It’s never easy going through a divorce. The debt that you deal with both during and after it can make that tough situation even tougher.

You may be wondering what will happen to joint accounts or how to rebuild your finances after everything is said and done. Debt.com is here to help! And in the fastest and most efficient way possible.

Instant Debt Advisor℠ is a new tool that connects everyday folks like you with the debt solutions they need. Answer a few questions and you’ll learn what debt relief program will truly save you the most money in your unique situation. Divorce is expensive and often leads to a drop in your credit. Fortunately, Instant Debt Advisor℠ is free to use and will have no impact on your credit.

We’ve created this guide to show you how you can expect debt to be divided during your divorce, how to pay it off once you’re divorced, and what divorce can mean for your credit.

Divorce and debt responsibility

There’s nothing easy about divorce. In addition to the emotions involved, there are difficult decisions inherent in separating one life back into two.

Whether you want to face it or not, divorce is a common part of life. Ninety percent of people marry by age 50, according to the American Psychology Association. But 40 percent to 50 percent of married couples divorce.

It’s important for couples to talk about money. Many couples don’t. And those who hide spending are likely to end in a tougher financial situation after they split up, says Debt.com’s 2024 Debt and Divorce survey. In a poll of more than 500 divorces, 1 in 3 said they divorced due to credit card debt. Of those respondents, more than 7 in 10 said they – or their ex – hid spending and credit card debt.

Knowing what happens to finances through a divorce can help people avoid catastrophes later. Here are eight things you should know about how debt is handled during a divorce…

1. Debt responsibility varies by location

When it comes to untangling your financial life during a divorce, your location determines in large part who is responsible for what debt.

For example, community property states hold both spouses liable for debts they incurred while married regardless of whose name is on the account, as a general rule (exceptions do apply). Community property states include:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

2. How an equitable distribution state handles debt

The majority of states adhere to the “equitable distribution” rule.

In these states, a family court judge will decide what’s equitable (or fair) and distribute assets and debts accordingly. Each spouse can legally claim what they feel is a fair and equitable amount of their assets as well as their debts.

Assets and debts may not be divided using the same formula in every case. One spouse could have more debt than assets or vice versa, for example.

3. Lender contracts remain in place despite divorce

A divorce doesn’t matter to your lenders. One or both of you signed a loan agreement to borrow money. That obligation isn’t affected by a divorce.

Creditors don’t tend to know whether or not you have gotten divorced because this information doesn’t appear anywhere like a credit report. Changing your name or address will not get you off the hook for repayment of any outstanding balances.

Divorcees usually see an initial drop in their credit score simply because they take on debt getting out of the marriage. Divorce attorneys don’t work for free. Research from Forbes and findlaw.com shows divorce typically costs more than $10,000 for each spouse – with the average cost between $15,000 and $20,000. Debt.com’s survey found 1 in 4 divorcees reported taking on more than $10,000 in debt after the divorce.

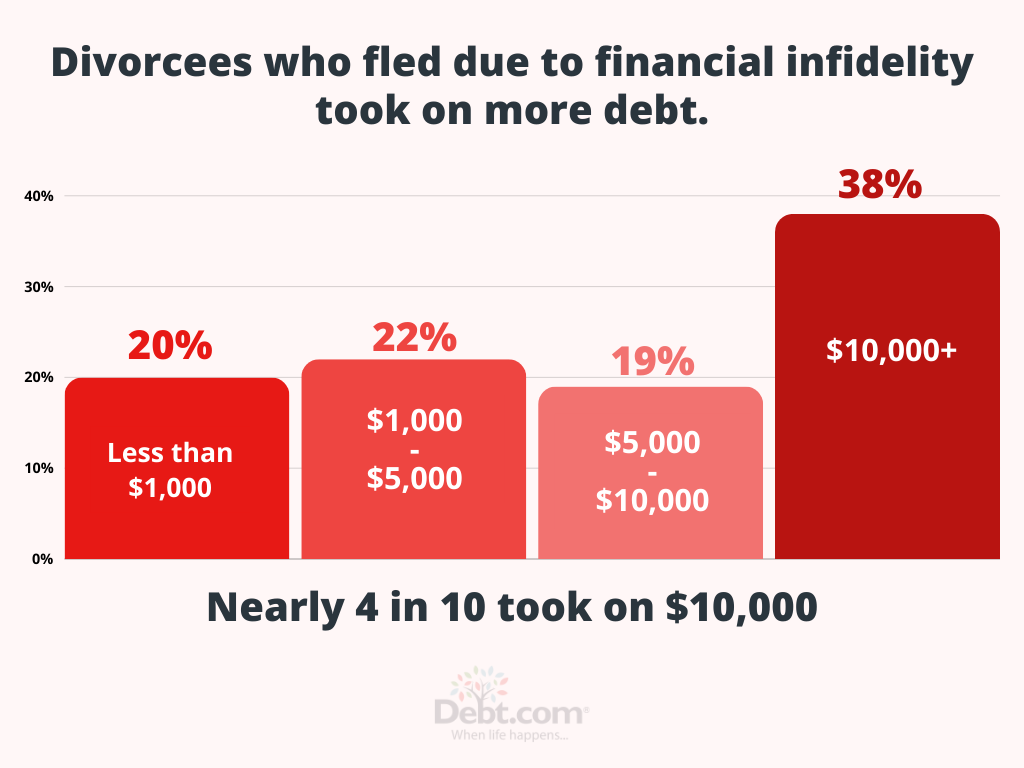

The number of divorcees reporting more than $10,000 in debt as a result of their divorce jumped up to nearly 4 in 10 (38%) among couples who split over credit card debt and financial infidelity.

4. Creditors may come after you on your ex-spouse’s accounts

Creditors often pursue the other spouse for payment on delinquent accounts. This can happen even when the innocent spouse’s name is not on the account. It can also happen even where the spouses are no longer married.

If you live in a community property state, one way to counteract this is to include a provision in your divorce decree that indemnifies you on any account in your ex-spouse’s name should they default. Besides repaying the debt, you’ll also be responsible for late fees and any collection costs.

Another option is to pay your ex-spouse’s debt and keep proof of payment. Then, you can contact family court and ask them to help you get reimbursement from your ex.

5. Student debt isn’t shared in some situations

While a mortgage, car loan, and credit card debt may be shared debt, student debt is different. If you racked up student loans before marriage, that debt remains your sole liability.

The only way that student debt in your ex-spouse’s name would be your responsibility is that if it was somehow listed that way in a prenuptial agreement.

6. Student debt acquired during marriage can get tricky, too

When student loan debt is incurred during the marriage, it becomes a bit more challenging to navigate. Unless both spouses co-signed for that student loan, the issue of who is responsible then depends on the state you live in (i.e., community property or equitable distribution state) and who benefitted from the student loan.

7. Joint responsibility for unsecured debt

Unsecured debt like credit cards is the fiscal responsibility of both parties in a divorce. If you both decide to not pay it off, then both of you will see your credit scores dip.

During a divorce when you are splitting up assets, it’s a good idea to consider using some of those proceeds to get rid of the joint credit card debt. Because so many couples take on additional debt many see their credit scores drop. How much? Debt.com’s Debt and Divorce survey shows more than 4 in 10 saw a drop by more than 50 points in their credit score.

8. Consider refinancing existing debt

If your divorce is relatively civil, you may want to discuss refinancing your existing debt to remove each other’s names from specific debts, leaving only one spouse responsible for those payments. You may each have to apply for your own new loan. Sometimes this can be challenging due to a low credit score or reduced income.

This strategy can help each person to move on physically, mentally. and financially. This video explains the financial part of divorce…

[On-screen text] How Will Divorce Affect Your Finances?

You may have debt to repay from your divorce decree

4 in 10 people who get divorced leave court with more than $5,000 in debt

And that’s not including the costs of getting divorced, which averages $12,900

Divorce may also cost you your good credit score

One-third (38%) of divorcees see their scores drop by 50 points or more

Debt.com knows how serious divorce debt and credit problems can be

That’s why we created a guide to help you find stability after divorce

Debunk the divorce and debt myths

When you tell friends and family about your divorce, you will likely hear a lot of divorce myths disguised as good-natured advice. In a stressed emotional state, you may be more likely to believe them. Don’t be fooled – especially when it comes to financial myths.

1: You aren’t liable for any of your ex-spouse’s debt after your divorce.

Reality: You could be liable depending on the situation, the state you file for divorce in, and terms of the debt.

2: Joint accounts are automatically closed after divorce.

Reality: It’s illegal for creditors to close an account due to altered marital status. Joint accounts can be closed by only one of the individual account holders, but they must have a zero balance before the account can be closed.

3: If a divorce agreement names one spouse responsible for joint account payments, the other spouse can’t be held responsible.

Reality: Unless the names on the account change to remove one of the account holders, both spouses are still responsible for payments.

How likely is it that one person will take sole responsibility for the debt?

Debt.com’s Debt and Divorce survey finds more than 1 in 3 (37%) “now have sole responsibility for a debt they once shared with their partner.”

For those that weren’t solely responsible, the debt didn’t just go away. Unless they removed their names from the account, they would still be held liable if the debt wasn’t paid by their ex.

4: Nothing your ex-spouse does will show up on your credit report.

Reality: When you share accounts, your ex-spouse’s actions can still affect your credit report. If you have joint accounts, close them quickly to avoid any potential damage moving forward.

5: Spouses share a credit score while they’re married.

Reality: Every individual has their own credit score, regardless of marital status. While joint accounts can affect both spouse’s credit, you maintained individual credit scores throughout your marriage and need to maintain those scores moving forward.

What impact does divorce really have on consumer credit scores?

Debt.com’s research shows that close to half of divorcees (48%) saw their personal credit scores drop after finalizing their divorce.

Find out what it really takes to get rid of your post-divorce debt.

How divorce affects different types of debt

Not everything gets split down the middle. Divorce affects different types of debt in varying ways, and every effect is totally dependent on the situation and the judgment by the court. Here are some examples:

Assuming control of debt with collateral

Debt with collateral, such as a mortgage or car loan, can be difficult to divide. If you want to keep the collateral – the house, car, or other assets – you need to assume control of it in the divorce agreement. Keep in mind that you may have a hard time affording these payments on your own.

Tips for managing debt with collateral:

- Don’t hang on to any property in your divorce for sentimental or emotional reasons. Always consider the financial burden first.

- If you decide to assume control of the debt, make sure your ex’s name is removed from any titles and loan agreements.

- Set up a budget with only your income to see if you’ll be able to afford the payments.

- Don’t include alimony or child support payments in your initial budget because you don’t yet know if your ex will pay!

- Consider setting up AutoPay to pay the bill automatically so you can avoid late or missed payments.

- If you determine you won’t be able to afford the payments, don’t wait for default. Arrange to sell the property as soon as possible and downsize to something you can afford.

Credit card debt in divorce

How is credit card debt split in a divorce? This is a common question for couples when they split up, especially because credit card debt is so common. Usually, the debt will be divided depending on whose name was on the account. This can get messy if you have joint accounts.

The bottom line is this: creditors don’t care about your divorce decree. You need to figure out how the debt will be divided during divorce proceedings and stick to the agreement after the fact. Once your divorce decree is final, pay off joint accounts quickly and close them, so your ex can’t make new charges that you’ll be responsible for repaying.

Tips for overcoming post-divorce credit card debt

- If you have good credit and multiple credit cards to pay off after your divorce, consider a debt consolidation loan first. This will roll all of the high-interest balances into a single monthly payment at the lowest interest rate possible.

- If your credit score isn’t the best, but you want to avoid additional damage, call a consumer credit counseling agency. They may be able to help you set up a debt management program, which will reduce the interest rates applied to your debts so you can pay them off faster.

- If you don’t care about credit score damage and simply want to eliminate the debt as quickly as possible, debt settlement might be your best option. This allows you to get out of debt for a portion of what you owe.

Student loan debt and divorce

With the country’s crushing student loan debt, it’s no wonder that student loan debt could cause problems in divorce. Student loan debt that you incurred before your marriage still belongs to you after your divorce. The same would be true of your ex.

If you took out student loans during your marriage, however, things get more complicated. It’s possible you will have to work with divorce counsel to divide the debt, or if it’s only in one person’s name, you can just divide it that way. The way student loans are split up in a divorce is largely dependent on your unique situation.

Tips for paying off student loans after you divorce

- For federal loans, look into income-driven repayment plans. These are plans that consolidate your debt into one monthly payment that’s set based on your income. Since a consumer’s income is usually lower after a divorce, these are often a great fit.

- If you have private student loans, you may need to refinance to lower the interest rate. This makes it easier to pay off the debt faster and may lower your monthly payments.

- If your student loan debt is simply overwhelming your budget on your income alone, then consider bankruptcy. It’s a myth that student loans can’t be discharged in any circumstance. If your loans are causing severe financial hardship, they can be discharged.

Dividing tax debt in divorce

Whether or not you are liable for their back taxes at all depends on when the taxes were filed and if you filed jointly. Tax debt in a divorce is often divided according to the person that incurred it. However, if you live in a community property state, the tax debt may be divided equally between you and your ex-spouse, regardless of who incurred it or your current employment status.

Community property states currently include:

- Alaska

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Innocent spouse relief

If your spouse incurred a large amount of tax debt that you weren’t aware of, you may qualify for Innocent Spouse Relief from the IRS.

Find out what it takes to qualify for Innocent Spouse Relief »

What to do if you don’t qualify for Innocent Spouse

- First look into setting up an Installment Agreement (IA). This is a repayment plan that will pay off all your tax debt in 72 payments or less.

- If you can’t afford the payments on an IA, consider an Offer in Compromise. This settles a tax debt for less than you owe.

Debt and divorce: step-by-step financial prep

When you decide to get a divorce, you may feel the need to pay off your debt as quickly as you can. This is not always a good idea, and you could end up in even more financial trouble. Instead of rushing to eliminate debt, focus on getting your divorce agreement to reflect what you really want and need. Once that’s organized, you can focus on debt relief.

These three basic steps can help you better prepare for your financial life post-divorce:

1 – Separate joint accounts.

If you and your spouse have joint accounts, it’s time to close them or find a way to take your name (or theirs) off. Avoid accruing more debt while in an already expensive situation.

2 – Open accounts under your own name.

After you get rid of your joint accounts, you will need some accounts of your own. Replace closed accounts with accounts under your own name. If you are changing your last name post-divorce, make sure you do that before you put your married name on the new account.

3 – Establish a personal budget.

The budget you had as a couple won’t be the same as your individual budget. Reassess your finances post-divorce and set a new budget for yourself. This can help you get out of debt faster – and stay out of debt in the future.

Because of your divorce, you may find that you have to add new things to your budget. Child support, alimony, and higher payments on debts with collateral are all possibilities you should consider.