Question: My husband and I are lucky enough to have city pensions because he’s been a police officer and I’ve been a secretary in the same department. So unlike most 50-somethings, we’re not worried about retirement.

But I AM worried about growing old and going into a nursing home. We have a grown son, but he’s struggling to keep a job. My husband says our son will take care of us when we get old, because it won’t be that expensive to do so in a few years. But I think we need to do more. I just don’t know what “more” is. Can you help me?

— Lilly in Texas

Howard Dvorkin CPA answers…

Elsewhere in your letter, which I edited for brevity, you explained your husband’s fascinating theory…

“Since the entire country is growing older and there will be more senior citizens in a couple decades, it’ll become cheaper to get space in nursing homes – because more of them will open up, which will drive prices down. He thinks it’s like supermarkets that can sell food so cheap because they sell so much. The profit on each can of beans is only pennies, but if you sell billions of cans, you’ve made millions of dollars.”

I’m glad your husband is a police officer and not an economist. Needless to say, caring for the elderly is more complicated – and much more expensive – than selling cans of beans.

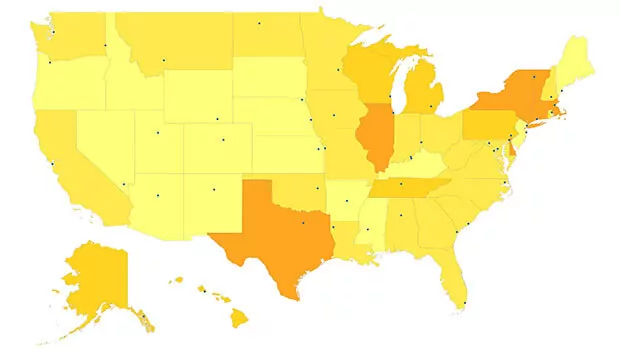

In fact, Care.com released a clever poll in 2017 that asked Americans in their 40s and 50s how much they think a retirement home will cost when they need one.

More than a quarter said they “think it will cost $45,000 or less per year.” The actual number from trained economists? A retirement home “really costs $82,125 to $92,378 per year.”

Care.com did back up one part of your husband’s theory: There will indeed be a record number of elderly in this country. “By 2050, the amount of people over 65 is projected to be 83.7 million, nearly double the rate now,” the company said.

However, caring for more elderly won’t reduce the price because unlike grocery stores, there’s no economy of scale. More elderly require more nurses and doctors, no matter how efficient they are.

What to do next

I’m a big fan of online calculators – Debt.com has several to help you manage your debt – so you might want to check out one of the many available for determining how much to save for retirement.

However, if there’s one lesson I’ve learned in more than two decades of counseling Americans about their money, it’s this: If you’re burdened by credit card debt, saving enough for retirement is nearly impossible. If that describes you, call one of our certified credit counselors at for a free consultation.

Right now, you’re lucky, Lilly. It seems like your retirement savings are already going strong. Next, you need to save for your own senior care. Check out Care.com’s Senior Care Guide Index or call Debt.com at for a free debt analysis.