Keeping money secrets from your partner can cause as much damage to your relationship as having an affair.

Personal finance site Bankrate had YouGov poll more than 2,000 on what they felt was considered financial infidelity – and how it made them feel.

Nearly 1 in 4 said “racking up debt without their partner’s knowledge” is the leading form of financial infidelity. Followed by…

- A secret savings account (19 percent)

- A hidden credit card (18 percent)

- An undisclosed checking account (17 percent)

“It’s not always easy to talk about money, but it’s so important,” says Ted Rossman, Bankrate’s senior industry analyst. “Financial secrets can take on a life of their own and undermine the relationship. In years of studying this, we’ve often found that the breach of trust has a greater impact than the dollars and cents. If you have a secret spending habit or undisclosed debt or a credit card or bank account that your spouse doesn’t know about, I think it’s best to come clean right away.”

What is financial infidelity?

Financial infidelity refers to any activity where you deliberately withhold information about your finances from your partner or spouse. This can be anything from spending money or opening credit cards without your partner’s knowledge, to more drastic actions like having secret accounts to stash money away or using mutual retirement savings without the other person’s permission.

Often it starts small. While each instance of infidelity varies, not every case will be that of millions of dollars or necessarily be that severe. However, it is an indicator there may be deeper-rooted issues in the relationship, stemming from an imbalance of income earned, a clash of personalities, or a low level of consciousness of what they are doing.

Debt.com has surveyed more than 500 divorcees on how their breakup impacted their finances. The latest survey revealed 1 in 3 (34%) divorced over credit card debt. Of those respondents, 8 in 10 say they or their ex hid spending – and 7 in 10 hid credit card debt.

Signs of financial infidelity

In today’s modern world it is becoming easier and easier to hide things from your partner. Like sexual infidelity, financial infidelity is a serious breach of trust. Clear communication between one another is the best way to make sure this doesn’t happen, but there are indicators that it may be happening right under your nose.

- New unexplained credit card statements

- An unwillingness to discuss personal finances or irritation at the topic

- Transferring assets surreptitiously

- Changing joint passwords

- Lying about income

- Addictions (gambling, drinking, drug use, or shopping)

- Concealing debt

Not telling your spouse about your $5 coffee every morning isn’t really committing financial infidelity, but it could have long-term consequences that could snowball and become a financial issue. If your partner doesn’t notice the $25 dollars a week spent on coffee in your joint bank account, why would they notice the $50 spent on a new pair of shoes?

How to avoid financial infidelity as a couple

Financial infidelity is a sensitive and sometimes unforgivable occurrence that can ruin relationships. Many times, the perpetrating spouse can go undetected until the financial situation becomes unfixable. The money conversation needs to be an ongoing effort in your relationship, just as any other aspect of it would be. These are five tips that can help you get ahead of the curve:

1. Have an equal partnership in financial decisions.

Make sure both parties have a say in budgeting, saving, investing, and any financial issue that arises in the relationship. If one partner takes the lead, they should be communicating with the other before making any decisions. And the other spouse should be asking questions and taking a firm interest in all of them.

2. Check your accounts regularly

If you have joint accounts, make a note to look at them at least once a day. Should you see anything unusual talk to your partner right away. If you decide to maintain separate accounts or have individual spending accounts, try to be transparent with what you’re spending on and make sure to always discuss major purchases.

3. Make sure your goals align

Talk about your financial goals at the start of your relationship and keep talking. People change and with that their goals change as well. If your financial goal changes, make sure to articulate that to your partner. Secrets can only cause damage.

4. Try to plan finance together

Have monthly or quarterly financial planning discussions. Take account of everything going on in each other’s lives and decide together how to handle debt or credit challenges. If something goes wrong on your end, as embarrassing as it may be, talk about it. Be upfront from the start.

5. Bring in a mediator

An accountant, financial advisor, or credit counselor can be the best help to have that talk about money. They are professionals that can advise on long-term goal setting, debt management, and investments.

Money fights are a leading cause of divorce but getting ahead of the curve can help to save your relationship.

How to recover from financial infidelity, financially and mentally

Hiding finances breaks down an essential component of partnerships: trust. Living this secret “double life”, can have many long-term consequences on your mental health and wellbeing. This stress can negatively affect your immune, digestive, sleep, and reproductive systems. The National Institute of Mental Health cautions that over a significant period of time, chronic stress can lead to serious health complications, including heart disease, high blood pressure, diabetes, and depression.

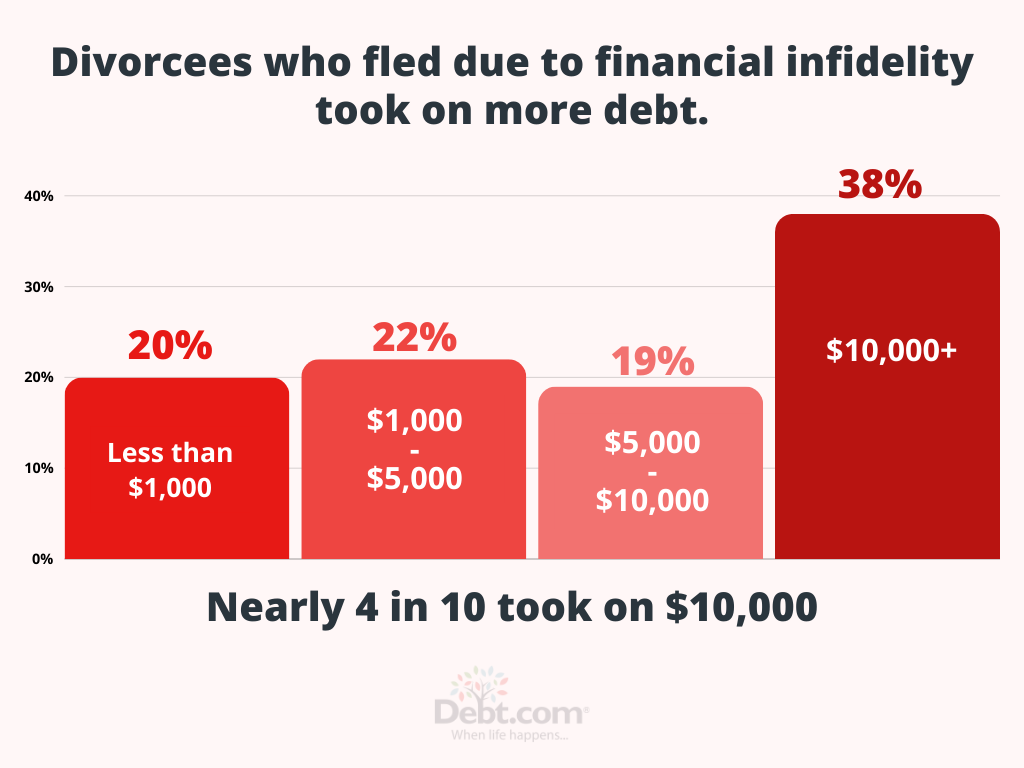

It’s important to confront financial infidelity to get back on track. Of divorcees who split over financial infidelity, more of them report taking on $10,000 or more in credit card as a direct result of their divorce.

Paying off debts you’ve been hiding from your spouse

Finding out that your spouse has run up a huge bill on a credit card or on several cards can be infuriating. But rest assured that there are ways to deal with the debt quickly and effectively. Here are some options that you may want to consider.

- Debt consolidation. If one or both of you have good credit, you may consider consolidating those balances with a personal loan. You can use the funds from the low-interest loan to pay off those high-interest credit card balances.

- Credit counseling. A nonprofit credit counseling service can help one or both spouses enroll in a debt management program. This program minimizes interest and can reduce your total payments by up to 50%. If the debt is only in one spouse’s name, only they need to enroll.

- Debt settlement. If one partner has missed payments and has debts that are behind or in collections, consider debt settlement. You can settle past-due and charged-off accounts for a percentage of what you owe. This will negatively affect the account holder’s credit score. But if the accounts are not held jointly, then the other person can maintain their score.

Finding debt relief is now safer and easier than ever. Instant Debt Advisor℠ can tell you the best solution for your situation in only three minutes. Instant Debt Advisor℠ will ask you a series of questions to narrow down the right debt relief for you. It’s free, secure, and has no impact on your credit.

Divorcees who split over financial infidelity are also more likely to report greater damage to their credit score. More than 4 in 10 of those divorcees report a credit score drop by more than 50 points.

Financial experts talk about the cost of financial infidelity

Debt.com and CPA Howard Dvorkin, Real Housewive and Coto Insurance Founder Vicki Gunvalson, Insurance and Financial Advisor Analisa Cleland, and Celebrity Divorce Attorney Christopher Melcher discussed the cost of financial infidelity in a roundtable on Facebook Live. Hear what these experts have to say about how this unique type of infidelity can affect your relationship, your future, and your credit.

Analisa Cleland, Insurance and Financial Advisor: Financial infidelity is what happens when one partner in the relationship is less than honest with their finances with the other person.

It seems to be on the rise, according to a survey from creditcards.com, that up to 40 percent of people are admitting to hiding a bank account, debt, or even just spending from their partner, so we’re very fortunate to have three amazing guests today to discuss this very important topic.

Our first guest is Howard. Howard Dvorkin is a serial entrepreneur, two-time author, CPA personal finance expert for debt.com.

Howard’s success in the financial industry has allowed him to be interviewed by countless media outlets over the years, including the New York Times, Washington Post, CNBC, Money Magazine, Forbes, Entrepreneur, Huffington Post, Investor’s Business Daily, among others.

He founded debt.com as a one-stop-shop to help make exploring debt options simple and safe.

The organization matches people seeking debt solutions with proven companies they can trust, and we all know that Vicki has partnered with debt.com, and if people want to reach out for their services, go to debt.com/Vicki, and Howard will make sure that you’re very well taken care of.

Howard Dvorkin, Debt.com Chairman, and CPA: Thank you for having me.

Cleland: Business owners, celebrities, and trust beneficiaries across California turn to our next guest Christopher Melcher for assistance in protecting their most valuable assets in high-stakes divorces.

With deep experience in complex family law litigation and pre-medical, excuse me, pre-marital agreements Christopher provides tactical representation in the most challenging family law disputes.

He understands the need to keep sensitive family matters private, having represented noteworthy clients in the largest divorce cases in California.

Clients include A-list celebrities, executives, tech company founders. He is frequently hired by other family lawyers as a consultant, expert, or co-counsel on significant divorce assets in California, and Christopher, we’re so happy to have you here.

Christopher Melcher, Celebrity Divorce Attorney: Well, thanks for having me.

Cleland: Our final guest is who really doesn’t need any sort of introduction, nor do I have anything written down, but Vicki has over 32 years of experience in the insurance and financial services industry.

You might think that that has nothing to do with this; however, with the insurance and the financial industry, people often turn to her for advice regarding divorce, debt management, retirement, everything comes into play.

I’m fortunate that I have seen her in action with her clients, and she’s wonderful and always does the right thing for them.

So happy to have all of you join us.

Vicki Gunvalson, Real Housewife, and Coto Insurance Founder: Thank you

Dvorkin: Thank you

Cleland: The first question to Vicki, since we’re talking Housewives, having had experience being on the real housewives shows. Interesting question.

Can you explain your perspective why somebody would go on the show meant to expose life, you know, expose their life knowing that their finances are in disarray? It just seems like it would kind of blow up, but what is your perspective on why people do that?

Gunvalson: Well, the show and real-life are two different things. But I think that a lot of new cast members coming on these series have really kind of an idea that nothing will ever be exposed and the whole point of a lot of these tv shows is really kind of unveiling what they’re doing and showing that maybe it isn’t as perfect on the inside as it appears to be on the outside so um you know I think be careful what you wish for you want to be on a tv show a reality show you have the risk of um you know being exposed. Whether it’s good or bad. So, you know that’s a risk and I think back 16 years ago when I got on that wasn’t what was supposed to be about. It was supposed to be about just showcasing our life and what it was going to be like doing you know living a privileged life. We had really kind of smoke and mirrors we had no idea that a lot of the things were going to be happening in our real life and be exposed. So, it’s part of life you know we just don’t know what our reality is going to be tomorrow.

Cleland: Right, makes perfect sense.

My next question is to Howard. Howard, do you have any experience counseling people who came to you because their spouse was hiding money in their financial situation from them?

Dvorkin: Listen, I have experience in everything because I’ve been in this business for so long. At the end of the day, a couple stories come out and that really resonated. When I first started out, I had a couple who was going through some marital problems, and let’s face it; marriage is tough in today’s age. 50% of all marriages fail, and the number one reason is financial pressures so. But at the end of the, at the end of the day, you know people have to work together.

The couple that I’m thinking they came in as a couple, and we counseled them, and we set up a program for them to pay back their creditors, and they had about $50,000 or $60 000 worth of debt which is a tremendous amount of money at the time. Then he calls me later in the afternoon. Can I come by? He goes, oh, I have another forty thousand, but this is for my girlfriend and it’s a little juicy situation, but sure enough, the gentleman, and I do put that in quotations, the gentleman did pay off his debts, but certainly, you know I’ve had clients, and I’ve had friends trying to hide money and do things, and there are certain things, and Christopher could certainly attest to this. That if you plan it properly, you could really set yourself up well regarding either spouse however you know the best thing is communication and talk and plan and try to work things out. But financial infidelity, it does happen. Because listen as human beings we are different, and some are brought up in one way, and some are brought up with, you know financial conservative values, and some are not. Some like to spend, so you have to be careful.

Cleland: Well, I mean, just from our work with what Vicki and I do, I mean I’ve noticed that COVID really has impacted people’s finances, and I’m getting calls constantly about people getting divorced, so that brings up the next question for Christopher but from a legal perspective what steps should somebody take, you know, outside of just filing for divorce but what steps should they take to protect themselves if they suspect financial infidelity or is there anything they can do prior to actually filing?

Melcher: Well, sure, and like Howard said, the communication is ideal, but it’s often lacking, and especially if they’re at a stage that you’re describing where the relationship is in trouble, they’re probably not talking, and they don’t trust each other, and that’s when people start looking around and at bank statements or maybe there’s a new credit card statement that comes to the house, or maybe they pull their credit report and all of a sudden they’re seeing things or maybe they go into the bank and they’re talking and realize that there’s more or less money or more or less debt than they thought there was. So, at that point, somebody’s going to really start investigating and maybe looking at separating some finances.

It’s hard if they’re living in a community property state like California where we’re kind of all in it together, but, they can start protecting themselves by separating their money and making sure that if the other spouse has a spending problem, a gambling problem, maybe has a relationship outside the marriage that money’s being spent on that that they basically sequester their savings so that can’t be burned on a non-marital purpose so that that I mean that’s very sad and I think we’re where the better impact has is before they get into the relationship is really understanding who they are and what they have to expect from each other financially. But unfortunately, people don’t have that conversation a lot.

Cleland: Right. Yeah, I’m getting a lot of those questions um. And Vicki, this one comes, I don’t know if you remember this case, but you know it goes along with the financial infidelity. A year or so ago I got a call and I’m sure I talked to you about it, but this couple he was making you know well over 500 a year and spending more than that. Blew through everything, drops dead of a heart attack, and turns out that he quit paying his life insurance and left the family with over close to a million dollars in debt. You know, with that being said, you and I in the life insurance business. We understand how vital it is to have that to protect everybody their life would have been vastly different if he hadn’t quit paying premiums.

But what I would like is can you explain what it means first of all to be the owner of a life insurance policy and why it is so important to make sure that you monitor the beneficiaries on a policy to prevent something like that from happening.

Gunvalson: So how life insurance works is if you have an insurable interest in somebody such as a spouse, you can become the owner and the beneficiary. The insured has to sign off on it but what that allows you to do is have control over that policy for instance, at 42 years old when Donn got a 2 million life insurance policy on himself. He’s the insured, I’m the owner, I’m the payer, and I’m the beneficiary. So, when we got divorced ten years ago, I maintain that policy because I own it, so if and when the time comes where he dies, and that policy is still in force, I own it; I’m the beneficiary. If he got remarried or decided to, you know go in another relationship he can never cancel it; he can’t change the beneficiary. I am the only one that can do it, and I never will. I’m always going to keep myself the beneficiary. That is my choice as the owner.

Now, if he was the owner of that policy, he could make changes to that without me knowing. So those of you that are listening right now and if you have a spouse whether or not you get divorced or not. You want to own that policy because you have control of who and how that beneficiary ever gets changes. So, I’m a firm believer bad things happen to good people, and you plan for the unplanned and all that stuff that I’ve always said. Own the policy on your spouse.

Divorce happens; you will never have to worry about having that beneficiary change or the ownership change, so you own it it’s yours. It’s like owning a home; it’s yours. Nobody can come in and take it away from you.

Cleland: And I know you recommend to people, and I’ll just say it for people that are listening, but when people get a divorce, I’ve heard you recommend that you take out a policy on the ex for the amount at least of the maintenance and the child support.

Gunvalson: Always.

Cleland: They die and for you to be an owner so.

Gunvalson: Always. It’s not negotiable. The divorce attorney should be making that part of the divorce decree. If somebody has to pay, you know, ten thousand dollars a year in child support or alimony or what have you. They should insure themselves for that for however many years they’re going to be responsible. If it’s ten years, 20 years, whatever the number is. Always buy life insurance to protect the one that is supposed to be paying you. Because what will happen, always to everybody so we want to make sure that they’re protected.

Cleland: Right, and I like your explanation because a lot of people don’t understand and they don’t understand the importance of it replacing that income should they die, so thank you for the explanation. Um, next question is both to Vicki and Howard.

But with your expertise in insurance and personal finances, what steps do you recommend partners take to prevent marital infidelity? I mean yes of course communication is great, is a benefit or not the benefit, but is the goal that doesn’t always happen, so take communication out of it. What steps do you recommend to possibly prevent that?

Dvorkin: May, I guess I’ll take this one to start. At the end of the day, as I said previously, we need to make sure that people communicate and whether that communication is sitting down once a month going over credit card bills and bank statements so you can look for irregularities or pulling credit reports to make sure that there’s no credit cards on the side that aren’t being accounted for that the one spouse possibly could run up some charges that the other spouse doesn’t know about.

I mean when we go through there’s lots of things coming into a marriage when you get into a marriage. There’s maybe one spouse has stirred in debt which could be hundreds of thousands of dollars. You need to make sure and know before you get married or even a second marriage what they’re coming in with, but you need to constantly communicate and look at all the ways around where the problems can happen and certainly with a prenuptial agreement whether you have lots of money or not it does serve a purpose where you lay out all of your debts and you lay out all of your assets so you can truly know what you’re getting into.

Because as I said previously marriage is tough, I’ve been married twice. Thank God I met a wonderful woman and we’ve been married for 22 years. However, you know there are challenges she came with two kids, and we had two kids of our own, so it was kind of like a smaller version of Brady Bunch and there are challenges with that. Who pays for what and all those things uh associated with mixed families, so with that it is communication communication communication. That is the strongest uh way to keep things on track and know what you’re getting into beforehand.

Cleland: Great Vicki, what is your perspective on do you have any other tips on ways to possibly prevent financial infidelity?

Gunvalson: Well, I’ve again over-communicate. I always believe somebody’s going to be the spender and somebody’s going to maybe be the saver or maybe you’re both on the same outlook on money, but money is one of the roots of all evil and if you can communicate about it and some people decide not to share money. Some people decide not to co-mingle and that’s fine it doesn’t have to be that because you get married you have to share money.

You could have your money, and he can have his money or vice versa. But it’s a level of respect and just stating that you know what you’ve got your assets you’ve got your money I’ve got mine and you know we’ll put it down the middle for housing expenses and things like that. But I know at 59 years old I’m not going to be commingling and neither is my partner.

We’re going to keep everything we’re going to enjoy life together and when I die my assets will go to my kids and his will go to his kids. So, I think there’s just another level of respect and just a common thread that states I don’t need his money, he doesn’t need mine, and we just build a relationship based on however we wish to do that.

Now if you’re not working and you’re dependent upon that person for your lifestyle you better have a communication about it. Are they willing all their money to their kids and leaving you out? I mean you need to have a conversation about that because if you’ve been in a relationship for a long period of time and then they die and leave you nothing um you pretty much won’t know about that, and you might want to look at life insurance to protect yourself on that. So, over-communicate. I think that’s my biggest thing.

Dvorkin: I would say, Vicki, that one thing is very important. Try not to commingle your finances when it comes to credit. Uh, I always recommend that people shouldn’t have joint credit cards and the reason being is one may charge up on a credit card and God forbid that marriage comes to an end and you are responsible for that credit card whether your spouse agrees to pay or the court even orders the spouse to pay. I always like having people have their own credit cards and to a certain extent a joint checking account but that’s about it. I think it’s important.

Cleland: You know there’s a situation that um a client of mine came to me for and Chris for I would like your perspective on this but you know they’re getting ready to get a divorce and it’s a difficult one and there’s some you know addiction issues going on but she found out that her husband modified the mortgage and wasn’t paying it um even though she was on it he went ahead and took that upon himself and the retirement accounts have pretty much been drained um but for some reason she’s dragging her feet actually you know wanting to file for divorce and I just keep saying her you’ve got to file you have to get representation because nothing is going to stop.

But when she actually files because for what happens then does that stop the, you know the sucking dry of the finances?

Melcher: Well, it could. Um, so in most states when you file for divorce, there’s automatically orders that go into effect that um or to preserve the status quo so you you’re prohibited from selling property, leasing it, giving it away, borrowing, um canceling life insurance, all those kind of things then would be a violation of a court order. But you know in that situation that you’ve described it’s very sad because there’s you know we’re in a trusted relationship with somebody else and then here we have our partner who’s secretly spending the money or wasting it whatever is happening, and now the savings that they had is gone and there’s really no way of replacing it.

So, I hope that this person you’re describing there’s some other money left over because the court could equalize things and say hey husband um you know ran off with all this money or wasted it, gambled it away whatever and then um take basically whatever is leftover and give it to the wife. But sometimes it’s too far gone and it sounds like in that particular case that the wife may be holding out hope that um things will get better or is just scared and doesn’t know what to do or this may be a product of an abusive relationship and it sure sounds like there’s whatever respect was present in that relationship is gone and that she should act quickly and that’s what’s saddest about the financial abuse in relationships is when it occurs after a longer marriage because there isn’t time to recreate yourself you’re not 20 years old or 30 years old. You’re not going to make another fortune probably.

So, this is something to monitor, and we like to think we know our partner, but there’s plenty of stories where people were married to somebody that they really didn’t know and that they had a secret life. So, I think some of the things we’ve been talking about here is checking the credit report that can be done quickly. Regularly checking that to see if credit’s being taken. Monitoring the bank accounts to see what’s happening. If there are joint credit cards um have them set up on your phone so when a charge is made you get alerted immediately and then take action. Because it yes we need to trust and communicate, but we also need to verify that our partner is complying with what their expectations are.

Cleland: Well, I appreciate that. Yeah, it does seem like you know with COVID, there’s a lot the addictions are on the rise and does play a factor into the divorces at least the ones that I’m seeing um and you answered one of my questions that I was going to ask you about what happens when someone files. So, it sounds like from what you’re saying is that it kind of puts a phrase on things and prohibits people from charging and opening up more with that. Another question I have for you Christopher, but aside from a prenup, are there any other legal protections that someone can take when they’re wanting to get a divorce but are not yet ready to file.

Melcher: Well so some couples will renegotiate their finances in what’s called a post-marital agreement um so I have seen folks that have gotten into trouble in the relationship and but they want to continue on but in a different situation, and so they’ll say hey we’re going to go ahead and divide up our property and uh going forward maybe my income is going to be mine your income is going to be yours and they basically do a financial separation but they stay together a lot of times for the sake of the family.

That is very complex and expensive to do. So, I’ve definitely written more of those or drafted more of those agreements that have ultimately been signed because if the couple’s in that state where they’ve lost trust and respect for each other and they’re basically cheating on each other financially. The thought that they’re going to survive round two is not great and probably uh better to spend that time and energy and money on just exiting the relationship rather than trying to re reorder it or refinance it essentially.

Dvorkin: How unromantic is that incredible? I mean listen, I still believe in love and I couldn’t imagine giving either one of my spouses uh a document like that and expecting it to last. But Chris is absolutely correct uh it’s a tough situation but people do stay in relationships for all types of reasons and some are not necessarily good reasons and it is a shame that that kind of stuff has to happen uh but it is you know that but I would think Chris that that’s on the upper echelon of people wealthy people would do that more so than middle uh middle-income folks.

Melcher: Yeah I mean it it’s by kind of nature is it if they’re bringing lawyers involved they’re gonna have to have a lot of free money to be able to do that and you know for me it’s I’m less concerned about these wealthy clients that I have because there’s a lot of money there to go around and even if you know there’s money that’s blown there’s usually a lot leftover and in the cases that really worry me are the ones where they’re getting towards retirement age, there isn’t an opportunity to recreate that savings and it’s heartbreaking because they’re going to be left out to dry and they may never have realized that all their money’s gone.

Yeah, maybe they the there’s a refinance of the house that was titled in one spouse’s name and there’s no equity left. So it is worthwhile doing the financial checkup and that can be done or at least even started with just saying hey let’s go to a financial advisor we’re not going to divorce attorney but it’s like hey let’s go to a financial advisor let’s do a check-in how are we doing with our retirement plans that could be started with an innocent conversation then to start seeing like what’s really there because there are some couples where one person holds the finances they’re controlling everything and the other just has literally no visibility or knowledge of anything that’s going on.

Cleland: Yeah, Vicki you know I’ve seen that before. Where a lot of times it’s these stay-at-home women that choose not to see it for one reason or another maybe they don’t want to or whatever. But um, why don’t you share your advice with that for the stay-at-home moms. That you.

Gunvalson: Yeah, well you and I have seen that my mother was a stay-at-home mom, so I’m not knocking by any means stay-at-home moms you have a strong responsibility, lots to do by you know providing for the home stability raising children all of that so there’s value to being a stay-at-home mother. I mean working and being in a marriage and raising children is not easy I just never had the privilege to do that. So I saw it from two sides of my mother being a stay-at-home mom with five kids and then she was clueless on money my dad managed and handled everything I have never had an opportunity to stay home and nor was I my DNA designed that way.

But you know at the end of the day, whatever your role is, that’s your choice if you want to go off and have a career and work and try to juggle it all there is a cost for that. If you want to stay home, you better know what’s going on with the finances because you’re going to get blindsided if something happens.

If something happens, an affair, a death, a divorce, whatever it could be you’re going to have to deal with it and I’d rather have you deal with it right now knowing where everything’s at versus ten years down the road and not having a career and not being able to support yourself. You know my father always told me you came in this world alone you’re going to leave alone. It’s you don’t depend upon somebody else to give you the lifestyle you want unless you’re prepared for the consequences. Meaning they’re going to control you, they’re going to tell you where you can spend your money they’re going to potentially leave and then you’re stuck without any opportunity to make a living possibly um you just want to be aware, and I hope nothing ever happens to anybody here. I hope everybody lives a beautiful marriage and everybody’s honest and everybody’s upfront.

The problem is everybody isn’t honest, everybody isn’t upfront, and when you just deal with it head-on and you want to know everything you have to worry about it you live your life and you enjoy your life and you be honest and you be ethical and you save more than you think you’re gonna need um and you just live a good life and always remember somebody’s watching your back I mean if it’s not you, it’s somebody else you’ve to watch out for yourself and I think that’s the biggest thing I want everyone to take away is take care of you because nobody else couldn’t do it you got to carry you.

Cleland: Right, I agree, good advice and I know you always say that at your seminars you came into this world alone you’re going to leave it alone and you know it’s very true and you need to open your eyes. I think it is what it is question for Howard.

We know that financial infidelity is a leading cause of overwhelming debt. When someone works with you um he said if they use Vicki’s link the debt.com/vicki is it possible to divide the debt amongst the spouses.

Dvorkin: Well first of all it is obviously possible. When somebody comes to us, we do a full evaluation. We figure out their income while they were married. Maybe if they’re getting divorced, we can figure out what that income is going to look like. We figure out their expenses. We make recommendations to their you know to reduce their expenses and then we look at the debt and we try to figure out a plan for paying down the debt that they’re responsible for whether it’s debt management or debt settlement and basically paying a portion of your debt off uh overtime or paying all of your debt and preserving your credit.

The challenge is who owes what and just because of a court order says the judge says you spouse one have to pay all these credit card bills doesn’t mean necessarily that they’re going to abide by the judge’s order I have a lot of people have come to me over the years and says my ex was supposed to pay this but they didn’t and now the creditors are after me at the end of the day the creditors don’t care what the judge said all they care about is who is responsible according to this credit card agreement that you signed and we want our money and they’re going to bang up the credit of the person.

Debt management takes care of a plan that will reduce their reduce the payment to pay off over time a hundred percent it preserves your credit uh probably three to four years you’re done you’re paying less interest. Whereas debt settlement is a completely different product and it’s more aggressive you’re going to pay less but you’re going to sacrifice your future credit as a result. So there are challenges by the way I want to mention I have figured out the key to a successful marriage and…

Cleland: Please tell us

Dvorkin: I’m bringing it on. Do whatever she says and buy her whatever she wants and it’s a happy life.

[Laughter]

Cleland: I agree

Dvorkin: Chris, I just put you out of business. I’m Sorry.

[Laughter]

Melcher: And I’m happy to be out of business.

Cleland: But Howard, you know what you said kind of goes along with my next question to Christopher, and it, you know it brings up something else but you know Christopher my next question was you know in a divorce decree a judge can decide you know which debts but what happens if the responsible party decides they’re not going to pay?

But that brings up another question what Howard brought up is that the creditors so does the credit agreement supersede the divorce decree because if the divorce decree says you owe something but Howard says that the credit company is different so.

Melcher: It’s a huge issue and I’m glad you’re asking and what Howard said is absolutely right and what we’re seeing in divorce cases is that you know sometimes the attention is on bigger issues. The kids or what the alimony is going to be um the house and then they forget the debt because they never wanted to consider the debt or think about it, to begin with, and so it’s kind of an afterthought and then they got bit by it later on. And then a lot of the attorneys, believe it or not, are not that sophisticated about this kind of stuff and what Howard just explained shows I mean I think he would bring a lot more value to a solution for a couple than a lot of divorce lawyers were because in in in the divorce they’re just fighting is a lot of emotions but ultimately what we’re seeing is it’s a money issue. There’s going to be an amount of income available to pay support with and debt and property to divide and let’s get out of this and what’s happening and what we’re talking what you’re highlighting with this question is the difference between a court order for one spouse to take on the responsibility to pay a debt versus an agreement that was made with the creditor.

Now the reason why the creditor agreement is going to supersede is that the creditor is not a party to divorce so the judge can only make orders against these spouses because that’s the two parties in front of them, but the creditors are not parties so there’s nothing that the divorce court generally can do that’s going to affect the right of a creditor. And so we have seen this over and over again some quick examples are um you know yeah there is a joint credit card or somebody has access to a credit card we think the divorce is over and we sign the papers and all of a sudden that credit card’s banged out by the other party and now you know my clients stuck paying this bill to preserve their credit even though technically under the order they should never have been responsible for it and that’s a loose end that wasn’t tied.

Another example comes up with personal guarantees on things so if you’re running a business you probably have a lease of a property and that may have been personally guaranteed by both spouses potentially and if the business is awarded to one spouse and we figure hey okay great they’re going to have the business and they’re going to take it on well if they immediately default on that lease the creditor the I’m sorry the lessor the landlord now is going to come after the other party who had nothing to do with the business but now they’re stuck with a gigantic liability.

Tax liabilities also, there could be unpaid taxes, and so we have to look at this, and that’s why having a debt expert is so important because again you think attorneys know this stuff a lot of them don’t and that’s the kind of stuff I obsess about looking at. I want to see all the documents, the agreements. I want to see every account. I want to know how it’s titled. I want to know whether this was personally guaranteed or not. I want to see the tax returns to show what the tax liability was. I want to see a canceled check to show that the taxes were paid. I’m not taking any of this for granted.

But that’s a lot of work and a lot of care to be done and this is the mess that we get ourselves into when we’re married because it’s everything that we have is tied up together and especially if it’s a long marriage it’s not going to be an easy process getting out of. But these are exactly the type of questions that should be answered it’s hard enough going through a divorce but then get burned at the end of it would just be horrendous.

Cleland: Yeah, um and I guess that’s that brings up another question too for Howard and Christopher. But you know I’m seeing situations where um spouses are not paying taxes, and I know that you work with tax debt Howard and Christopher I’m sure you divvy that up in the divorce. How does that work if one um spouse is working and didn’t pay their taxes and then you know they’re married filing jointly, but one doesn’t have an income does that work the same as credit card?

Dvorkin: That’s a little different, and now you’re asking me to put my CPA hat on; thank God I am a CPA so there is something called innocent spouse relief in the IRS code. And what that basically does is allow for situations that you just laid out where one spouse is incurring the income but they file a joint tax return and all of a sudden you find out that you’re responsible for uh the other party’s tax debt and it could be significant maybe they ignored it for years and with penalties and interest it could be hundreds of thousands of dollars there is a procedure and a form that is filed I’ve done it many times especially when I was practicing as a certified public accountant for many years before getting into this tax or the debt stuff. But there is a form that’s filled out and usually, that works out well for the innocent party and whether they’re getting a divorce or where they could remain married, but it puts the burden back on the other party the spouse where it should belong.

Cleland: Christopher, do you have anything to add to that?

Melcher: Well yeah, and we’ve seen I mean one way to get wealthy is to not pay your taxes. And so we’re seeing you know and it’s frustrating um that I’ve seen this happen where these parties have incredible wealth and assets and it’s because they cheated the government and never paid the taxes. And then now we have this gigantic tax bill coming up and so with the innocent spouse thing, one thing we see in divorce court is lawyers not really being careful about how they advise the client because now the client’s coming in saying we had this great lifestyle and we did all these things that would um then make it hard for them to tell the IRS later on that I didn’t know we had all this income that we weren’t paying taxes on.

So, there’s we got to be careful what we do. But again, it goes back to the kind of trust but verify concept. It’s if we’re going to bury our head in the sand and say I’m going to basically delegate authority and control of all of our finances to my marital partner. We’re taking a gigantic risk that they’re doing it properly and honestly. So there should be check-ins, this is a healthy thing you go to the doctor hopefully once a year you get a checkup you should go to a financial professional once a year at least get a checkup how are we doing and then hopefully some of these issues come out and then don’t wait till the day before the tax return is due and just have it pushed under your nose and sign it. It’s like hey I want time to review this. I want to understand it. I want to go through it with somebody. So, we, you know, its yes people are mistreated and cheated in divorces, but they’ve also allowed themselves to be cheated and mistreated, and I hate to say that but we do have to take some responsibility and accountability for the decisions that we make and if we trust everyone implicitly and don’t verify anything we are taking a risk.

Dvorkin: I would say pay attention to the mail as well. Because the people don’t look through the mail, they think a lot of junk is getting delivered you could find collection letters, IRS letters, saying you owe this much, and it could also be state taxes as well. So, pay attention to the mail sometimes if you do believe that well that’s just good advice to begin with but certainly if you believe there’s some financial infidelity situation going on.

Cleland: We do have a question for somebody Vicki, I’ll let you answer this one. Do you have any tips for same-sex couples?

Gunvalson: I don’t think it’s gender-specific. It is what it is. I mean, whether you’re the same sex or not it doesn’t matter you know you’re in a relationship you want to be committed you want to be honest and to me it doesn’t matter what the sex is something there yeah you just I don’t know what state laws are regarding debt and all that I just know a committed relationship is a committed relationship and honesty is everything.

Cleland: I agree. Do you have any stories that connect with any of this Vicki? Well, I mean I know you do but do you need at the top of your head that you want to share?

Gunvalson: Regarding?

Cleland: You know with financial infidelity or maybe how you felt.

Gunvalson: It happened with it I mean it just happens. I think you want to get ahead of it before um it happens to you. I just think so many people are being not honest nowadays. For whatever reason, they’re not being honest, and I see it every single day in my office. I had a lady come in; she’s 32 years married, and she said I don’t know where any money is he keeps saying he has it handled they’ve been married forever, and she says I’m insecure about it. I said well, did you talk to him about she goes yeah, he keeps telling me not to worry. Well, there’s a problem there. If she’s worried about it, he should be worried. He should be honest with her and tell her what’s going on. But you know she married him I didn’t. I just got to try to figure out how to help her you know.

Cleland: Were you able to help her, or did you give her any advice?

Gunvalson: Well, she’s still on her way in for our first appointment. I told her to bring him in and let me be the bad guy.

Cleland: Yeah, take that on. Howard, are there any uh resources available for people who suspect their spouse is secretly taking on debt?

Dvorkin: There’s tremendous resources, especially you know and I’ll plug Debt.com.com. We have spent a tremendous amount of money going through and trying to put on our website uh educational products and videos and courses. But more importantly, specific to marriage and debt and maybe marriage and or divorce and debt and things such as this so there are offerings on there it’s all free obviously. But people should do research and be careful where you go because sometimes that research or the advice may lead you to buy something uh from somebody maybe you shouldn’t be buying from. I will tell you that marriage is a roller coaster and some years are great some years are bad and I will just from what I’m seeing because of this COVID situation uh people have been cooped up together and there are a lot of what was uh good relationships breaking up uh because they’ve spent so much time together and now the next couple years we’re unsure of what is to come maybe some more financial pressures maybe the economy won’t be so good or maybe the economy has been good and maybe now is the time to check out of a relationship. But if you can and especially if you have kids try to keep it together, try to keep the marriage together.

Cleland: You know, and that brings up too, and Vicki and I have seen this along the way too. That financial infidelity is not always limited to um spouses, relationship partners it can also be through business relationships where one is not always ethical, or you know embezzling funds whatsoever but um you know I think the same things hold through with that but are you are your resources available for you know say a business partner that took on debt?

Dvorkin: I mean businesses are a little bit different because you know there’s an agreement between them usually that is better handled by attorneys. Debt.com really is focused on personal finances rather than business relationships. I will tell you that the one thing that Vicki said earlier which really hammered at home is if you’re going through a divorce you always need to protect the children and that is done by an insurance policy to make sure that if I’ve seen it too many times where the parents are in a dysfunctional relationship but the children shouldn’t suffer and you can solve that relatively easily and relatively inexpensively by an insurance policy.

Cleland: I agree um one last thing Christopher and Vicki did an article on this week. We just published it today. About a postnup can you explain what a postnup is?

Melcher: Well and that’s the agreement that you know they try to make during the marriage to reorder their finances so state law you know controls what the rights and obligations are to each other as marital partners and by agreement typically they can alter those as to property not as to kids. But that is a very complex agreement and so to me the thought should be given before entering into the relationship and for those that are non-marital partners here dating partners contemplating marriage um I hate prenups and that was my specialty. I don’t even want to do them anymore and I developed a career around prenups I really don’t like them anymore except for one reason it forces people to talk about their financial expectations and their relationship and I guarantee no one talks about that stuff when they’re dating or contemplating marriage they want to know where do you want to live and what kind of kids do you want where your dreams where do you want to retire. Nobody talks about are you a spender or saver and what their goals are financially.

So that is one good thing and like Howard mentioned also there’s like basically an inventory of your assets and debts that you would fill out. So, I would encourage couples as they’re thinking about a marriage um not only just doing the wedding plans but also doing the financial plans because you this relationship is more of more than just the love and having kids and growing a life together. It’s also saving money and being responsible with the money and being on the same page with that and how would you know how your partner feels about money if you’ve never asked and that’s the shocker five years in all of a sudden somebody’s blowing all the money and the other is a saver and they’re upset and it’s like well did you ever talk about it? No, they just assumed. So I wouldn’t assume that anyone else thinks like you do unless you’ve really talked to them and they verified that. So that would be my tip is to know what you’re getting into beforehand and if you’re already in the relationship to do the financial health checkups with a professional who’s going to help you achieve your goals and also make sure that you are both have the visibility that you need on your finances.

Cleland: Sounds good. And Vicki maybe you can get some questions or some bullet points together we can put in the group on you know financial checklist for people that are dating looking to enter a marriage just from your perspective that they can talk about we can post that.

Gunvalson: Yeah, I think that would be great. So, um I think a lot of it is just common sense. I mean if you’re scared, we’re scared, if you’re not scared we’re not scared. But at the end of the day, it’s your life you get to control how you want to live it but I think at the end of the day we just want full disclosure. We want to know what’s going on and you never want to be blindsided by you know infidelity like that.

Dvorkin: But Vicki you have to admit that young love is great. Early love is great, and you know you’re more involved with the romance of a relationship, and then it is difficult for people to bring up finances because all of a sudden, you’re on a high and then you bring up finances and it may not be so great after that.

But people do Chris is a hundred percent correct that people need to understand the mindset. How they were raised, the values that they were raised, are they bringing debt into the union and it’s best to do it early before the marriage is consummated simply because you don’t want surprises. Marriage is tough enough you certainly don’t want to know that your spouse is coming in with bad credit, or lots of debt, or student loan debt, or judgments, and the list goes on and on.

Gunvalson: Yeah, I agree. Young love is good and older love is good. Love is love and you know how much I love love but um we gotta just be mature about this and also understand if there’s gonna be a situation that probably will be about money you know yeah literally.

Dvorkin: Normally is.

Cleland: Well, thank you guys for your time and your um expertise. I think is very valuable um I don’t see any additional questions at this time so.

Gunvalson: Good.

Cleland: Let everybody get back to work. But I really appreciate it.

Gunvalson: Thank you, everyone.

Dvorkin: Thanks

Gunvalson: Thanks, Howard

Dvorkin: Thank you so much for having us

Cleland: Okay take care

Gunvalson: Okay bye bye

Financial infidelity FAQ

Is financial infidelity a crime?

Financial infidelity is viewed as a “premeditated crime” because hiding or lying about money takes active and deliberate planning. And many people view it as worse than cheating, physically, on a partner.

Is financial fidelity abuse?

Financial fidelity can be a form of abuse. Financial abuse is a tactic used by one person in a relationship to gain power and control by limiting access to money, assets, and family finances. While they may be linked, they are two separate behaviors. Many relationships can survive financial infidelity; most cannot survive financial abuse.

Is financial infidelity grounds for divorce?

While the cases will vary from person to person, financial infidelity is among the more common causes of modern divorce. Spouses lying about their level of debt, spending habits, income, or what property they might own, can do real damage to the marital relationship. A level of trust has been broken and it is up to the two individuals to see if they can rectify their issues. However, it rarely constitutes legal grounds for divorce, depending on the state’s divorce laws.