or die before it’s paid off, then the insurer will take out the amount owed plus interest. In other words, your family will have less life insurance to help them live after you’re gone. That money is there to provide your family with a financial safety net in case the worst happens. You don’t want to do anything that will weaken that safety net.

Should I Cash Out My Whole Life Insurance Policy to Pay Off Debt? »

4. Borrow money from family and friends

Unless you don’t mind losing a friend or making family gatherings extremely awkward, it’s best to avoid borrowing money from people you know. Approximately one-third of Americans already know this and reported that they would prefer to go into debt than borrow from loved ones.

Nearly half of Americans have lent money to a friend or loved one and over 1 in 4 regrets having done so.[1] One in three (35%) of combined borrowers and lenders report that money hurt their relationship:

- 14% say it caused hurt feelings

- 11% say it led to decreased contact

- 10% say it led to resentment

Borrowing money from someone you know rather than an institution can be a lot cheaper than going through with a formal loan, but it carries the risk of straining relationships.

How to avoid credit card debt

Trying to avoid credit card debt in the future? No need to cut up your credit cards and swear off plastic for good. Credit cards can be extremely useful financial tools as long as you know how to use them. There are four key things to keep in mind when trying to use credit cards to your best advantage.

1. Get the right type of credit card

It can be daunting trying to figure out which type of credit card is best suited to your needs. We’ll help break down the types of credit cards so you can have a better understanding of what you may be getting yourself into.

2. Open the right card at the right time

Don’t rush into a decision. Take your time and examine all your options before you pick a card. Whether you need a card to help rebuild your credit or a card that has a promotional 0% APR, or one that earns rewards, make sure it fits your specific needs. From there, you’ll narrow down your choices and decide between no more than two or three similar cards.

The credit card you choose should help you achieve your financial goals. So, don’t settle for less, but don’t shoot for the stars either. Find a balance that works for your lifestyle.

3. Negotiate lower interest rates

Negotiating lower interest rates is an art form in and of itself. It takes skill, knowledge, and a lot of patience. But the end game is worth the effort since your reward comes in the form of lower interest rates and lower monthly payments. You may even be able to get a reduction on the time it takes you to pay off your creditor.

4. Always pay the statement balance in full

The most surefire way to avoid credit card debt is to pay the statement balance (not the minimum balance) when the regular purchase APR is applied. If your financial situation allows, set up credit card auto payments and select to automatically pay the statement balance. The next best option is to set up automatic minimum payments and then make an additional payment within 30 days of your due date to pay off the remaining monthly balance. If you have a zero-percent APR offer active, all you technically need to pay is the minimum monthly payment. However, you should plan on paying off the entire balance by the end of that promotional period.

How credit card debt will affect your…

You may feel like you have your credit card debt under control but it could be costing you in more ways than you think, slowly but surely chipping away at your financial health.

Credit score

Credit card debt can directly contribute to a lower credit score because it affects what’s known as credit utilization rate. Also sometimes referred to as debt-to-credit ratio, your credit utilization rate is a percentage that shows how much of your available credit is being used. It makes up 30% of FICO scores and is second only to payment history (which is obviously a huge deal to potential lenders).

The general rule of thumb is to keep your total credit usage below 30% but the lower it is, the better. A high credit utilization rate signals a greater reliance on credit which, to lenders, can indicate that you don’t have enough cash to pay for expenses and could have difficulty repaying what you owe.

Your credit card balance can indirectly make it more difficult to get approved for loans or other lines of credit and to get the best interest rates. Higher interest rates can mean more fees, more debt, and more negative remarks on your credit. It’s a vicious cycle.

Debt-to-income ratio (DTI)

Credit card debt can also drive up your debt-to-income ratio, something prospective homeowners will want to pay close attention to. This number is a percentage that reflects how much of your income goes towards paying your debt and is of particular importance to mortgage lenders. They like to see low DTIs which indicate that you have enough disposable income to cover your debts even if an unexpected expense arises (like going to the emergency room or having to take your car to the mechanic).

Say you make $5,000 a month but have $3,000 in collective monthly minimum payments to make. Your DTI would come out to 60%, showing that more than half of your monthly income goes towards bills. The higher your credit card balance, the higher your minimum credit card payment is going to be, meaning a higher DTI.

Personal relationships

Unpaid IOUs to credit card issuers can end up both directly and indirectly affecting your family. Spouses, children, or parents can find themselves saddled with lawsuits and bills.

Have you ever thought about what happens to credit card debt when you die? In community property states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin), spouses can be held liable for the credit card debt of the deceased.

Children usually aren’t held directly responsible for a deceased parent’s debt unless they’re joint account owners. However, creditors can, and often do, go after the deceased’s estate which can detract from their inheritance. There are also bad apples that may pressure the child into paying off this debt even if they’re not legally liable.

What happens if you don’t pay your credit card bill?

Failing to pay your credit card bill is never a good idea. It can result in a slew of unpleasant side effects ranging from mildly inconvenient to majorly damaging your credit score.

If you’re having trouble making your payments or think that you might in the near future, contact your creditors as soon as possible (ideally before you miss your first payment). Being proactive and communicating with your creditors is much more effective than missing due dates and later trying to undo the damage and charges. You may be able to arrange deferment or forbearance to pause or reduce your payments while you get back on your feet. This will help you avoid credit damage and closed accounts.

Delinquency

The immediate consequence of not paying a credit card bill is that your account will be reported as delinquent, which is just a fancy term for being past due or overdue. It is in this stage that the initial penalties will be applied such as a late fee or penalty APR. Both of which can result in your remaining unpaid balance becoming even more expensive to carry.

Credit card issuers typically after 30 days report delinquent accounts to credit bureaus, although some will wait 60 days if this is your first time missing a payment. Once this negative remark hits your credit report you can expect your credit score to take a hit. Delinquency remains on credit histories for seven years. However, this can be avoided if you pay the past-due balance before the 30 days when it’s reported to credit bureaus.

Learn more about credit card delinquency »

Charge-offs

If your account continues to be delinquent and several months of missed payments go by, the next stage is a credit card charge-off. A charge-off is when a credit card company or lender closes an account as a result of nonpayment. Essentially, they write your account off as a loss because they no longer expect to receive any payments. This happens to accounts that have been delinquent for more than 180 days.

This may sound like you’re off the hook, but you still owe the full amount even once the account is written off and deemed uncollectable. Failure to pay could end up in legal action. However, in most instances when this occurs, it’s no longer the original lender you’ll owe money to. They may hire a collection agency or sell your debt to a collection agency.

A charged-off account can cause serious damage to your credit that can be hard to undo. The charge-off will result in another ding on your credit report on top of the months of delinquency. And like delinquency, a charge-off will stay on your report for up to seven years, even if it’s eventually paid off. With that in mind, debt negotiation is often your best bet. You can ask for debt forgiveness. However, creditors will rarely agree to forgive your balance outright with no payment in exchange.

Account levy

One of the most severe repercussions of not paying a credit card bill is an account levy. This is when a creditor seeks repayment by taking the funds directly from your accounts, usually a personal checking account. Credit card issuers must take you to court. If the court rules in their favor, then they can tap your accounts to withdraw your money directly. In addition to taking funds from an account, they can also garnish your wages (taking funds from a paycheck), force the sale of your property (including a home or car), or till tap to remove cash from your business’ cash register.

However, if you owe money on a credit card where a financial institution like a bank or credit union is the issuer of that credit card, they can bypass going to court and instead take money directly out of the checking or savings accounts you have with them. The exception is that you must have previously authorized that account to make automatic credit card payments.

Protections for consumers with credit card debt

Fortunately, there is legislation in place that protects consumers who are dealing with credit card debt. Keep these in mind when determining which strategy for getting out of debt is best for you. They’ll also help you identify if any debt collection methods you’re facing are being conducted legally.

Statute of limitations on credit card debt

The statute of limitations on debt is a protective measure for consumers that limits the window of time where a creditor (including debt collection agencies) could file a lawsuit against you to get the money you owe. Once the allowed timeframe has passed, typically 3-6 years, those debtors can no longer take you to court over the unpaid debt which becomes “time-barred”.

This statute applies to all types of debt such as mortgage debt, auto loan debt, medical debt, and private student loan debt in addition to credit card debt. The exact time frame can vary by state, as can the circumstances of when that countdown timer begins. Be mindful that making a payment (even a partial one) towards the overdue debt or even just acknowledging that you owe it can cause the timeframe to restart. Contact your state attorney general’s office to discover the specifics for your state.

Uniform Debt-Management Services Act

The Uniform Debt-Management Services Act was a federal law passed in 2005, which governs the credit counseling and debt management service industry. As a result of the act, credit counseling agencies must register as a consumer debt management service in each state where they operate. They must also provide full disclosures about their debt management plan and a penalty-free three-day cancellation policy.

Credit Card Debt Relief Act of 2010

In 2010, the Federal Trade Commission stepped in to regulate debt settlement companies. The main part of this legislation focused on creating what’s known as an advance-fee ban. This regulation prevents debt settlement companies from charging any fees up-front before they complete at least one settlement.

In the past, scammers would set up fake debt settlement companies, promising to help people get out of debt. They would charge setup fees that would be as high as 25-40% of the debt enrolled in some cases. They’d take the money and then disappear, leaving the consumer out the money for the fees without any settlements reached.

The Credit Card Debt Relief Act prevents this scam. Settlement companies cannot charge fees upfront without at least a money-back guarantee. They can only apply fees once they settle a debt on your behalf.

Government credit card debt relief programs

A common misconception is that there are federal credit card debt relief government programs that consumers can use to get out of debt. For the record, there are no grants or any federally sponsored repayment plans to pay off your credit card debts. That being said, the federal government does oversee and regulate the debt relief industry, which is where some of the confusion about government debt relief programs comes from.

Average credit card debt statistics

Americans collectively have $1.13 trillion in credit card debt. [2] These figures are likely to increase as plastic continues to grow as the preferred method for making purchases among U.S. consumers.

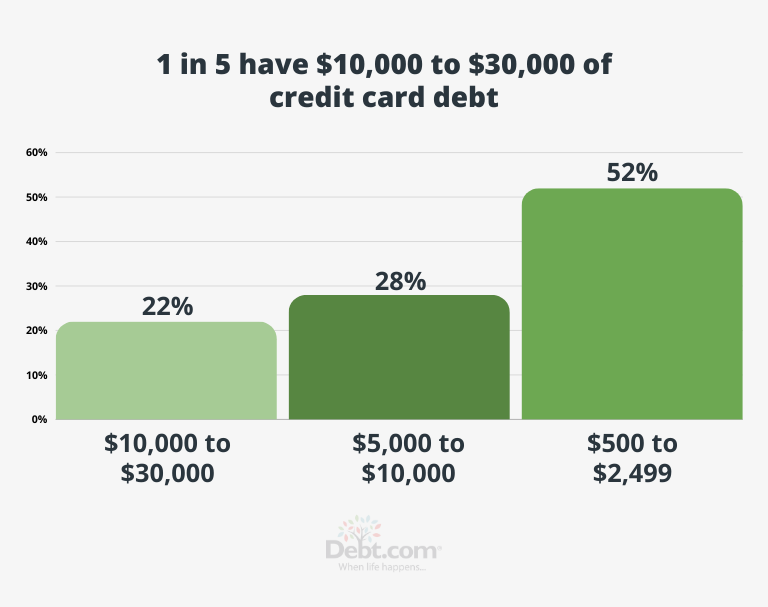

Debt.com polled more than 1,000 Americans in its annual “Credit Card Survey.” More than 1 in 4 respondents say they have between $10,000 and $30,000 in credit card debt. Nearly 3 in 10 say they owe $5,000 to $10,000.

Credit card debt may not be the most critical source of debt for most Americans but when paired with rising mortgage debt, student loans, and unexpected healthcare costs, any credit card balance can be enough to pull your finances too thin for comfort.

See more credit card debt statistics »

How do people end up with credit card debt?

Although overspending is an obvious cause of credit card debt, it isn’t the only one. At the core of the issue is that people simply don’t understand how credit cards work and how much their debt is actually costing them.

Only 40% of Americans have what’s considered fundamental financial literacy:

- Less than half of Americans have enough savings to cover three months of living expenses

- More than half reported that they didn’t try to estimate monthly payments when getting a loan

- Nearly a third prefer to use non-bank borrowing methods like an auto title loan or payday loan which can carry even steep interest rates than credit cards.

- The same percentage also admitted to feeling intimidated reaching out to financial institutions with questions.[3]

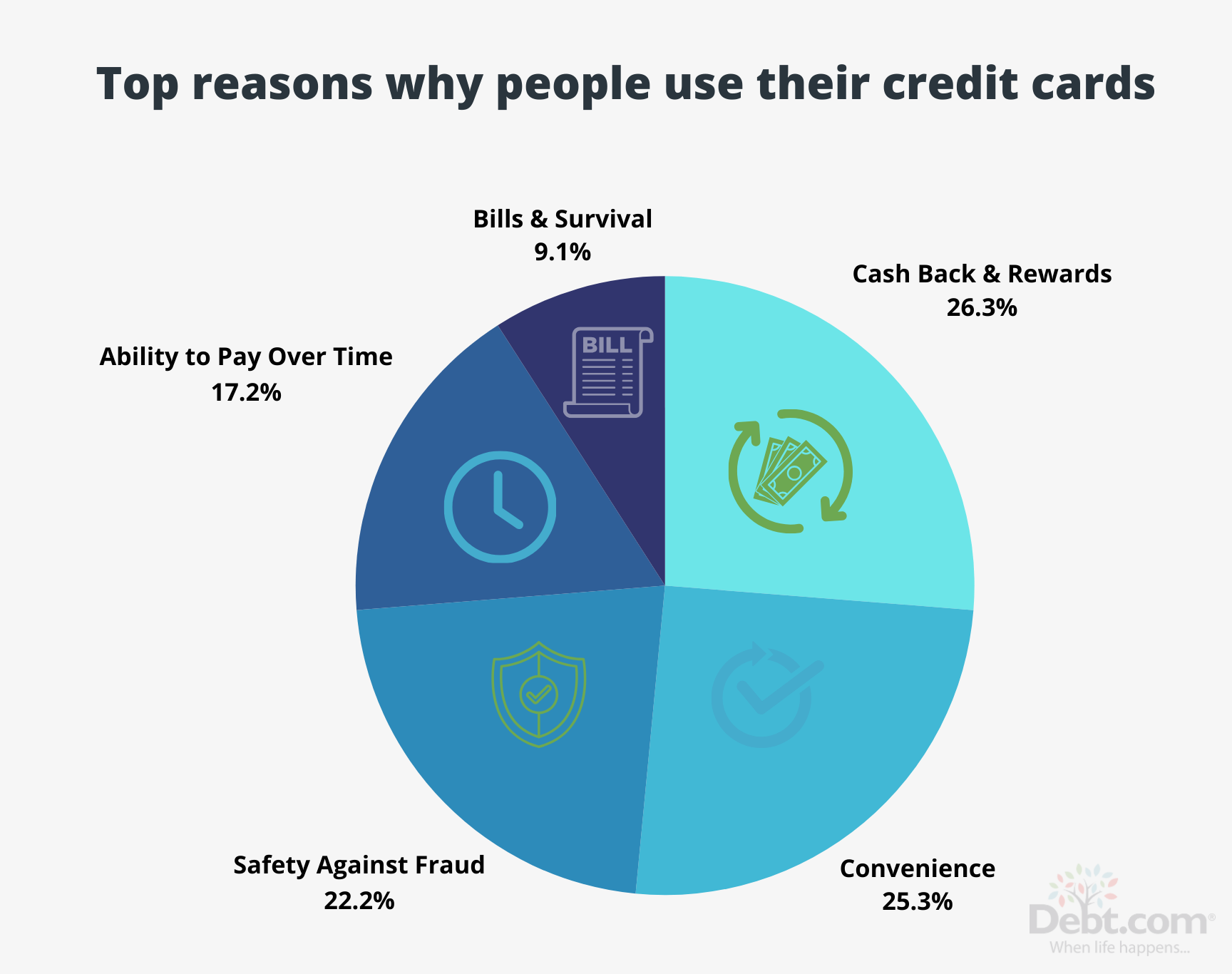

In Debt.com’s latest Credit Card Survey, more than half (57%) said they got their first credit card when they were between the ages of 18 and 24. When asked who introduced them to their first credit card, the most common answer was “their parents” – with 1 in 3 (32%) of respondents choosing that answer. One of the most interesting takeaways from the survey was the main reason why people use credit cards.

More than 1 in 4 (25%) say they use credit cards because of the convenience.

The fact that credit cards are accepted everywhere and essentially allow you to pay off bills over time rather than all at once makes it easy to fall into debt. One of the best ways to prevent credit card debt is to understand the basic elements of how credit cards work—especially the functionalities that tend to be pitfalls for consumers.

Credit card interest (APR)

Credit card interest, or annual percentage rate (APR), is the amount you’re charged for carrying a credit card balance and how lenders make a profit. The average credit card interest rate is around 24%, even for someone with Excellent credit. By contrast, the average rate for a personal loan is around 12% for the same credit score.

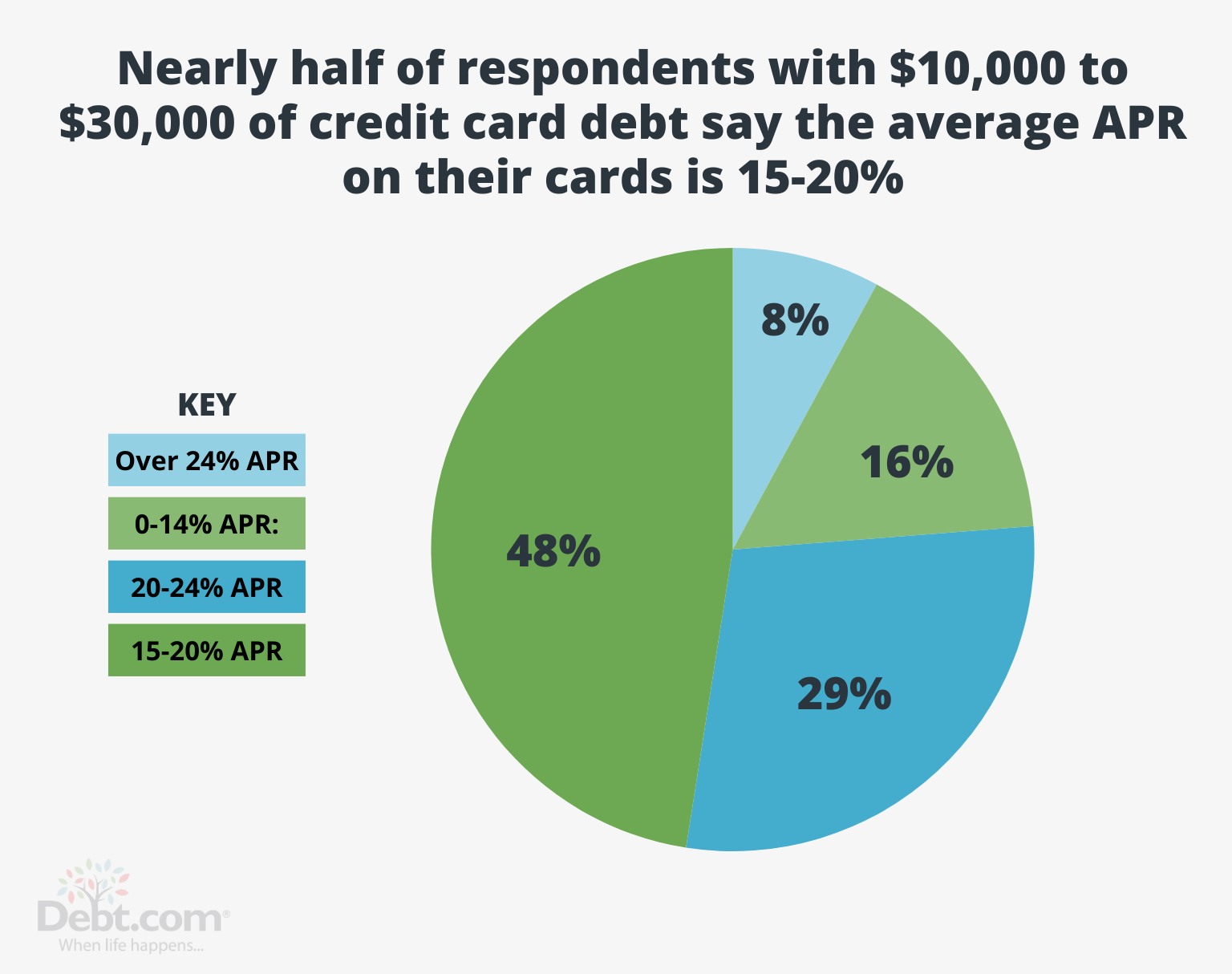

Debt.com’s Credit Card Survey found nearly half (48%) of respondents with $10,000 to $30,000 in credit card debt say the average APR on their cards is 15-20%.

Because of the extremely high-interest rates, credit card debt is often the most expensive type of debt. Carrying a balance even once can negate any rewards or other credit card perks. Additionally, high APRs mean that for future payments, more money goes toward interest charges rather than your principal amount which can make it extremely challenging to pay off if they get out of hand.

Minimum payment

Credit card minimum payments aren’t designed to help you get out of debt quicker. In fact, they are designed to make banks or credit card companies profit. Though it might make them more affordable and keep you from being penalized, you’re flushing a lot of money down the drain in the long run and putting yourself deeper in debt.

When you only make minimum payments on your debts, it can take you years if not decades to pay off even one account with potential thousands in added interest charges. Always pay as much as possible, ideally paying off the balance in full every month.

Credit card fees

All credit cards come with fees or some sort. There are annual fees, late payment fees, balance transfer fees, foreign transaction fees, and cash advance fees. If you’re not careful with how you use your credit card, you may inadvertently find yourself charged with unexpected costs. The best way to determine what types of transactions you’d be charged for (and how much) is to look at the Schumer box of the credit card you’re interested in.

Annual fee: The yearly charge of owning a credit card that is added to the customer’s statement balance. It may sometimes be waived for the first year during the initial sign-up. If you no longer want to pay an annual fee, ask your card issuer if it’s possible to waive it again or ask to downgrade to a version of the card without the fee.

Late payment fee: A flat fee charged for failing to make the minimum payment by the due date. This charge is applied immediately following the missing payment. However, many card issuers will waive the fee the first time you miss or are behind on a payment. It’s not automatic so you’ll have to reach out to them. Their answer may also depend on your relationship so if you’re a long-time customer, you may find yourself with more bargaining power than a brand new customer.

Balance transfer fee: A fee charged per balance transfer. It will be either a percentage of the total amount or a flat fee, typically $5 or $10 (whichever is greater). This charge is rolled into the total balance and can be paid off over time. Some balance transfer cards may offer a promotional interest rate of low or no interest for a set period.

Foreign transaction fee: An additional surcharge per transaction for purchases made outside of the United States. These range between 1% and 3%. Many credit cards don’t charge a foreign transaction fee even outside the types designated for travel.

Cash advance fee: One of the worst ways to use a credit card is for cash advances. Not only do they come with outrageously high fees (even by credit card standards), but those fees are charged immediately. Whereas normal purchases have a grace period before your charged interest (which you aren’t charged as long as you pay the full statement balance by the due date), cash advances have no grace period.

Increased credit limits

A credit limit determines the maximum amount you can charge to your credit card. It’s determined by a variety of factors including your income, credit score, and payment history. Having a larger credit limit means greater borrowing power, but just because you can spend more on a credit card doesn’t mean that you should.

For one reason, the general rule of thumb to keep your credit score happy is to keep your credit utilization rate below 30%. But beyond FICO scores, maxing out a credit card is simply a bad habit to get into. And those who have a habit of using up all of their available credit tend to get into trouble when credit card issuers raise your credit limit—something many issuers do periodically and unprompted.

A higher credit limit can be a source of constant temptation for someone who hasn’t developed healthy credit usage habits. The safest way to use a credit card responsibly is to only spend what you can pay off by the statement balance due date regardless of how much credit you might have available to you.

Credit card debt FAQ

Below are a few of the most popular questions about credit card debt we’ve received. If you still have questions about credit card debt. Our comprehensive Credit Card Debt FAQ can answer any – and all – remaining questions. If not, you can always call us at . You’ll be connected with a friendly certified credit counselor that provides the answers you need.

Social Security income is generally safe from most debt garnishments. However, it is not safe from federal government garnishments. If you owe back taxes, federal mortgages, student loans, alimony, or child support payments, up to 15% or more of your Social Security income may be garnished depending on your state laws.

Read the full response to this question »

Thankfully, debtors’ prison ended in the 1800s. According to the Fair Debt Collection Practices Act, collectors cannot threaten you with jail time because of failure to pay a credit card debt. To do so would technically be breaking the law. If they did you, they would be fined and you could be compensated.

The only real way you can go to jail for racking up credit card debt is if you ran up credit cards using someone else’s identity which is credit fraud.

Read the full response to this question »

If a collector calls and threatens to take money directly out of your bank account, rest assured it’s probably a lie. There is, however, one exception. If the collector has already obtained a court order then they are legally able to take money out of your account. However, if that is the case they wouldn’t go out of their way to threaten you because they could simply take the money they came for and be on their way.

Only federal student loans and unpaid income taxes can be garnished out of your accounts or wages without a court-issued order. Debts incurred on credit cards or through personal loans cannot be settled with garnishment – unless the collector sues you and the court rules in their favor.