What’s the state of credit card debt for Americans? Collectively $1.13 trillion in credit card debt, according to the latest data from the New York Fed. But how do credit card debt statistics look for American households?

How much credit card debt does the average American have?

Not all Americans use credit cards—but most do. Nearly eight out of ten Americans (79%) have at least one card in their name.[1] Of those, only 45.4% of households carry credit card debt over from month to month.[2] Overall consumer debt has increased for Americans, average credit card balances jumped to $7,951.

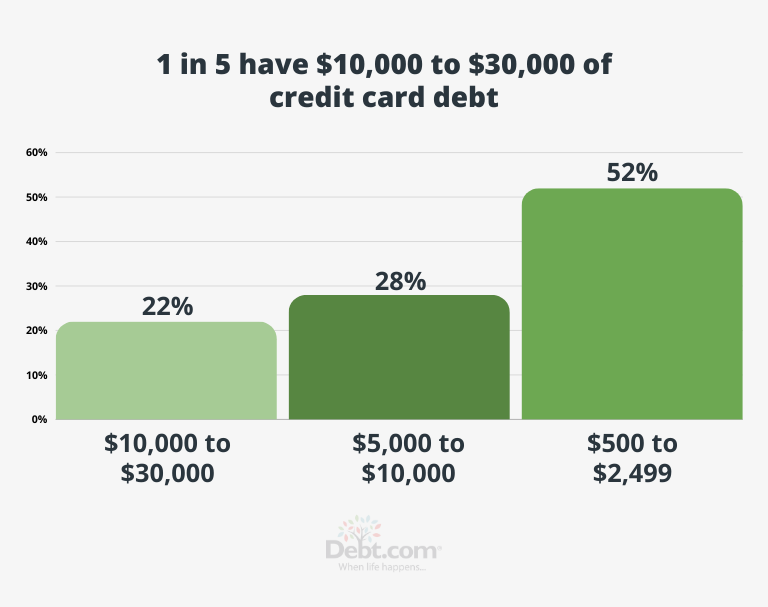

Debt.com’s latest survey of 1,000 credit card users shows 1 in 5 have between $10,000 and $30,000 in credit card debt.

Total U.S. Credit Card Debt

- Total amount American consumers owe in revolving credit card debt (as of March 2023) — $1.13 trillion

- The average amount owed by households that carry credit card debt (as of Dec 2022) — $7,951

Credit card debt statistics per borrower

- Average credit card debt per borrower in 2023 — $7,951

- Average credit card debt per borrower in 2022 — $5,910[11]

- Average credit card debt per borrower in 2021 — $5,525[3]

- Average credit card debt per borrower in 2020 — $5,897[3]

- Average credit card debt per borrower in 2019 — $6,494[3]

Credit card interest rate statistics

- Average national APR (annual percentage rate) on credit cards as of 2023 — 20.77%[5]

- Average rate on low-interest credit cards — 17.92%[5]

- Average penalty interest rate for credit cardholders who missed a payment — 25.57%[6]

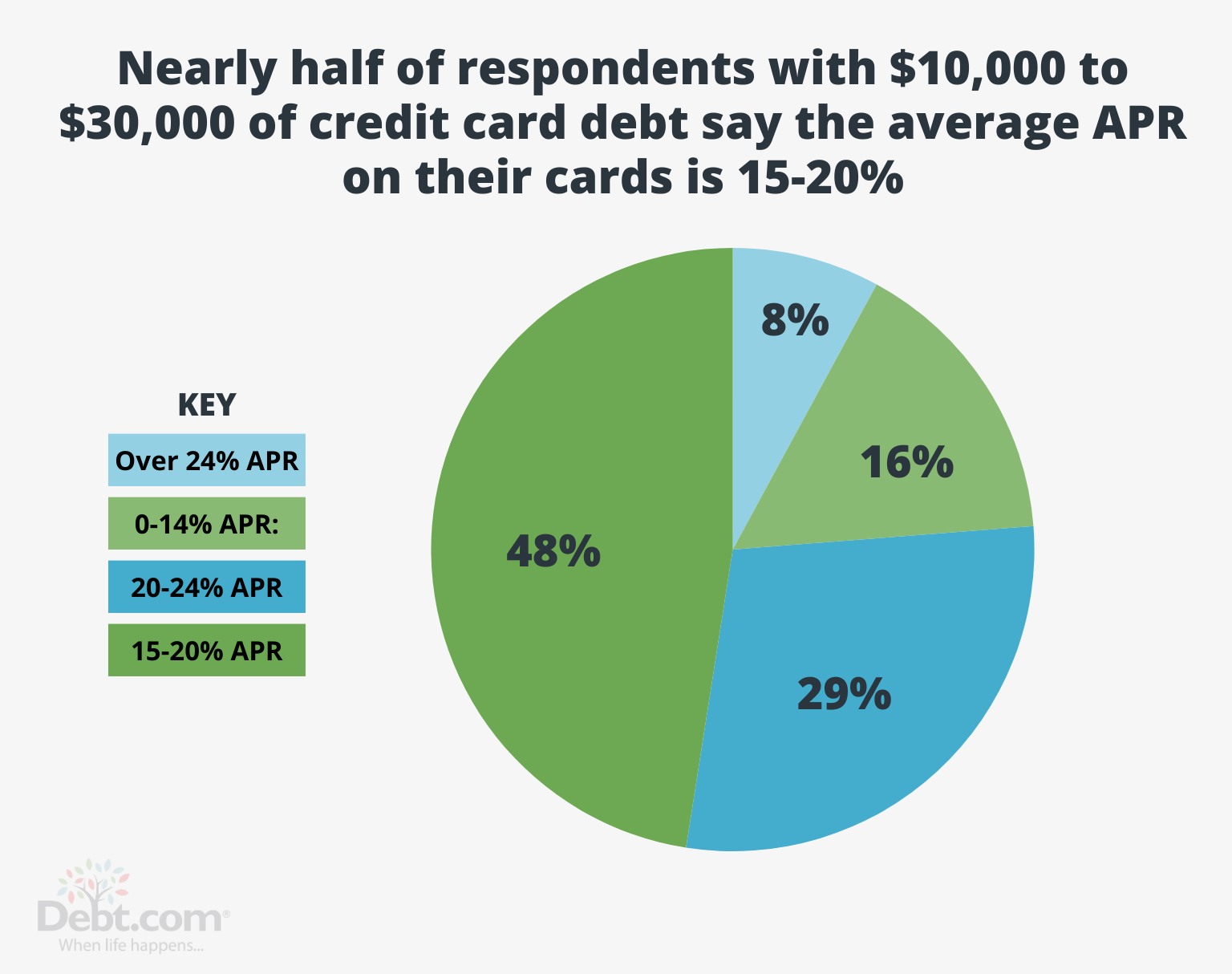

Debt.com’s 2024 Credit Card Debt survey reveals more than half of respondents with $10,000 to $30,000 in credit card debt have an average APR between 15% and 20%.

Credit card debt for college students

- The average college student had 5 credit cards in 2019[7]

- Only 60% of college students pay the full balance of their bill every month[7]

- 22% of college students have paid a credit card bill late at least once[7]

- Average balance of a student’s credit card for the latest month was $1,423 in 2019[7]

- 23% of students replied “somewhat agree” or “strongly agree” to the statement that their credit card debts were out of control[7]

Other statistics related to unsecured debt

- Average payday loan amount — $350 on a two-week term[8]

- Average payday loan cost from a storefront — $15 / $100 borrowed[9]

- For a two-week loan, this is an APR of 391%[9]

- Median online payday loan cost — $23.53 / $100 borrowed[9]

- For a two-week loan, this is an APR of 613%[9]

- Average auto title loan — Between $100 and $5,500[10]

Don’t let credit cards and other debts take control of your finance. Find solutions to regain stability.

Credit Card Debt by State

Alabama Average Credit Card Debt

- 2021: $4,875

- 2022: $5,364

- Change: +10%

Alaska Average Credit Card Debt

- 2021: $6.617

- 2022: $7,338

- Change: +10.9%

Arizona Average Credit Card Debt

- 2021: $5,061

- 2022: $5,061

- Change: +13.7%

Arkansas Average Credit Card Debt

- 2021: $4,670

- 2022: $5,183

- Change: +11%

California Average Credit Card Debt

- 2021: $5,154

- 2022: $6,030

- Change: +17%

Colorado Average Credit Card Debt

- 2021: $5,593

- 2022: $6,274

- Change: +12.3%

Connecticut Average Credit Card Debt

- 2021: $6,052

- 2022: $6,825

- Change: +12.8%

Delaware Average Credit Card Debt

- 2021: $5,357

- 2022: $6,015

- Change: +12.3%

District of Columbia Average Credit Card Debt

- 2021: $5,949

- 2022: $6,904

- Change: +16%

Florida Average Credit Card Debt

- 2021: $5,620

- 2022: $6,408

- Change: +14%

Georgia Average Credit Card Debt

- 2021: $5,604

- 2022: $6,343

- Change: +14.8%

Hawaii Average Credit Card Debt

- 2021: $5,525

- 2022: $6,343

- Change: +14.8%

Idaho Average Credit Card Debt

- 2021: $4,539

- 2022: $5,181

- Change: +14.1%

Illinois Average Credit Card Debt

- 2021: $5,315

- 2022: $6,011

- Change: +13.1%

Indiana Average Credit Card Debt

- 2021: $4,285

- 2022: $5,017

- Change: +10.8%

Iowa Average Credit Card Debt

- 2021: $4,285

- 2022: $4,811

- Change: +12.3%

Kansas Average Credit Card Debt

- 2021: $5,029

- 2022: $5,532

- Change: +10%

Kentucky Average Credit Card Debt

- 2021: $4,408

- 2022: $4,894

- Change: +11%

Louisiana Average Credit Card Debt

- 2021: $5,054

- 2022: $5,577

- Change: +10.4%

Maine Average Credit Card Debt

- 2021: $4,538

- 2022: $5,078

- Change: +11.9%

Maryland Average Credit Card Debt

- 2021: $5,911

- 2022: $6,668

- Change: +12.8%

Massachusetts Average Credit Card Debt

- 2021: $5,232

- 2022: $6,046

- Change: +15.5%

Michigan Average Credit Card Debt

- 2021: $4,661

- 2022: $5,265

- Change: +13%

Minnesota Average Credit Card Debt

- 2021: $4,754

- 2022: $5,425

- Change: +14.1%

Mississippi Average Credit Card Debt

- 2021: $4,449

- 2022: $4,912

- Change: +10.4%

Missouri Average Credit Card Debt

- 2021: $4,865

- 2022: $5,417

- Change: +11.4%

Montana Average Credit Card Debt

- 2021: $4,778

- 2022: $5,385

- Change: +12.7%

Nebraska Average Credit Card Debt

- 2021: $4,789

- 2022: $5,312

- Change: +10.9%

Nevada Average Credit Card Debt

- 2021: $5,373

- 2022: $6,176

- Change: +14.9%

New Hampshire Average Credit Card Debt

- 2021: $5,251

- 2022: $5,944

- Change: +13.2%

New Jersey Average Credit Card Debt

- 2021: $5,995

- 2022: $6,819

- Change: +13.8%

New Mexico Average Credit Card Debt

- 2021: $4,821

- 2022: $5,350

- Change: +11%

New York Average Credit Card Debt

- 2021: $5,473

- 2022: $6,269

- Change: +14.5%

North Carolina Average Credit Card Debt

- 2021: $5,101

- 2022: $5,658

- Change: +10.9%

North Dakota Average Credit Card Debt

- 2021: $4,874

- 2022: $5,408

- Change: +11%

Ohio Average Credit Card Debt

- 2021: $4,808

- 2022: $5,320

- Change: +10.7%

Oklahoma Average Credit Card Debt

- 2021: $5,155

- 2022: $5,654

- Change: +10.7%

Oregon Average Credit Card Debt

- 2021: $4,630

- 2022: $5,316

- Change: +14.8%

Pennsylvania Average Credit Card Debt

- 2021: $5,026

- 2022: $5,316

- Change: +12.2%

Rhode Island Average Credit Card Debt

- 2021: $5,153

- 2022: $5,867

- Change: +13.9%

South Carolina Average Credit Card Debt

- 2020: $5,237

- 2021: $5,176

- Change: -1.80%

South Dakota Average Credit Card Debt

- 2021: $4,591

- 2022: $5,071

- Change: +10.5%

Tennessee Average Credit Card Debt

- 2021: $4,891

- 2022: $5,432

- Change: +11.1%

Texas Average Credit Card Debt

- 2021: $5,820

- 2022: $6,542

- Change: -0.80%

Utah Average Credit Card Debt

- 2021: $4,831

- 2022: $5,535

- Change: +14.6%

Vermont Average Credit Card Debt

- 2021: $4,595

- 2022: $5,159

- Change: +12.3%

Virginia Average Credit Card Debt

- 2021: $5,864

- 2022: $6,477

- Change: +10.5%

Washington Average Credit Card Debt

- 2021: $5,231

- 2022: $6,043

- Change: +15.5%

West Virginia Average Credit Card Debt

- 2021: $4,574

- 2022: $5,005

- Change: -+9.4%

Wisconsin Average Credit Card Debt

- 2021: $4,329

- 2022: $4,808

- Change: +11.1%

Wyoming Average Credit Card Debt

- 2021: $5,159

- 2022: $5,745

- Change: +11.4%

Source: Experian

If you have too much credit card debt, we can help. Talk to a certified credit counselor to find solutions today.

Source:

[2] https://www.valuepenguin.com/average-credit-card-debt

[3] https://www.experian.com/blogs/insights/2021/09/state-of-credit-2021/

[4] https://www.nerdwallet.com/blog/average-credit-card-debt-household/

[5] https://www.creditcards.com/credit-card-news/rate-report/

[6] https://wallethub.com/edu/cc/credit-card-interest-rates/52541/

[7] https://www.creditcards.com/credit-card-news/student-credit-debit-prepaid-statistics/

[8] https://www.experian.com/blogs/ask-experian/how-payday-loans-work/

[9] https://www.nerdwallet.com/article/loans/what-is-a-payday-loan

[10] https://consumer.ftc.gov/articles/what-know-about-payday-car-title-loans

[11] https://www.experian.com/blogs/ask-experian/state-of-credit-cards/