After months of nonpayment, credit card companies assume you’ll never pay. So they close the account calling it a “charge off.” It’ll seriously damage your credit, and just because the account is closed doesn’t mean you’re off the hook for the debt.

If you just learned one of your credit card accounts has been charged-off, don’t feel ashamed or alone. Federal Reserve Economic Data shows charge-off rates have been trending upward since 2022, when most stimulus money from the CARES Act and American Rescue Plan ran out.[1]

If you’re struggling to make minimum payments – or already facing a charge-off – there are resources to tap for help. Use Instant Debt Advisor℠ to find the right one for you in only three minutes. Answer a brief questionnaire about your current financial situation. It’s secure, free, and has no impact on your credit.

Learn how credit card charge-offs work and what you need to know as you decide how to deal with them this year.

What is a charge-off?

When a credit card company or lender closes an account due to nonpayment, it becomes a charge-off. The company has effectively written the debt off as a loss, meaning they have little expectation of getting paid. Charge-offs can occur with both credit cards and installment loans, but for the purposes of this guide, we’ll be focusing on credit cards.

Charge-offs happen after your account has become highly delinquent, usually after you have not made the minimum payment for six months.

Even though the creditor is assuming the account is a loss when they charge it off, you are still legally responsible for the debt. The creditor may:

Send the account to their in-house collections department

Have a third-party collector attempt to collect on their behalf

Sell the account to a third-party debt buyer

In any case, the collection practices will now be governed by the Fair Debt Collection Practices Act.

If you make payments but continually fail to meet your minimum monthly requirements, your account may become delinquent.

Then the creditor can declare your account to be a loss, and you will have a charge-off on your credit record.

You should keep in contact with your creditors if you can only partially pay to avoid your account getting charged off.

What charge-offs mean for your credit report

A charge-off is a serious derogatory mark on your credit report. The status of the account will show it as a charge-off. The account history will also show the missed payments leading up to the charge-off. This is all negative information that can seriously damage your credit score.

The charged-off account will continue to list the unpaid balance owed until it is paid, settled, or sold to a collector. Once any of those happen, the account balance will be changed to $0, and the status will be updated.

Charge-offs vs. collection accounts on your credit report

A charge-off is from the original creditor. A collection account is from a collection agency. Even though the original creditor wrote off your account as a loss, you still owe the total amount of the debt.

Sometimes the original creditor has a collections department. In this case, only the original account will show up on your credit report.

But collection accounts are often sold to third-party companies. In this case, you may get an additional negative item on your credit file. You will have the account from the original creditor and a collection account from the debt collector.

How long do charge-offs stay on your credit report?

Like many other derogatory records, charge-offs will remain on your credit report for seven years from the date the account originally became delinquent. This is the same as late payments, collections, or most other negative items.

How do charge-offs affect your credit score?

You will typically see a significant drop in your credit score as you begin to fall behind on payments, and your accounts eventually get charged-off. Credit history is the biggest factor used to calculate major credit scoring models like FICO and VantageScore. Thus, charged-off accounts are likely to drag your score down.

If you’ve had charge-offs in the past, the good news is that the “weight” of negative items decreases over time. So, the further you move away from those negative items, the less they’ll affect your score. If you’re recovering from a period of hardship, you can take steps to rebuild your credit so you can offset those negative items in the past with positive credit history now.

How to remove a charge-off

After you have a charge-off, there are a few options to remove it from your credit report, although the results are not guaranteed. If the charge-off was legitimately incurred, in most cases, you simply need to wait it out of the information to drop off your credit report. That will happen seven years from the date the account first became delinquent.

Does paying a charge-off remove it?

Paying off a charge-off will usually not remove it from your credit report unless you negotiate to re-age the account. If you pay off the account – either in full or for less than the full amount owed – the balance on the account will drop to zero, the status will change from “charge-off” to either “paid in full” or “settled in full,” but the account will remain on your credit file.

Negotiating re-aging

Consumers can try to negotiate re-aging the account. This means they will remove the charge-off status even if you haven’t yet repaid the full amount you owe back. In most cases, however, the creditor will not remove missed payment notations from the account. The Fair Credit Reporting Act requires that creditors and credit bureaus report accurate information on consumer credit use. Thus, if the missed payments were incurred legitimately, most creditors won’t want to violate the FCRA.

However, bringing the account status out of charge-off will help clean up your credit report, so it’s worth negotiating if you’re working to pay off the account. Creditors may agree to remove the charge-off status sooner. And this will look better on your credit report to anyone reviewing it.

Removing a charge-off without paying

If you can’t pay after a charge-off, there are few options left to remove it from your credit report.

Options for dealing with charged-off accounts

After your debt gets charged off, it may get sold to a third-party debt collection agency. You can choose to settle in full, pay in full, or do nothing (which we do not recommend).

It’s important to review your credit report carefully, so you know who owns the account. Credit card companies may hire outside collection agencies to collect on their behalf. If that happens and you negotiate a settlement with the collection company, make sure the credit card company is actually agreeing to the settlement. Otherwise, you may settle, and the creditor will continue to come after you for the remaining balance owed.

Paying a charge-off

Deciding whether you should pay a change-off – or how much of it you should pay – depends on your goals. Some people are committed on a personal level to paying what they owe, in which case it makes sense to pay in full. Others are simply looking to avoid collections and court, so either paying in full or negotiating a settlement could make sense.

But if your goal is to improve your credit score, then you may want to think twice about paying the full balance to achieve your goal.

As with paying off collections in full, experts largely agree that paying off a charge-off account in full probably won’t boost your credit score. So, if your mission is to get a better score, there may be better uses for your money, especially if you have other debts that aren’t charged off.

Even the credit experts at Experian agree:

“Paying a closed or charged-off account will not typically result in immediate improvement to your credit scores,” says Jennifer White, Consumer Education Specialist at Experian. “Paying an outstanding debt is always better than not paying it, but how much it will affect your credit score (if at all) depends on other factors in your credit history.”[2]

In other words, paying off charge-offs and collections will only translate to an improvement in credit score in some cases and only over the long term. Keeping up with debts that are current and catching up with debts that are past-due but not charged off will have a much better effect on your credit.

What part of a credit profile does paying the account in full effect?

Paying an account in full will affect one line on your credit report. When you pay a charged-off account, the status of the account will be updated from “Charged-Off” to “Paid in full” or slight variations of that phrase, depending on the credit bureau. The account balance will be updated to $0.

If you settle an account for less than the full amount owed, the balance will also update to $0. The account status, however, will be listed as “Settled in Full” or some variation. That’s the difference between paying less than the full balance versus paying it in full.

In both cases, the account will stay flagged on your report for the next seven years for the negative credit history you stacked up before the account became a charge-off. That information will only be removed seven years from the date the account first became delinquent.

So, you may want to think twice about paying an account in full if boosting your credit score is your primary goal. If there are other reasons you want to pay the account in full, don’t let this discourage you. Just don’t bank on it for a quick credit score increase.

Should I include charged-off accounts in a debt management plan?

If you get credit counseling and decide to enroll in a debt management plan to pay off your debt, you have the option of including charged-off accounts.

However, be aware that a debt management plan will always pay off balances in full. So, if you have charged-off accounts and collections, you can include them but you’ll pay back everything.

You will also typically lose one of the main benefits of enrolling in a debt management program with these types of accounts. Most creditors do not charge interest once accounts are charged-off. Thus, there’s nothing for a credit counseling team to negotiate for you. They can’t reduce or eliminate interest when no interest is being charged in the first place.

The good news is that there is no rule that you must include every account you have in a debt management plan. You can decide to leave charge-offs and collections out and only use the program for debts that are current or behind. Then you can settle the charge offs and collections separately.

Settling charge-offs for less than the full balance

Since paying a charge-off in full isn’t likely to improve your credit, in many cases, it may make sense to settle. With debt settlement, you pay a percentage of the full balance owed. In exchange for that money, the creditor will agree to discharge the remaining balance.

Once the settlement is accepted and you pay as agreed, the balance will be updated to $0 on your credit report. The account will be listed as settled.

If you plan to settle a debt that’s charged off, be aware that timing can be everything. If the creditor doesn’t hear from you while you generate funds for the settlement offer, they may sell the account to a third-party collector. Then you’ll have collections to deal with.

Another possibility is that the creditor or the collector that purchases can sue you in civil court for the debt. That can lead to issues like wage garnishment.

So, if you’re settling debt on your own, keep this in mind.

Working with a debt settlement company

If you have multiple charge-offs, collections, and delinquent accounts to pay off, then you may want to enroll in a debt settlement program. That way, you can take care of everything faster with one plan.

However, not all debt settlement companies work the same way. Some will contact your creditors when you sign up for a debt settlement program, letting creditors know you’re working with them. Others won’t contact your creditors until you have funds for them to make settlement offers.

Before signing up for a program, make sure to ask what communication the company will have with your creditors – and when. That way, you can understand how the program will affect your accounts and what you can expect moving forward.

Debt settlement is a more commonly known debt relief option than many personal finance experts and debt management professionals have previously thought, according to a survey on 1,000 Americans by Debt.com. Bankruptcy in some form has been an available option to discharge responsibility of outstanding debts since the 1800s. Debt settlement has really only been available since the late 1980s, when the federal government deregulated the banking industry.

Given debt settlement’s short history in comparison to bankruptcy, it’s surprising to see how many Americans are aware it’s an available option.

Discharge through bankruptcy

Most of your debt, including unsecured debts (such as credit cards) that became charge-offs, can be discharged through bankruptcy. In Chapter 7 bankruptcy, any non-exempt assets will be liquidated to pay your creditors. In Chapter 13 bankruptcy, you will pay a portion of the balance owed and then the remainder will get discharged.

Keep in mind that the accounts will remain on your credit record for seven years from the date they became delinquent.

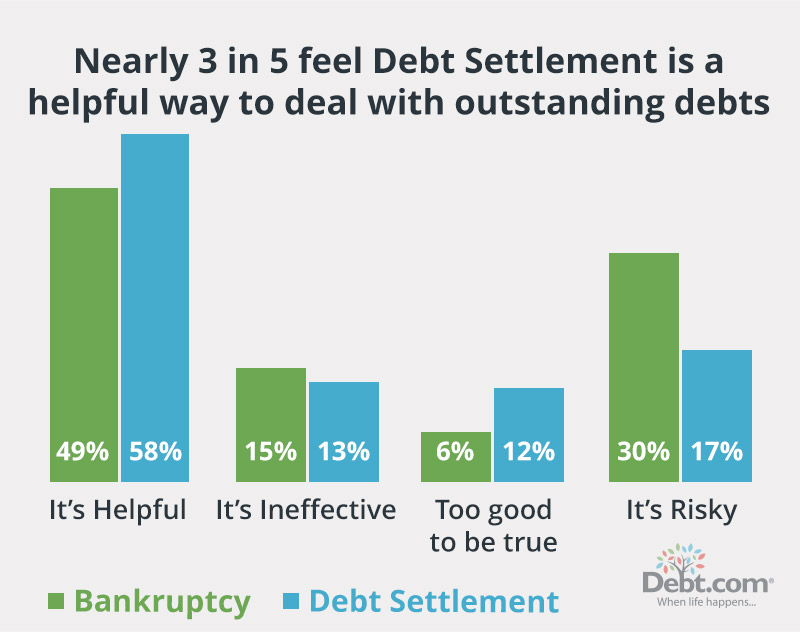

Given the choice between debt settlement and Chapter 7 Bankruptcy, most people favor settlement, according to Debt.com’s. Nearly 3 in 5 (58%) say debt settlement is “an effective way to deal with outstanding debts,” compared to less than half (49%) who said the same about Chapter 7 Bankruptcy.

More respondents also called Chapter 7 Bankruptcy “risky” than debt settlement:

The Chapter 7 Bankruptcy itself will fall off your credit report in ten years from the date of filing. Chapter 13 Bankruptcy will fall off after seven years.

What if you ignore a charge-off?

Even though your original creditor has taken a tax write-off and closed your account, you still owe the debt. If you completely ignore the charge-off, the creditor or a collector that purchases the debt and potentially get a judgment to garnish your wages or pursue other legal actions.

If possible and you have the means to pay at least something, then it may be in your best interest to avoid the risk of getting taken to court. It never has to get that far. Confront the problem head-on with Debt.com in your corner.

Give us a call at (844) 452-9059. One of our certified debt management professionals will go through a FREE debt analysis with you. It’s the first step to financial freedom.