YES! You should always file your taxes!

No one wants to owe the IRS or state taxes, but it happens. After getting over the initial shock of how much you owe, the next step may be wondering what you’ll do if it turns out you can’t pay your taxes.

In a perfect world, this isn’t supposed to happen.

Taxes are meant to be paid gradually throughout the year so when tax time comes, if you do owe anything it should be minimal. Hopefully, you are entitled to a refund of overpaid taxes.

Employees have income tax withheld from their paychecks, while the self-employed pay quarterly estimated taxes directly to the Internal Revenue Service (IRS).

Learn about what to do if you can’t pay your taxes, what happens if you don’t file your taxes, what happens if you pay your taxes late, and much more.

What happens if you don’t file taxes?

The first thing that you want to be sure of is that you actually need to file taxes. While it may sound odd, not everyone must file a tax return each year.

Generally, if your yearly income is less than the standard deduction, there is no need to file your tax return. However, you do need to meet ALL of the conditions below to not file a tax return.

- Under the age of 65

- Made less than the 2022 standard deduction

- No special circumstance requiring you to file (Earning $400 or more while self-employed)

- Have not received unearned income of more than $1,150 for 2022 as a child or other dependent.

A tax return is necessary if you don’t meet these conditions. If you earned any income where taxes were withheld by an employer you’ll need to file a tax return.

If you don’t have the paperwork to file organized you can file for an extension. But this does not help if you owe taxes. Those are still due on April 18th.

IRS reminds taxpayers an extension to file is not an extension to pay taxes

If you do not file your taxes and have not met the requirements to require doing so, the IRS has several consequences for not filling taxes:

IRS notices will start to arrive in your mailbox

When someone forgets to file their tax return, the IRS sends out a summons, essentially, a not-so-friendly reminder. Receiving a summons means the IRS believes you owe taxes and is the first part of the IRS collection process.

The IRS notices will include notices of your tax debt balance, any penalties and fees that have been added, and information on the enforcement of tax debt collection. These notices may seem annoying and you might be tempted to ignore them.

“This legally compels you to meet with the IRS to determine your tax liability. While it is possible you won’t hear anything,” says David Beck, a Dix Hills, NY-based CPA, “if the IRS does find willful neglect to file a return, they can look into your entire tax history in lieu of fraud.”

The IRS Automated Collection System (ACS) will be activated

When you don’t respond to the IRS notices, you will be added to the IRS Automated Collection System (ACS), which is the system that the IRS uses to collect back taxes.

This system can issue liens as well as levy bank accounts and garnish wages as part of the consequences of your tax debt.

Penalties will be assessed

Like the summons before it, you will receive notice in the mail that you are being penalized. There are a number of reasons you could incur a penalty.

The penalties for failing to file a tax return are as follows:

- Failure to File penalty: 5% of the unpaid tax obligation for every month your return is late (will not exceed 25% of total unpaid taxes).

- A failure to pay penalty may also be applied, which is if you don’t pay the tax you report on your tax return. After 60 days, a minimum Failure to File penalty of $435 or “100%” of the tax is required to be shown on the return, whichever is less.

You will accrue interest on your tax amount due balance

If the added fees and penalties weren’t enough, you will begin accruing interest starting on your tax due date. You may end up paying interest on your unpaid taxes, a penalty, then interest on that penalty.

The IRS uses the federal short-term rate (which can vary), plus 3% in determining the amount of interest owed on your unpaid taxes. The failure to pay penalty is equal to 0.5% for each month.

Federal payments and state tax refunds could be affected

The IRS has the authority to seize your tax refund to offset the federal taxes you owe through what’s called the State Income Tax Levy Program (SITLP).

The tax organization will send a letter in the mail notifying you of what is taking place and you will have the opportunity to appeal once the funds are taken.

Further levies could be enacted, such as through the Federal Payment Levy Program (FPLP), which is a continuous levy enacted in order to collect the taxes due.

The payments that can be levied are:

- Federal employee retirement annuities

- Federal payments made to you

- Travel advances or reimbursements

- Social security benefits

- Other (Medicare provider and supplier payments, benefits by the Railroad Retirement Board and Military Retirement Fund)

The IRS will get its money somehow

The measures the IRS will enact include garnishing your wages, filing a federal tax lien, seizing money and assets, and sending your account to a debt collection agency.

If you owe more than $10,000 but don’t pay, you may first get a Notice of Federal Tax Lien. This means that if you try and sell your property or borrow against it, the IRS will get its payment first before you get your proceeds. These liens are public information, which means anyone can see that you have this obligation. As a result, it could negatively impact access to future credit. Declaring bankruptcy won’t clear these liens or discharge the tax debt.

Second, the IRS can assess levies by seizing assets. Typically, the IRS starts with seizing money but can move to other assets like property, vehicles, boats, etc. Common levies include wage levies, also known as wage garnishments. Here, it will take a portion of your wages to pay your tax bill until it’s settled.

The IRS can also conduct accounts receivable levies and bank levies. These levies can create problems for you in terms of paying your other bills or disrupting the cash flow of your business.

Third, the IRS may go as far as to turn you over to a private debt collector to collect your tax balance. This could lead to even more pressure and inconvenience as these debt collectors repeatedly call you and do anything they can to get you to pay.

Finally, revenue officers may pay you an in-person visit. The IRS may send these employees when you owe a significant amount of back taxes, have many unfiled back tax returns, or owe for many tax years. These revenue officers have the power to file liens, issue levies, and start seizing assets.

You may lose passport privileges, prohibiting international travel

The last consequence of your tax debt is that it could stop you from traveling outside of the country. This is a relatively new consequence that the IRS has decided to enact. It primarily applies to those who owe more than $51,000 and have not responded to previous collection attempts or are not in a current payment agreement.

In these circumstances, the State Department can restrict your passport or deny your application or renewal request.

What happens if you don’t pay your taxes

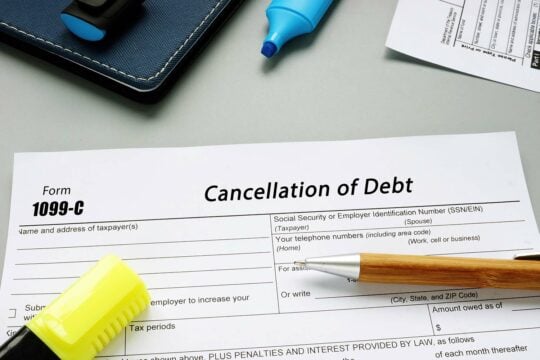

Not paying your taxes for years, whether accidentally or purposefully, is a very serious issue the IRS does not take lightly. Legal action can be taken against you, resulting in a tax lien or levy placed on your property. It gives the IRS legal authority to repossess your valuables including your home, car, and other possessions to satisfy your tax deficit. In the most serious cases, you can even be sentenced to jail for up to five years.

Commonly referred to as “back taxes.” And if you have them, check out this report for five ways to address them.

The IRS has a weapon known as a federal tax lien, which can not only ruin your credit score but can even result in personal property being seized to pay off those back taxes.

On occasion, a married couple may experience this. One spouse pays while the other does not. In that case, you might qualify for something called Innocent Spouse Relief. While this IRS rule comes with a bunch of preconditions, I mention simply to point out that the IRS has thought of everything. That’s why it’s not smart to try to out-think the IRS.

What happens if you pay taxes late?

When taxes are paid late, you face penalties and interest which can quickly add up and have a severe impact on your finances. The penalties and interest charged vary depending on the type of taxes you owe and how long you have been delinquent in paying them.

If you owe federal income tax, for example, the penalty for late payment is normally 0.5% of the unpaid tax amount per month, up to a maximum of 25% of the total owed. In addition, the interest on the unpaid balance is currently at a rate of 3% per year, compounded daily.

Should you owe state income tax, the penalties, and interest will vary depending on the state you live in.

If you aren’t able to fully pay your taxes, it is very important to contact the IRS or the state’s tax agency to negotiate different payment options. Entering into a payment plan can help reduce the financial burden of paying late, though additional charges will still be applied.

Do I have to pay my taxes all at once?

If you can’t afford to pay your taxes all at once, you may be able to set up a payment plan with the IRS. There are several types available including short-term and long-term plans.

Short-term: Pay the amount owed in 180 days or less.

Long-term (Installment Agreement): When you request an Installment Agreement, the IRS is prohibited from levying your assets, and the time to collect is suspended or prolonged while the agreement is being reviewed.

- Partial Payment IRS Installment Agreement – If full payment is not possible by the Collection Statue Expiration Date (CSED) and you have some capacity to pay, the IRS can enter into Partial Payment Installment Agreements. To determine if you are eligible, an assessment of your assets must be conducted to see if it can be utilized to settle your tax obligation.

- Regular IRS Installment Agreement – If taxpayers owe more than $50,000 they are subject to a separate set of regulations by the Automated Collection System (ACS). This system is an automated inventory that preserves taxpayer information about cases involving non-filers and outstanding balances. Taxpayers must submit either form 433-F or 433-A to enroll.

- Automatic IRS Installment Agreement – Taxpayers can establish an IRS installment agreement automatically, allowing them to pay their monthly installments using one of the three online methods. They can self-certify through an online payment agreement application to make payments online instead of having to meet an agent in person.

5 Things to do when you can’t pay your tax bill

You’ll see how much you owe when you calculate your taxes or have your tax professional do it. At that point, you haven’t filed or e-filed your tax return yet. When you see the amount owed and know you don’t have the funds to cover it, your first reaction may be not to file your taxes yet.

That’s the worst decision you can make, however. You will owe money to the IRS for those taxes, and you may also have to pay a failure-to-file penalty. This penalty can be as much as five percent of your unpaid tax bill owed for each month you go past the April 18th deadline. This penalty tops out at 25 percent of what you owe on your taxes for that year.

In contrast, if you go ahead and file your taxes but don’t pay, the penalty is a fraction of that. The IRS will tack on half a percent of what you owe for each month you don’t pay your tax bill in full.

When it comes to the IRS, paying something is better than paying nothing. Consider using your savings, home equity, or credit cards to make some kind of payment. It should help you reduce tax debt and penalties at a faster rate.

Determine what you think you can pay that doesn’t create a bigger burden on yourself and your family. This is important when deciding your next plan of action, which is going to the IRS to negotiate an installment plan.

Many people don’t know this, but the IRS offers payment options if you request them.

First, there’s a full-payment agreement if you know you can pay your entire tax bill within 120 days of the April 18th due date. You’ll still have to pay interest and penalties but there won’t be any other fees tacked on with this agreement.

Second, if your tax bill is quite large, consider an IRS installment agreement. You’ll have more than 120 days to pay your tax debt, but you’ll also have to pay application fees for this repayment plan.

There are a couple of other key requirements. You have to file your taxes first. Also, you’ll be held liable for the payment arrangement you’ve agreed to. If you don’t uphold the payment agreement, the IRS may file a federal tax lien against your home or property.

Third, there’s another option called Offer in Compromise.

An Offer in Compromise (OIC) is a way to pay less than the tax you owe. Typically, an OIC is for people who have a tax debt of $50,000 or larger.

However, this payment arrangement has other requirements beyond just a large tax bill. You must prove there’s a serious financial hardship stopping you from paying off the debt. The IRS will examine your asset equity, income, and expenses to see if you truly have this hardship.

In some cases, the feds may also temporarily delay collection until your financial situation changes.

If you are considering this type of negotiation, be wary of organizations that claim they can help you slash your tax debt. None of these groups should promise what they can’t necessarily deliver. Do your due diligence before approaching any of these organizations.

Instead, seek out a tax professional who can help you apply for an OIC. You can also use the IRS Pre-Qualifier online tool to get started or see if you even qualify.

It’s intimidating to know you owe money right now. But there are solutions for that debt and stress.

Look ahead at how you can address future tax bills that you’ll have to pay. Perhaps you need to adjust how much you withhold from your paychecks, or how much you pay for your estimated taxes.

Can you make changes to your budget and spending so you have better cash flow? If you have more available money, you can potentially pay down future installment plans earlier. You also may not have to worry about where the money is coming from to pay your next tax bill.

Finally, get assistance from a tax professional or financial advisor on effectively planning for future tax burdens. Maybe you can start a retirement account that can lead to deductions that lower how much you end up paying. When you improve your financial planning, you’ll put yourself in a position that lessens the worry and stress associated with tax time.

If you’re consistently struggling to pay your taxes, it may be time to revisit your withholdings. Your employer withholds a portion of your paycheck each pay period to cover your tax liability, but if you’re not withholding enough, you may end up owing money during tax season.

Your employer should have had you fill out a form W-4 that determines how much federal and state taxes are withheld from each paycheck to cover taxes. The form can be complicated, but from what you are saying, I recommend you enter “1” as the number of exemptions. This should ensure the IRS withholds an adequate amount to prevent you from owing any tax when you file a return. It’s better to be conservative in the first year of a job change to protect yourself from owing taxes when you file. If, after filing your return, you receive too large of a refund, you can always ask your employer to amend your W-4 form. This will increase your number of exemptions, so less is taken from each check.

Use Debt.com’s tax withholding calculator to determine how much you should withhold from each paycheck. Adjust your withholdings accordingly so you’re not caught off guard when the time comes.

Tax debt for small business owners

If you are unsure of your options, the best advice is to call a tax resolution expert to help determine if you qualify for any IRS resolution programs. These include…

- offer in compromise

- currently not collectible status

- an installment agreement

- one of the other IRS resolution programs

Here are the basics of the process…

IRS resolution basics

To begin, if you want to put yourself in the best position to qualify for an IRS resolution, the first step is to work on “compliance.” Compliance means that you have filed the past six years of tax returns, starting with the most recent and paying all required Estimated Tax Payments for the year.

The IRS wants to be confident that you will not owe in the future before they agree to a resolution program. So setting aside and paying taxes for this year is the most important payment to make at the beginning.

After compliance is complete, you will be ready to negotiate a resolution with the IRS. In general, the IRS allows you to pay off the balance in full with a 72-month payment plan. Or it allows you to submit a financial statement to determine an appropriate resolution if you are unable to pay it off in 72 months.

What is the financial statement?

The financial statement is basically a list of your monthly income, monthly “allowable” expenses (like housing, vehicle, health insurance, etc.), and a list of the value of any assets (such as real estate or retirement accounts). The IRS also allows you to count any Estimate Tax Payments as an expense on the financial statement so that you are not being stretched beyond your financial capability.

The IRS will reduce the monthly payment to an amount you can afford for one instance. That’s when the financial statement shows you’re unable to pay off the balance in 72 months with a combination of the value of your assets and net income.

If your financial statement shows that you cannot pay off the balance within 120 months (10 years) with a combination of the value of your assets and your net income, you may qualify for an offer in compromise and the IRS will settle for less than you owe.

Don’t Wait to Get Professional Help!

If you’re in a dire tax situation, it is important to seek help from a tax professional. They can help you understand your options and create a plan to get back on track with your taxes. Debt.com has a network of tax professionals who can help manage your tax debt and avoid penalties and legal action.

Give us a call at the number on the top, or fill out a form on the homepage, and speak to a certified financial counselor in minutes!