Question:Hi Howard! I’m in a dilemma. I’m 55 years old, have $107,000 saved between two retirement accounts and make net $14,000 a month. I work the oil and gas industry and am very blessed to have a great job!

I have no deductions other than my daughter’s college education expenses for 2015. I am putting $6,500 into a Roth IRA for 2015, but that’s it for now. My employer does not have a 401K plan. I have a SUV debt of $17,000, a motorcycle payment of $525 a month, no credit card debt, and a rental payment for a townhouse of $2,750 a month. My daughter’s education will cost me approximately $25,000 a year.

I’m afraid I don’t have enough deductions and will get hit very hard on taxes this year (25-28 percent tax bracket?). Should I be looking at some real estate (property and mortgage deductions) to offset the amount of taxes I’m going to have to pay?

Dawn in New Mexico

Howard Dvorkin CPA answers…

The short answer is easy, both for you in this particular case and for any others reading this: Never buy real estate just to save on your taxes.

As a real estate investor myself, I can tell you: It’s a serious commitment of not only money but also mind power. While you need to monitor any investment you make, real estate can be much more time-consuming for reasons I won’t delve into here.

That said, I asked you some followup questions, and after reviewing your answers, it’s crystal clear; If you want to buy a house to live in and enjoy, buy it now.

You don’t need a CPA like myself to crunch the numbers, because you’re doing so many things right. For starters — and this is the big one — you have no credit card debt. I applaud you for the accomplishment. For others who are reading this, Dawn is one example of what paying off credit card debt can mean. It can mean a new house.

I didn’t work up your complete financial picture, but I urge you to check you debt-to-income ratio with our free DTI ratio calculator. Based on what you’ve told me, I’m guessing yours is well below 41 percent. Anything above that, and mortgage companies will hesitate to work with you — and if they do, you’ll pay for the privilege in higher rates.

You’ve made some mistakes along the way — who hasn’t? — but you seem to have learned from them. If you don’t mind, I’m going to touch on those, because others can learn from what you did wrong and what you’re now doing right…

1. Bad car, good payments

You told me…

“I bought the SUV when my credit wasn’t too good — at a 12 percent rate for six years. I know, stupid, but I’ve been paying an additional $50 a month on it and can step up the payments anytime. On the motorcycles, I pay $527 a month but have started paying twice a month and should pay off the balance of $17,000 in a little over a year.”

You’ve learned the value of a good credit score the hard way — it’s not just a number, it saves you money on interest rates. Paying higher interest rates might not mean higher monthly payments, but those rates can mean many more months of payments. It’s a trap many fall into.

What you’ve done right: You’re digging your way out by saving money and paying off those loans quicker. Keep up those twice-monthly payments, then use that money toward your mortgage.

Is your credit rating holding you back? Find out how to fix it.

2. Seeking the right house at the right price

You told me…

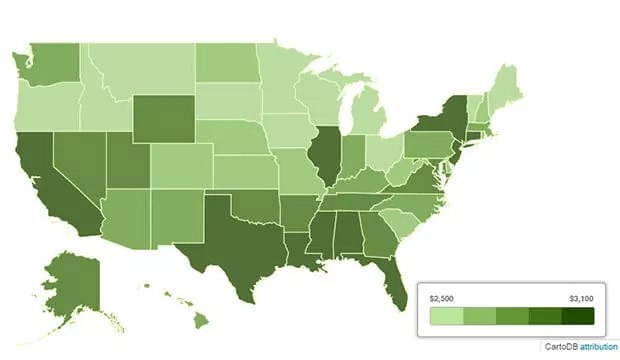

“I would love to own a home on what they call The Western Slope in Colorado. I know taxes are high in Colorado and have even considered a home back in Wyoming, where I’m originally from. A state with no state income tax would be ideal. I don’t need anything more than 1,750 square feet (3 bed, 2 bath with a view!) Cost anywhere between $150,000 and $250,000.”

Since you’re renting a townhouse for $2,750 a month, it’s very likely you can negotiate a monthly mortgage payment for less than that, even with taxes, insurance, and any homeowner fees included.

What you’ve done right: You’re being logical about your first home purchase instead of emotional. You’re reasonable about how many square feet you need rather than want. You’re even willing to relocate to save money.

What to do now

As you start the house-hunting process, be sure to use our Mortgage Repayment Calculator before signing on the dotted line. However, you’re in a good place, Dawn. Soon, you should be in your own place!