Has the knot tied with your soulmate become a financial noose around your marriage’s neck? If so, you’re not the only couple struggling to navigate individual financial differences.

More than 3 in 10 (32%) of divorcees blame debt or other financial difficulties for their breakup, according to a survey from Debt.com. More than 1 in 3 (34%) specifically say they split up over credit card debt.

The fact that you and your spouse have money issues doesn’t mean your marriage is doomed. Here are some common money conflicts that could lead to divorce – and ways to prevent them from ruining your marriage.

Overspending and other financial surprises

When one person in a couple lives within their means and the other spends like crazy, that can lead to trouble. When both people in the marriage overspend, the stress caused by too much debt, overdrawn accounts and unaffordable monthly payments can destroy marital bliss.

A significant amount of Americans agree that conversations about shared financial goals can prevent disagreements about how to spend shared finances. Three in 10 Gen Z adults and 4 in 10 millennials think that these discussions should happen early in a relationship, as revealed in Northwestern Mutual’s 2023 Planning & Progress Study.

To curtail divorce due to overspending, create a monthly budget with your spouse. Then stick to it. Avoid surprises, like finding out your spouse owes $70,000 in student loans and has spending habits that don’t align with your own, by talking about money with your partner as soon as possible.

Credit card debt

More than a third of divorcees split up over credit card debt. Of those respondents, 7 in 10 say they – or their ex – hid credit card debt. Meanwhile, another 8 in 10 say they – or their ex – hid spending during their marriage.

Talk openly and honestly with each other about how much debt you each have, views on money and spending and financial goals long before the wedding day. Premarital financial counseling can help avert future financial problems.

If credit card debt is causing you to lose interest in staying in the marriage, it may be time to meet with a financial counselor at a nonprofit credit counseling agency for help creating a budget and setting up a debt payoff plan.

Financial infidelity

You don’t have to meet your mistress at a motel for lunch or try out private poses with your yoga instructor to be a cheater. You can be a financial philanderer, too.

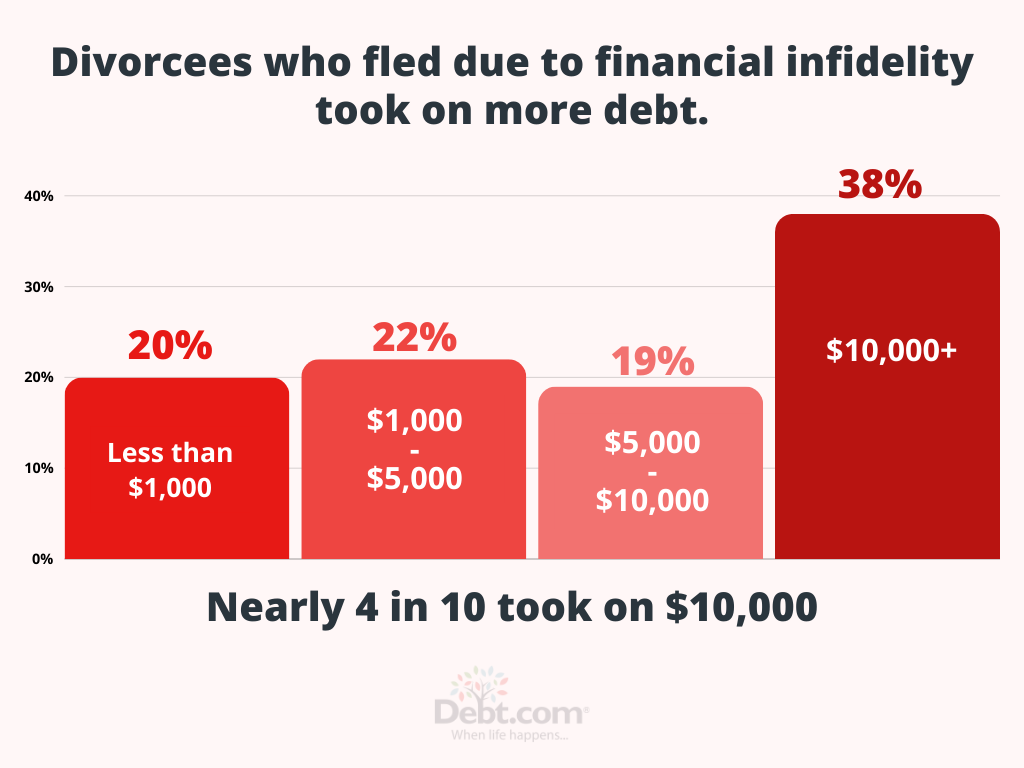

Hiding money from your partner is considered financial infidelity. So is spending it without their knowledge. More than 1 in 4 (26%) of all Debt.com’s 2024 Debt and Divorce survey respondents took on $10,000 or more in debt as a result of their divorce. But when you drill down on the data of divorcees who split over financial infidelity, nearly 4 in 10 (38%) said the same.

A recent survey from Bankrate reports that 42% of married adults admit to “keeping a financial secret” from their partner. Thirty percent say that their infidelity comes in the form of spending more than their spouse would be comfortable with, while 1 in 5 are digging themselves into debt without the other knowing about it. The driving force behind this behavior was a “need for financial privacy” and a desire to control their own money.

Even if you try to hide financial missteps, the truth will likely emerge at some point, so be upfront about what you spend and where you stand.

Types of financial secrets

Overspending and accruing hidden debt are not the only kinds of money secrets partners can keep from each other.

Nearly 20% of respondents from the Bankrate poll said they have a secret savings account, while almost the same amount admitted to using a covert credit card. Hidden checking accounts were opened by 17% of those polled. In terms of overspending, 1 in 10 spent $500 or more without their partner knowing, while a little less than that spent $1,000 or more.

If you or your partner are keeping secrets to avoid the embarrassment of a low credit score, a much better solution is to be open and honest about it. A poor credit score doesn’t have to be a permanent stain, since collections and late payments drop off your credit report after seven years. Start paying on time, correcting credit report discrepancies, and building your individual credit scores now so you’re on equal financial footing eventually.

If you or your spouse is saddled with a crippling amount of credit card debt, student loan debt, or have lost control of your finances altogether, get instant solutions with Debt.com’s Instant Debt Advisor technology. Debt.com makes it fast and easy for you and your partner to start getting back on track.