Before committing to bankruptcy, there are several alternatives to consider. Here, we review alternatives to bankruptcy and how they compare. If you’re trying to avoid bankruptcy altogether or you’re just not sure what to do, this will give you an overview of your options.

Consolidation loans

A consolidation loan is a personal loan that you use to pay off all of your debt. Then, your monthly payments are replaced by one payment with a lower interest rate.

If you want to maintain your credit score and you could reasonably repay your debt with a loan, it may be a better option for you than bankruptcy. Learn more in our more extensive comparison of debt consolidation vs. bankruptcy.

Negotiate your debt

You also have the option to negotiate your debt with your creditors on your own. Unfortunately, this doesn’t always work, especially with very large amounts of debt.

With a low amount of debt, it can be possible to negotiate interest rates or balances by yourself. However, if you have enough debt that you’re considering bankruptcy, you may owe too much to make this option worth it.

Credit counseling/Debt management plans

Getting credit counseling is a great way to start any search for debt relief. Many credit counseling agencies offer evaluations from credit counselors for free to help you find the best solution for your needs. This can lead to enrollment in a debt management program, or DMP. A DMP is one of the least harmful options for your credit score, because it helps you pay back everything you owe at lower interest rates.

While bankruptcy will majorly hurt your credit, a DMP is a good way to preserve your credit score. If your amount of debt is too large, bankruptcy could still be your best bet; some (not all) credit counseling agencies have a maximum debt amount of $100,000, although some have no maximum. You can always talk to a credit counselor for free to find out!

Talk to a debt professional who can help you decide which bankruptcy alternative makes sense for you.

Debt settlement

Settling your debt involves paying less than you owe, but at the cost of your credit score. You work with a debt settlement agency that will negotiate with your creditors on your behalf to agree on an amount that’s less than your current balance. Then, you pay one bill through the debt settlement company instead of paying each of your creditors individually.

Although both debt settlement and bankruptcy will hurt your credit score, debt settlement is often the less damaging of the two. Want to know more? Take a look at our in-depth comparison of debt settlement vs. bankruptcy.

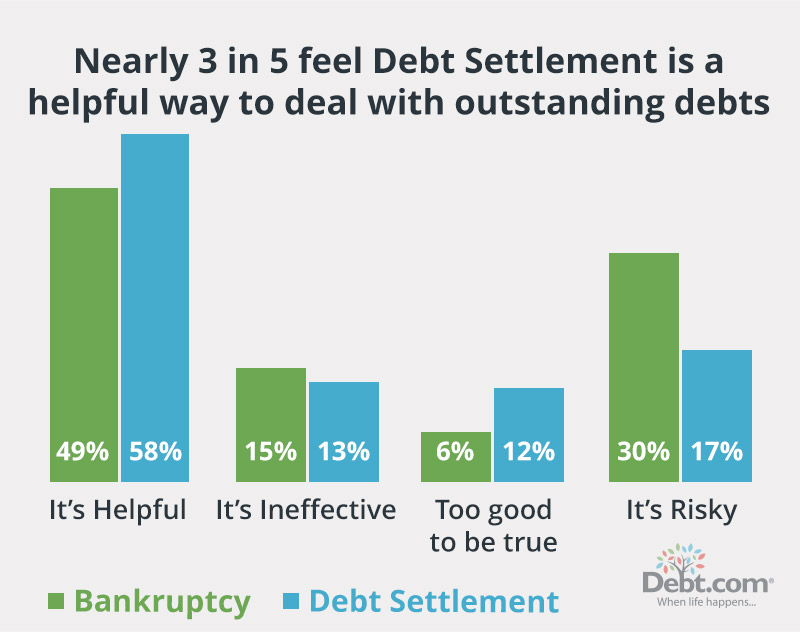

Debt.com has surveyed more than 1,000 Americans on how they feel about debt settlement and filing for bankruptcy. Most respondents say debt settlement is a “helpful way to deal with outstanding debts,” while more say bankruptcy is risky.

Ignore it

You do have the (unwise) option to ignore your debts, but it’s not recommended. You will likely continue to be hounded by debt collectors and your credit scores may continue to drop. No matter how much debt you have, it’s always best not to address it head-on.

Final thoughts

There are so many pathways toward debt relief that it can be difficult to decide. If you still think bankruptcy is the best option for you compared to these alternatives, read our guide to the pros and cons of bankruptcy to solidify your decision. The guide also reviews the differences between Chapter 7 bankruptcy and Chapter 13 bankruptcy to give you a deeper understanding of bankruptcy proceedings.